Bank of America Corp. strategist Michael Hartnett supposes that investors should sell US stocks as “tech and artificial intelligence are forming a bubble.”

Notably, in 2022, Michael Hartnett predicted a massive outflow of money from US stocks amid concerns about the approaching recession. The forecast came true and traders switched to some other assets. At the moment, the analyst recommends selling the S&P 500 at its current level of 4,200 points.

BofA thinks that the Federal Reserve is unlikely to stop the key rate hike this year. In the event of this, US bond yields may jump to 4% or even higher.

On May 19, the 10-year US Treasury yield was trading at about 3.6% after a surge caused by the debt-ceiling debate.

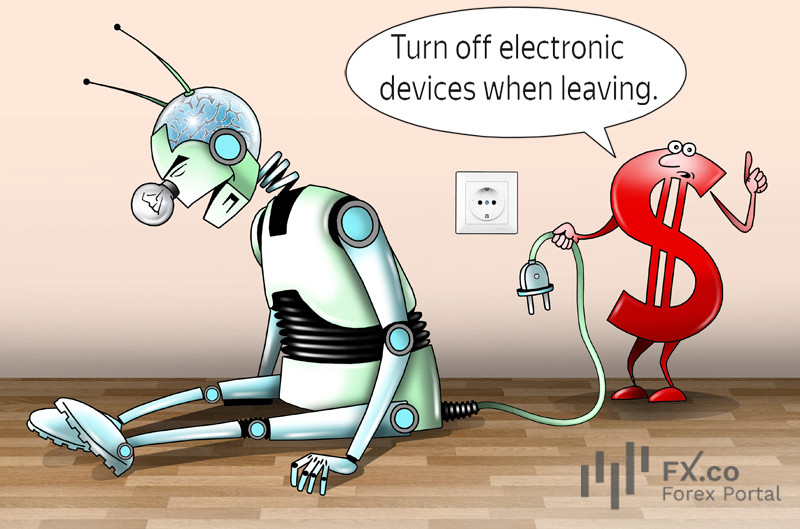

What is more, BofA fears the formation of a small bubble caused by investments in artificial intelligence (AI) technologies. “AI for now is a baby bubble, noting that in the past bubbles always started with easy money and ended with rate hikes,” Michael Hartnett pinpointed. This time, the situation may repeat.

Citing EPFR Global data, BofA reported that the outflow of capital from tech companies had been observed for five weeks already. As a result, during the week through May 17, equity funds had $7.7 billion outflows. Meanwhile, bonds have seen considerable inflows in the last eight weeks.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: