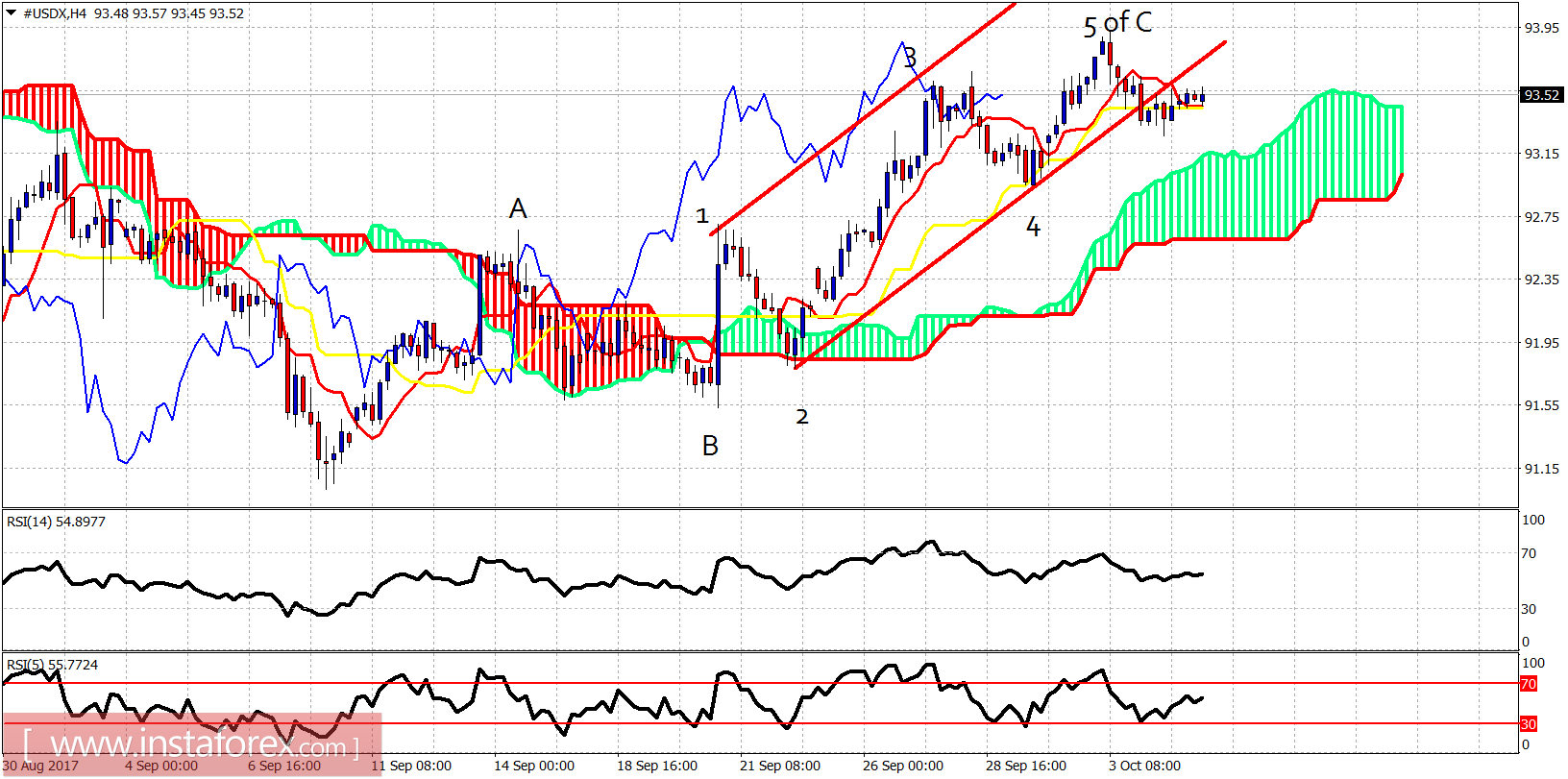

The Dollar index has broken out and below the bullish channel. The upside correction is most probably complete. However, in order to cancel any bullish wave count, price will need to overlap the high of wave A.

The Dollar index remains in a bullish trend. Price made a reversal lower the last couple of sessions. Is it enough? Price so far has been making higher highs and higher lows. A move below 92.95 will cancel that and will give bears the upper hand. The above wave count is my preferred one. However in order for this wave count to be confirmed, we will need price to move past and below the high of wave A.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română