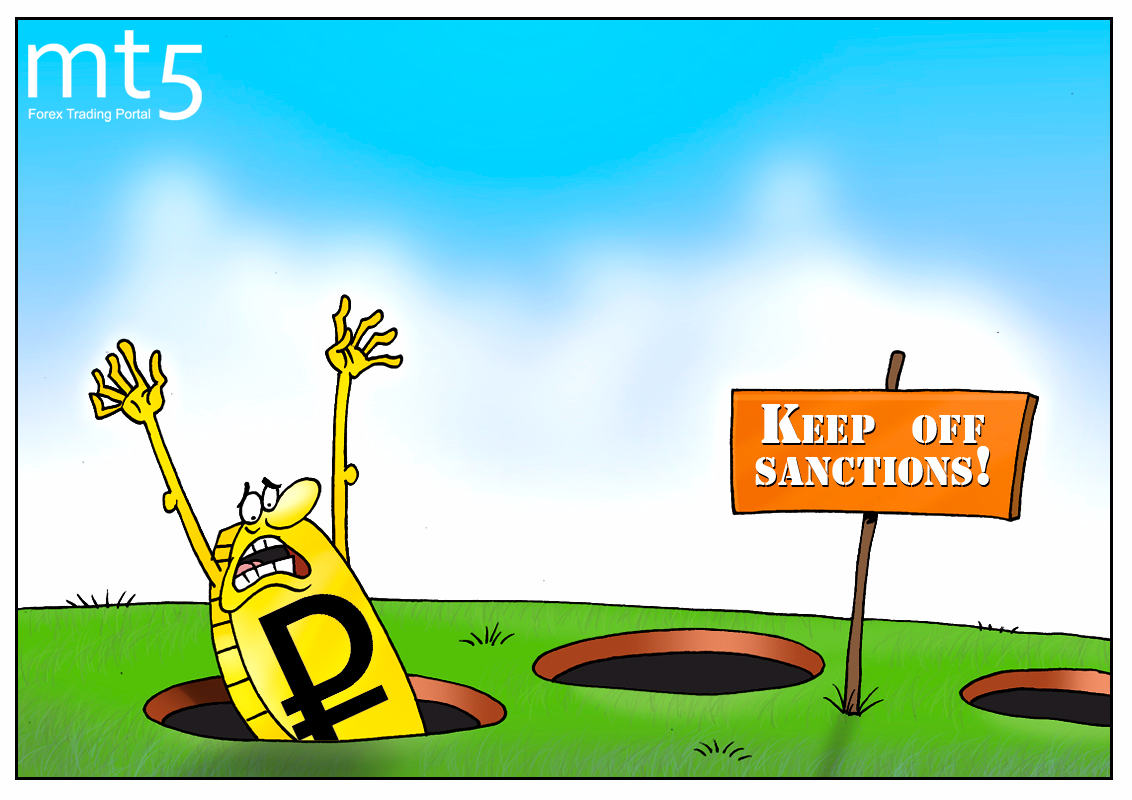

Sanctions and the Russian ruble are closely interrelated. When we speak about the ruble, we think about sanctions and vice versa. The Russian currency not only stopped falling after the sanctions had been imposed, but even managed to recover losses. However, the sanctions still weight on the ruble exchange rate, and an adverse effect is yet to appear.

Currently, the ruble’s rise is dented not by existing but by prospective sanctions. The outlook for the Russian currency is gloomy as it faces risks that more harsh financial restrictions will be placed. Some experts say there is no reason to panic. However, when the new year comes, the situation may change drastically. The Russian finance ministry has the national currency on a short leash. It keeps its savings in the foreign currency and ahead of the New Year the ministry plans to increase the volume of forex purchases significantly. At any rate, the government agency deliberately continues to buy US dollars and euros as the weaker ruble ensures bigger budget revenues, making it possible to offset difficulties in cutting the budget deficit through borrowing on financial markets.

Besides, the Russian central bank is expected to lower the interest rates, therefore the gap between the US dollar and the ruble may increase. To sum up, the Russian currency is going to have a harsh start of the upcoming year. On the one hand, it will get a blow from the Russian finance ministry and the central bank; and on the other hand, the Western sanctions will continue to weigh on it.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română