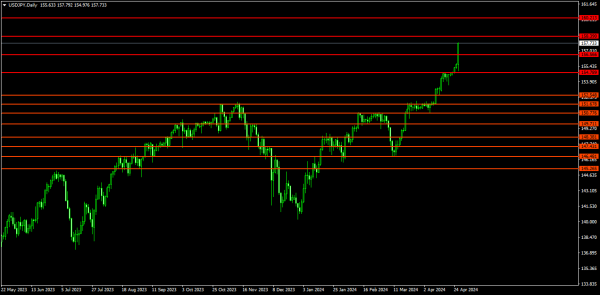

Good day. Today the Bank of Japan held a meeting. The Bank of Japan left the key interest rate unchanged. It will also continue to buy government and corporate bonds in accordance with previous decisions. At the last meeting, the Bank of Japan raised the interest rate. And it also promised to cancel the purchase of corporate bonds, but the Bank of Japan did not announce anything like that this time and remained true to its policy. As a result, the pair rose by 300 points today. It is considered that such an increase in the pair is caused by the correlation between the policies of the Bank of Japan and the Federal Reserve. Since Japan has long remained true to its previous policy, they were not planning to raise interest rates, so everything happened as it did. Ueda spoke, saying that soft financial conditions will be maintained. He also emphasized that changes in monetary policy will depend on future economic, price, and financial conditions. Inflation is a top priority here. If inflation continues to rise, they said they would adjust the policy. Inflation is currently showing a reverse trend, as its growth has slowed to 2.6%. Ueda suggested that the yen will continue to weaken. He also refuted rumors that yen devaluation would contribute to inflation. He indicated that changes in monetary policy are not aimed at managing the exchange rate. In terms of direct support for the yen, he said that this will not have any effect. At the end of the meeting, he said that everything remains the same. Further prospects for tightening are not yet defined, except for verbal interventions, nothing like that is likely to happen. On the technical side. On Thursday, the price rose all day. I gave priority to growth towards the resistance at 156.566 for Friday. Today the price has been rising all day, it has passed about 300 points. It will most likely close near the resistance at 158.390. Since the resistance has not been tested, on Monday I will give priority to growth towards the resistance at 160.213.

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade

Comments: