Nucor

Nucor Corp is the most promising company on the list whose shares may bring profit this year. This steel company is also a constituent of the popular S&P 500 index. In 2021, Nucor recorded a fourfold increase in its free cash flows. In addition, in the first nine months of 2022, the firm’s stock value soared by 150%. Nucor used those funds to expand its business and partially refinance its debt. The company belongs to the commodity sector. The onset of a recession in this field may reduce demand for steel. In this light, Nucor’s shares trade 4.5 times lower than its free cash flows. Nevertheless, experts say the company is in a good financial state and consider its stock to be profitable in the long term.

Abbott Laboratories

Abbott Laboratories is another potentially profitable firm in 2023. This is a medical devices and healthcare company with a constant increase in revenues. Over the past five years, it has demonstrated high operating profits. Abbott Laboratories stock currently trades in line with market expectations. Analysts believe the firm is more robust than any other similar company. In 2023, Abbott Laboratories has shown fairly steady growth. Its dividends to shareholders have recently increased as well. Experts reckon this will help make Abbott Laboratories’ investment portfolio more reliable and boost its income.

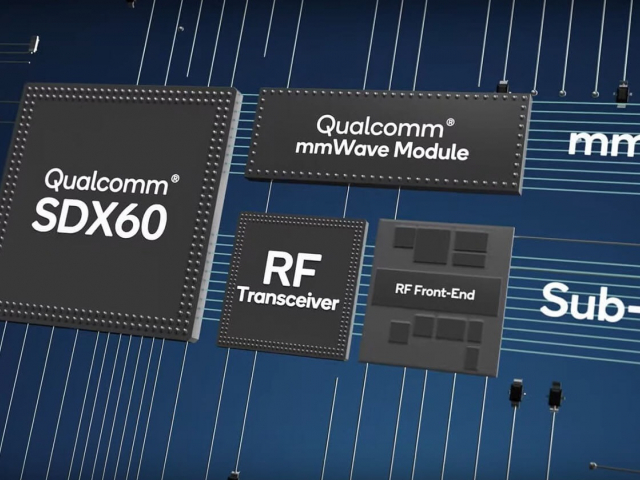

Qualcomm Incorporated

Qualcomm Incorporated is believed to be in a more difficult position than any other similar company. In 2022, the semiconductor and telecommunications equipment firm was bearish and its shares price plummeted by over 35%. Collaboration with other developers of devices running on 3G, 4G, and 5G wireless technologies is seen as one of Qualcomm Incorporated's major accomplishments. The company has many other key IT technologies in its portfolio of products that are used in mobile phones and other wireless devices such as Wi-Fi, GPS, and Bluetooth. In 2022, Qualcomm Incorporate saw its annual earnings per share swell by 46%, the highest figure in three years. Above all else, the firm recorded a high return on equity.

Carnival

Carnival Corporation is the final firm on our list whose shares may bring a profit this year. Nevertheless, when it comes to its stock, there is still a fly in the ointment. Over the past two years, this multinational cruise company has seen its shares tumbling. In 2022, the cruise business also faced a sharp decline in profits due to the COVID-19 pandemic. The company had an excellent credit rating with constantly growing revenues and stable profits until 2020. However, in that same year, Carnival Corporation lost about 80% in share value. In the summer of 2022, the price started to recover, showing the best post-pandemic performance, but dropped steeply by the fall. At the end of fiscal 2022, the company recorded $6 billion in losses. The firm is believed to be unstable in terms of profit and growth prospects. Nevertheless, aggressive traders may still take a chance. According to preliminary forecasts, the company will return to pre-crisis levels only by 2024.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română