The headline reading, Retail Sales With Auto Fuel, was released at the level of -0.8% after 0.9% increase a month ago. The market consensus was at the level of -0.1.%. Moreover, the data indicated that the underlying pattern in the retail industry is one of growth; for the three-months on three-months measure, the quantity bought increased by 0.6%. Year-on-year, the quantity bought in the retail sector increased by 1.2% with non-food (household goods, clothing stores) and non-store retailing all providing growth. Store prices continue to rise across all store types and are at their highest year-on-year price growth since March 2012 at 3.3% (non-seasonally adjusted). Online sales values increased year-on-year by 14%, accounting for approximately 17% of all retail spending.

In conclusion, despite the weaker one-month data, there is a continuation of the underlying trend of steady growth in sales volumes following a weak start to the year, and a background of generally rising prices. These increased costs are reflected in the more rapid growth in the amount spent when compared with the quantity bought.

Earlier this week, Silvana Tenreyro, a new member of the BOE, said in her speech in the British Parliament that it is necessary to raise interest rates in the current economic climate. Tenreyro points out that the BOE is quite close to the point at which the scale of monetary stimulation should be reduced. In addition, it stresses the problem of a rather poor trajectory of economic growth, which in her opinion is a problem of temporary rank.

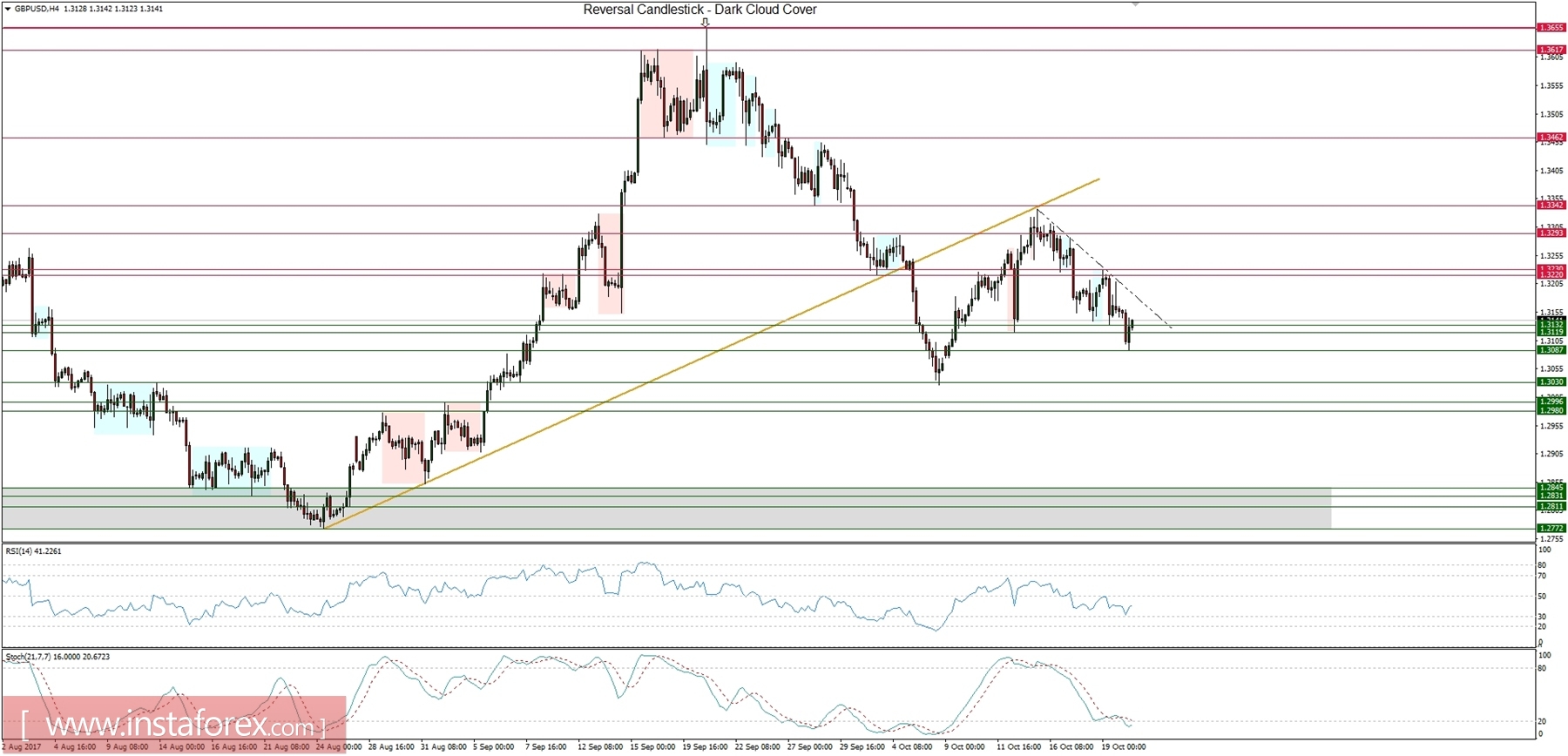

Let's now take a look at the GBP/USD technical picture on the H4 time frame. The market is trading below the dashed black short-term trend line in oversold conditions. A bounce from the level of 1.3087 might indicate a correction towards the level of 1.3155 where the dashed trend line will provide a dynamic resistance. As long as the level of 1.3342 is not clearly violated, the near-term outlook remais bearish.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română