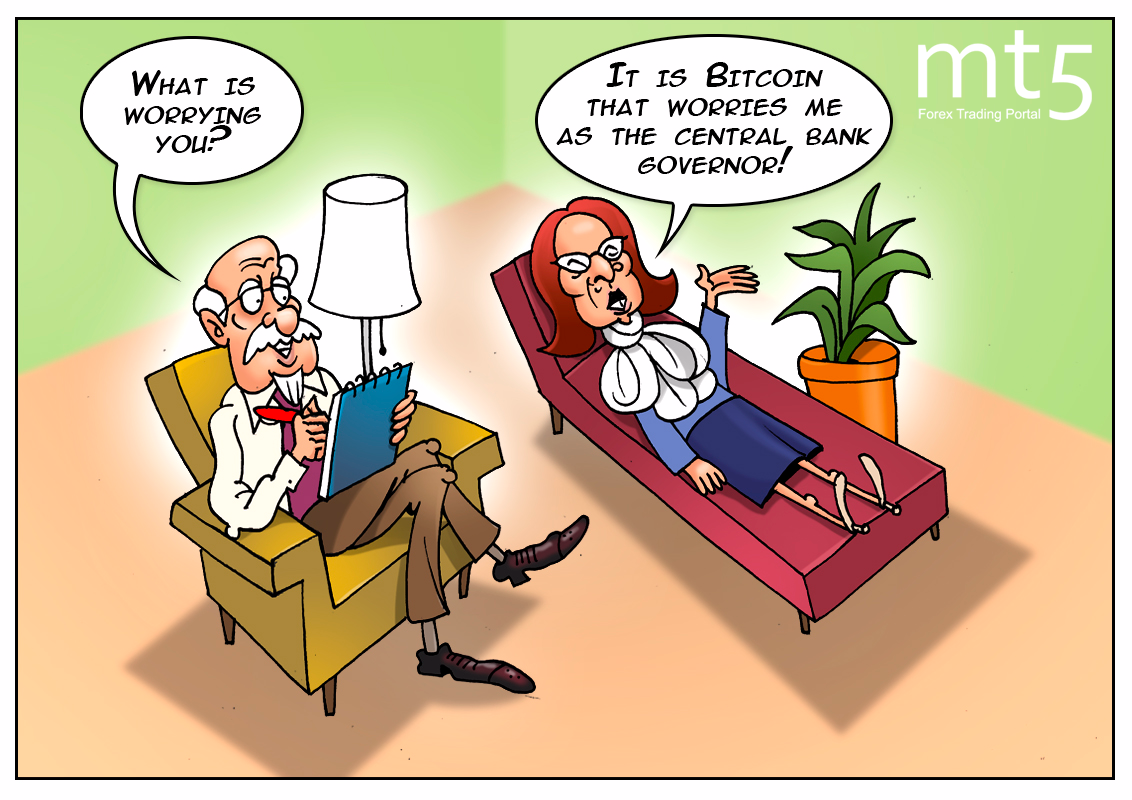

Global central banks have not come to a common denominator on what bitcoin is about. In fact, the first cryptocurrency was invented exactly 10 years ago. However, it has not gained the stellar popularity until recently. At the dawn of the digital currency market, bitcoin was of little importance to regulators because of its minor value. Over this year on the back of buoyant demand for bitcoin, its value has skyrocketed to incredible highs. Therefore, global central banks have to accept the challenge.

In early December, bitcoin hit an all-time record with the price of over $11,000. Amid such a triumph, central banks made statements one by one, warning of risks related to investment in the cryptocurrency. It seems that monetary authorities are in limbo, being unable to provide guidelines on digital currencies. Some central banks are making efforts to ban any bitcoin-based transactions in good faith that they protect people against risky speculations. On the other hand, some regulators claim that cryptocurrencies are a precursor of a new totally decentralized financial system. In any case, monetary authorities are unwilling to lose control over banks and the financial sector. Interestingly, any scenario involving bitcoin and central banks is likely to deal a blow to banks.

If bitcoin eventually turns into a bubble, banks will be to blame as they failed to prevent bitcoin from thriving. Alternatively, if bitcoin evolves into a full-fledged unique financial system, banks are likely to become extinct. One day, banks will find out that accounts of their customers are empty. So the society will not need banks anymore as the financial system has been shifted to the blockchain technology.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română