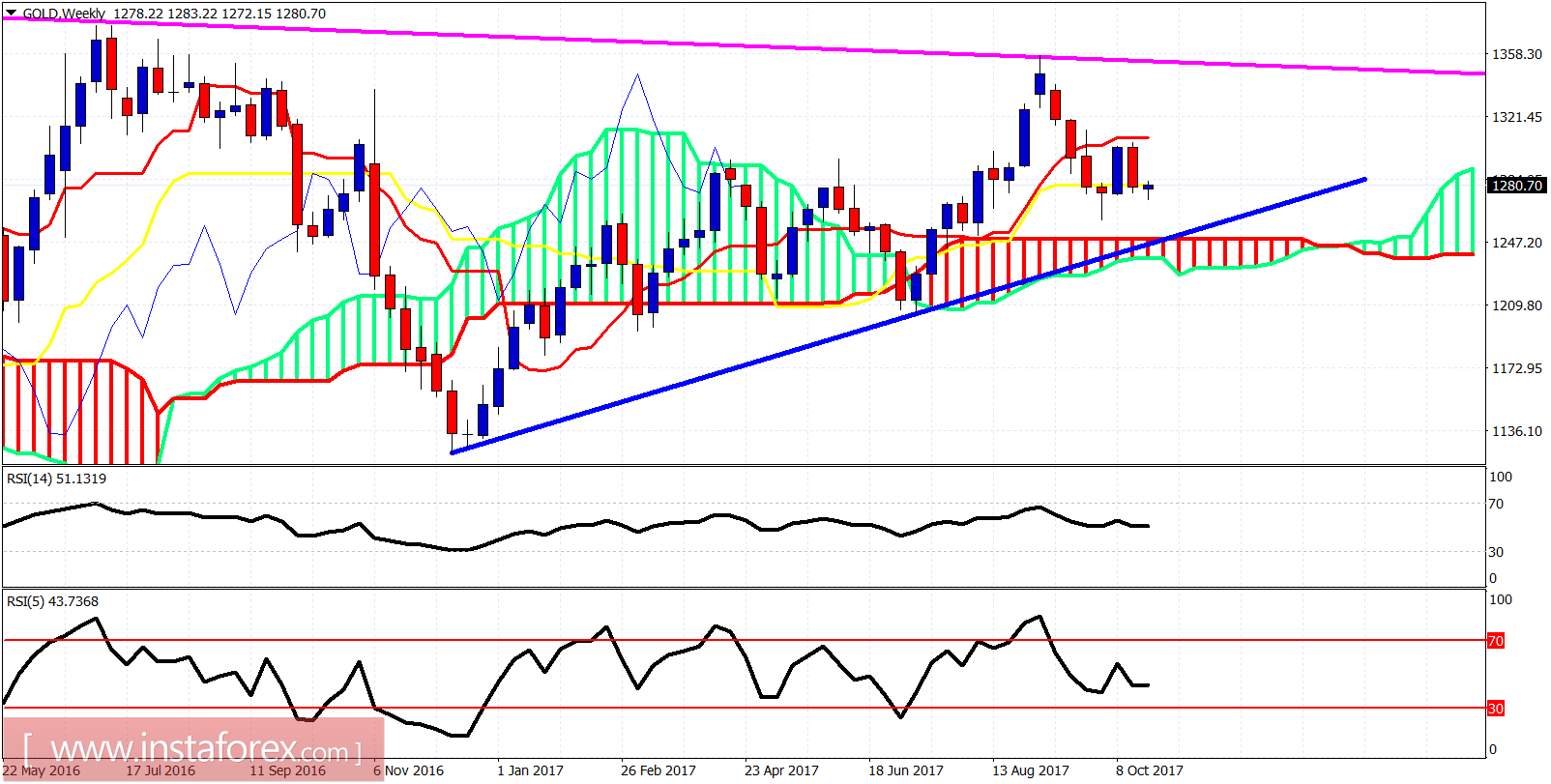

The Gold price has broken out of the downward sloping wedge pattern but has stopped right at the short-term cloud resistance at $1,282. Price needs to break above $1,282 and especially $1,290 for any upward move to consider the start of the next upward move to $1,400.

Blue line - resistance (broken)

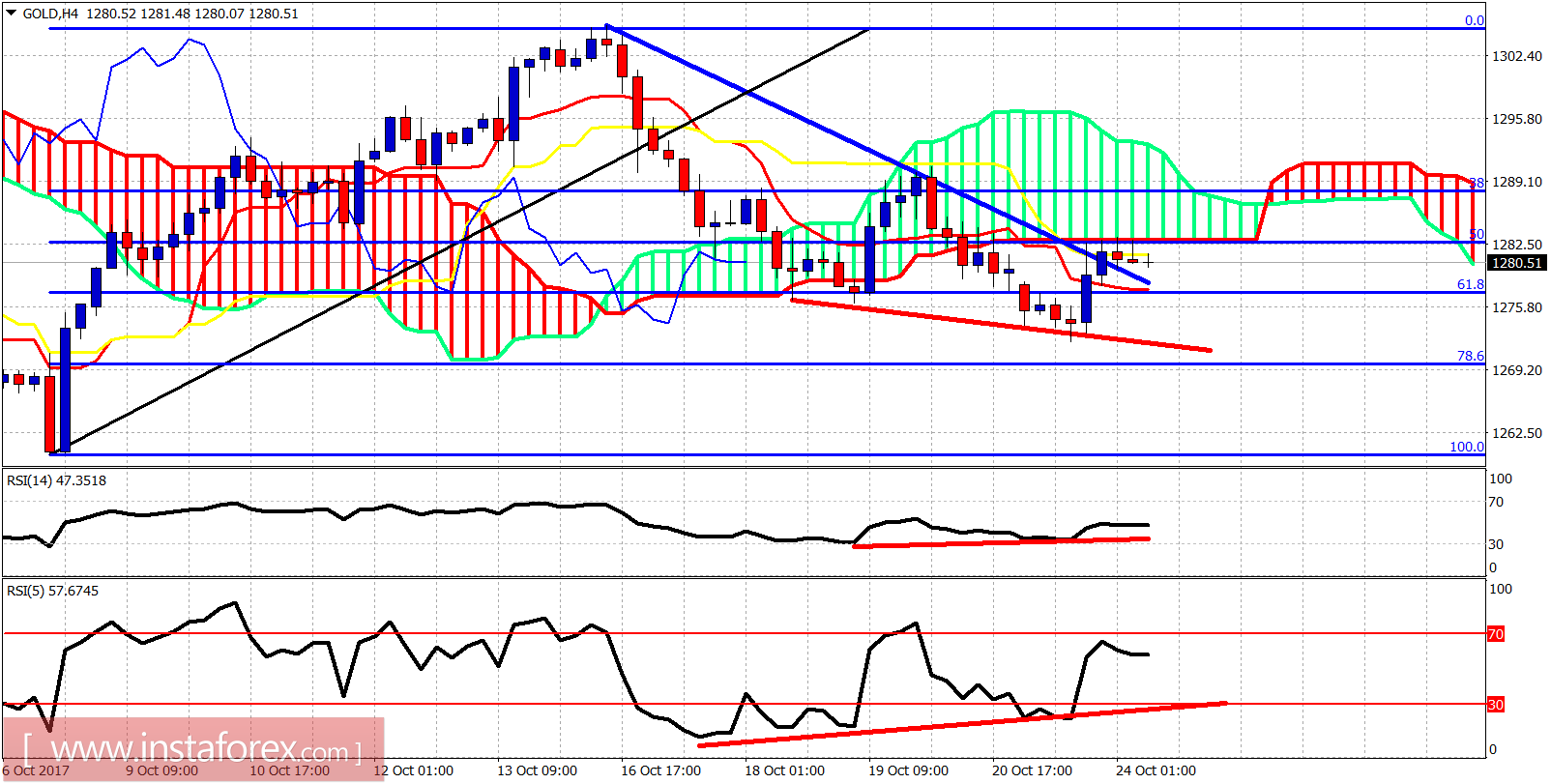

Red lines - bullish divergence signs

Gold price is trading below the Ichimoku cloud in the 4-hour chart. Price bounced off the 61.8% Fibonacci support area but the important short-term resistance at $1,282 is not clearly broken, Next important resistance for bulls is at $1,290. As long as the price is below that level, we remain in a short-term bearish trend.

Magenta line - resistance

Blue line - support

On a weekly basis, Gold prices try to move back above the kijun-sen (yellow line indicator). This would be a bullish sign. However, as long as we are trading below the tenkan-sen (red line indicator) there will always be a danger of moving lower towards the weekly Kumo (cloud) and the blue trend line support.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română