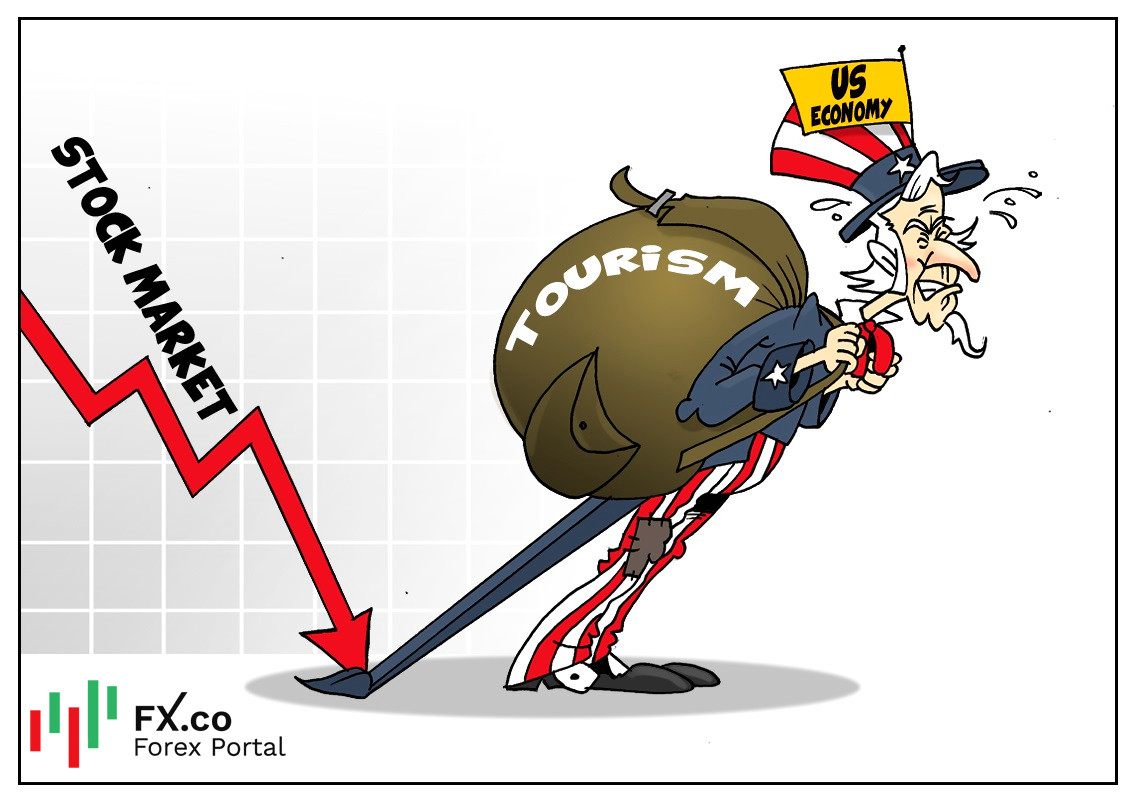

Although the US economy has gained steam over the past few months, not all sectors seem to be able to recover at a rapid pace. Among those that are lagging and even hampering the overall growth are tourism and the stock market.

Returning to pre-crisis levels has proven to be rather difficult for the US economy. Of course, the world's leading economy is handling the coronavirus crisis much better than others. Nevertheless, it is too early to talk about full recovery since such a key industry in the US economic activity as tourism is still struggling to bounce back from the devastating impact of the pandemic. According to Omer Zarpli, a researcher in political science at the University of Pittsburgh, the tourism industry in the United States tumbled by 69% over the year, in the European Union - by almost 90%, and in the UK - by 73%. Given that the US is not the worst-hit country in this regard, it has not yet been able to revive tourism and is unlikely to succeed in the near future.

The stock market is ranked second on the list of the sectors inhibiting the US economic recovery from the crisis. This sector used to generate investments in the country’s economy through Americans or foreign investors’ extra free cash. Nowadays, the back-to-normal index reflects global changes in the US economy, signaling that it is operating 7% below normal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: