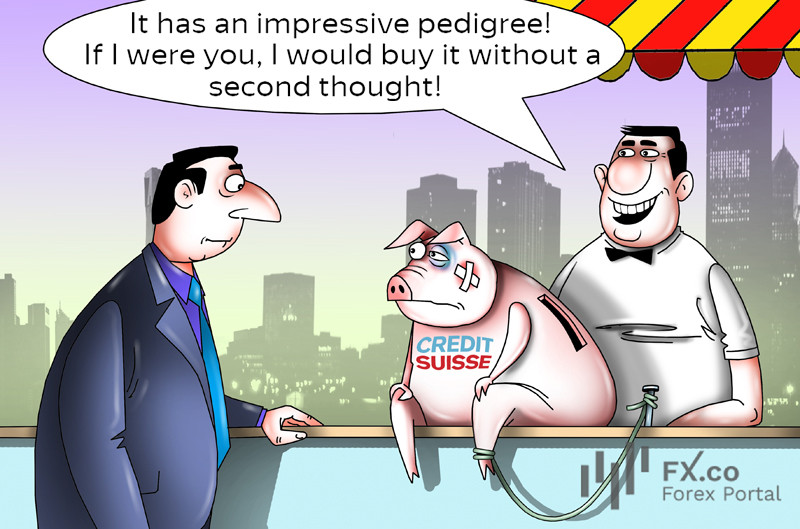

Major Swiss bank UBS agreed to buy out the beleaguered Credit Suisse for $2 billion, the Financial Times reported.

According to FT, the deal to acquire all shares of Credit Suisse was finalized on Sunday, March 19. It was expected to be priced at a fraction of Credit Suisse’s closing price on Friday, all but wiping out the bank’s shareholders. UBS planned to pay 0.5 Swiss franks per share. Before March 17, Credit Suisse stock traded at 1.86 Swiss franks.

The newspaper noted that the Swiss authorities planned to enact emergency measures to fast-track the takeover, including amending local laws. However, such moves were not necessary. Experts say the situation will steadily improve, and the crisis will end.

Earlier, the Swiss authorities secured approval from regulators in the US and Europe. First reports regarding the possible crisis at Credit Suisse emerged in mass media in early February 2023. Last year, the bank was struck with massive outflows which eroded its liquidity. As a result, the bank reported a net loss of $1.5 billion for the fourth quarter of 2022, marking the worst performance in years.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română