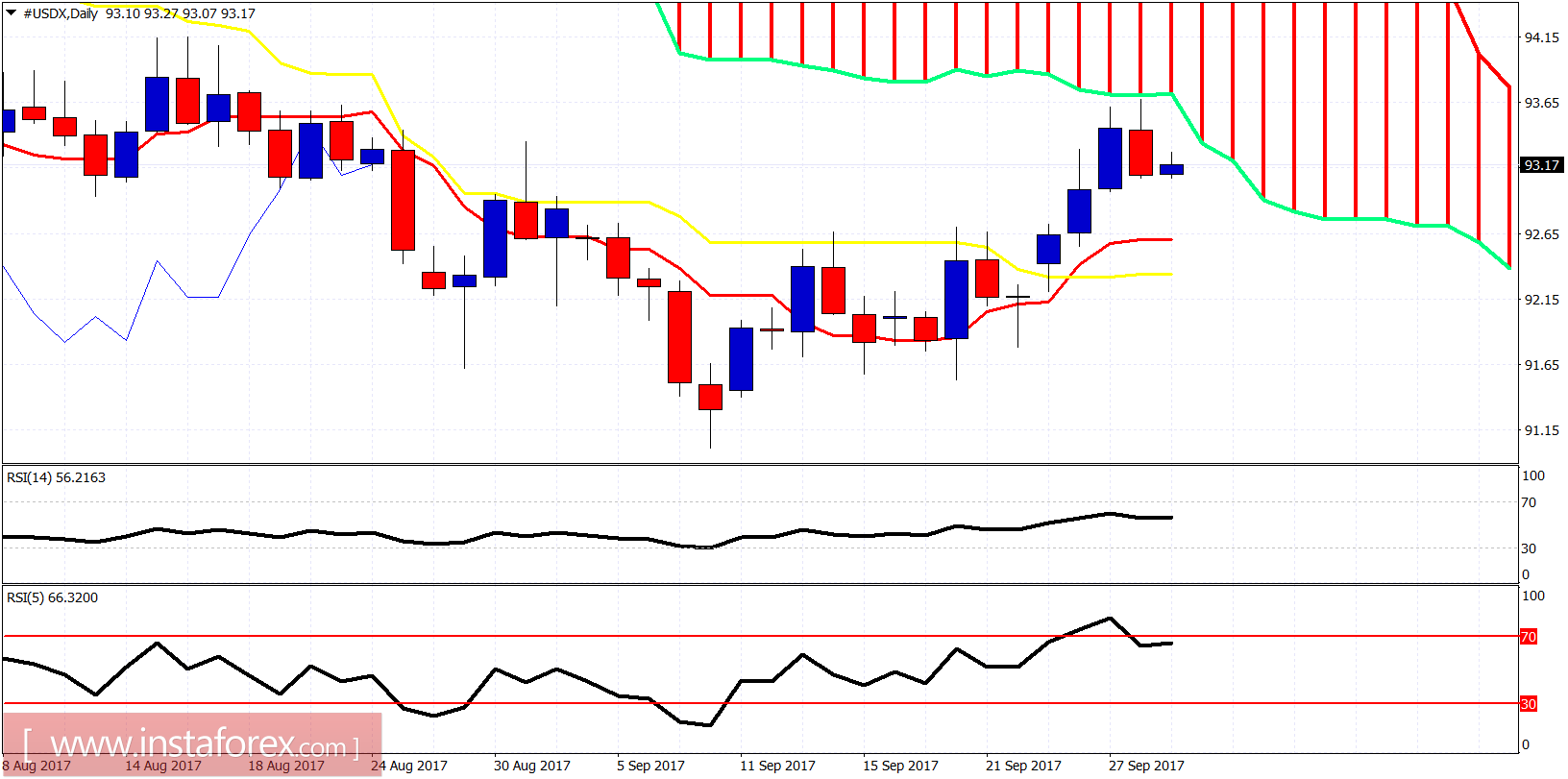

The Dollar index made a pullback yesterday after being rejected at the daily cloud resistance of 93.70 as we expected. Short-term trend remains bullish and the current downward move is still considered a pullback. However I believe that this downward move will soon accelerate.

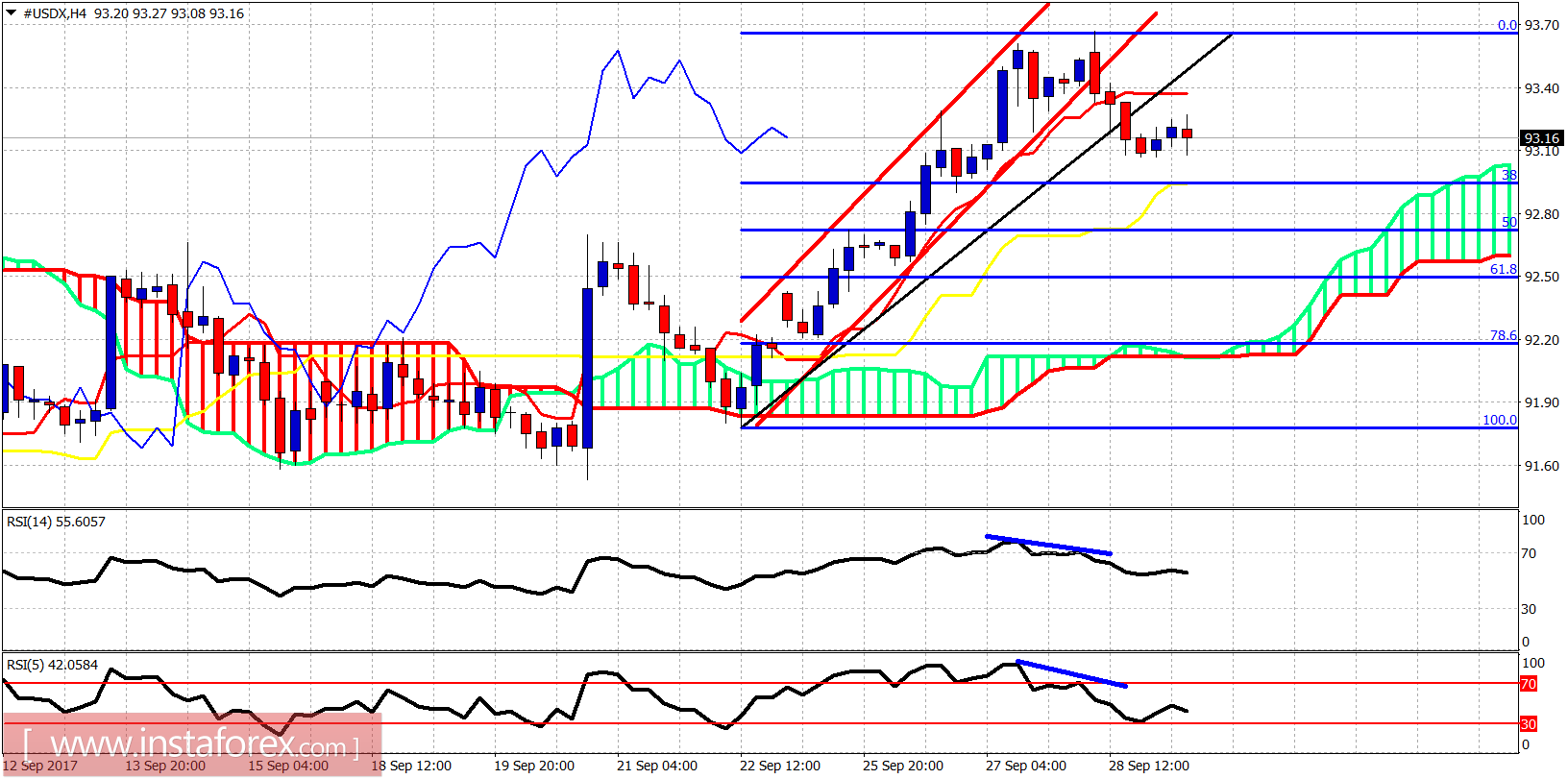

The Dollar index has broken down and out of the bullish channel. This at least will bring a corrective pullback towards the 38% Fibonacci retracement. The 38% Fibonacci retracement at 92.95 is the first important short-term support. Next support is at 92.50 (61.8% Fibonacci retracement).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română