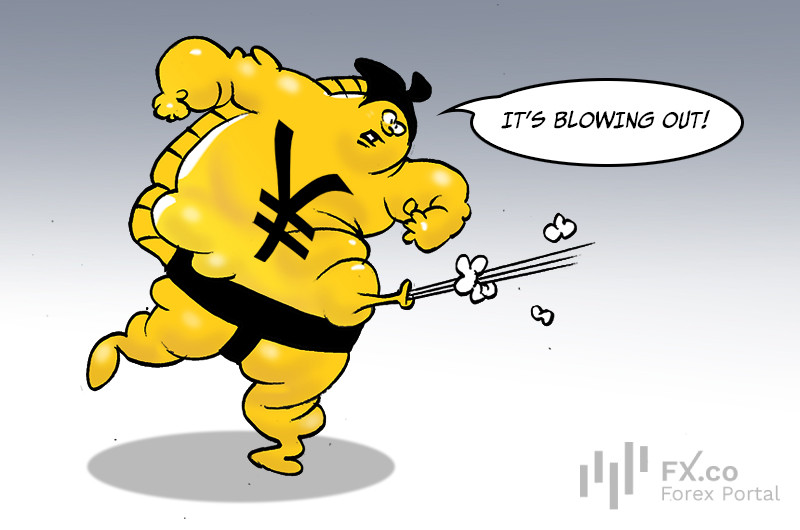

The Japanese yen dropped to levels not seen since August 2008. The culprit in the whole situation was none other than the central bank.

Vladimir Chernov at Freedom Finance Global, who seems to have spent more than one evening looking at trends and charts, concluded that the yen might continue its journey to new record lows. This, in his opinion, could force the Bank of Japan to come out of the shadows and become active in the currency market. Well, we know that when bankers become active, it is definitely a serious matter.

The actions of the Central Bank, which decided to raise the key rate for the first time in 17 years, led to the fact that the yen slumped to the bottom against the euro since 2008. The US dollar, in turn, nearly set a record by jumping by 0.62% against the yen.

Expert Chernov notes that the market was ready for such changes. The main reasons why the yen gave up without a fight were low yields on government bonds and, strangely enough, rising wages in Japan, which apparently made the yen a bit devalued.

Rewriting its history, the Japanese central bank decided to raise the rate to 0.5% in 2007, but then, as if regretting its decision, started slowly lowering it from 2008 until it reached negative levels. It was only recently, on March 19, that the regulator decided to take a small step from minus to zero, moving the rate into the range of 0-0.1%. It looks like the yen and the Japanese Central Bank together decided it was time to experiment a little with its weight and status in the global economy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română

Comments: