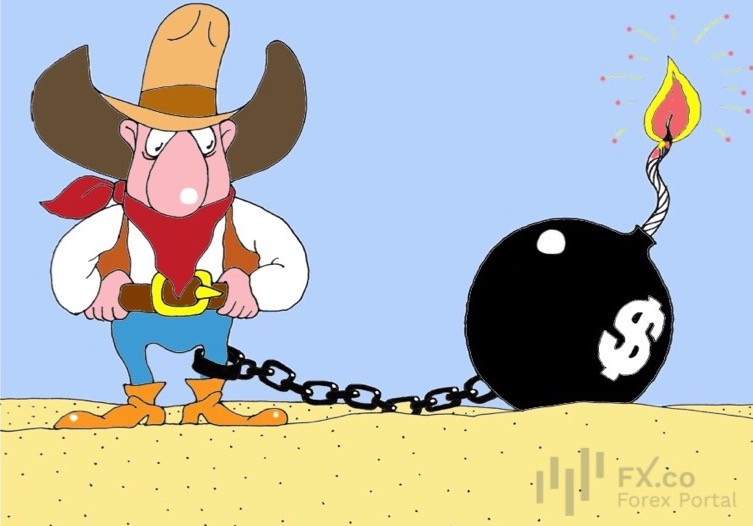

Analysts are alarmed about the US swelling federal debt. Experts warn that it is taking its toll on the domestic economy. Retired Admiral Bill Owens, US Comptroller General David Walker, and Professor of Economics at the University of Colorado Barry Poulson have spotted a bad omen for the US economy.

Moreover, they share the viewpoint that the huge public debt poses the most serious danger to the national economy. Analysts underscore the exponential growth of its value. Over the last 20 years, Washington’s spending has been ramping up faster than the country’s gross domestic product. Remarkably, the lion’s share of such spending was backed by borrowings.

Experts estimate that the US federal debt has more than doubled since 2000, from 55% to 122%. According to the Washington Times, preliminary estimates show that the debt’s value could zoom up to 200% by the mid-XXI century.

Experts are worried that the US economy is going through stagflation for the time being which is making a more adverse effect than in the 1970s. The US Treasury Department reported that in October 2022, the public debt topped the landmark level of $31 trillion for the first time in history. Interestingly, the bulk of debt securities has been amassed by individuals. Such holdings are worth more than $24 trillion. Besides, Washington owes $7 trillion to foreign governments.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: