By the end of the week, the British pound regained its footing and resumed its downward movement. Just to remind you, the wave 3 or c presumably started to form around March 8th, implying a significant downward movement of the instrument. GBP/USD has approximately covered half of the way down; however, wave 3 or c could take on a much more extended form, considering the length of wave 2 or b. Therefore, the pound should fall further to avoid confusion in wave markings.

There will be relatively few significant events in the upcoming week. The service and manufacturing PMIs will be released on Tuesday, which currently have minor influence. At the moment, it is extremely important for the market to understand which direction the Bank of England is leaning towards. There is very little information about its plans regarding interest rates. It is extremely difficult to say whether the central bank intends to carry out the first round of rate cuts between May and September, as most market participants and economists expect. The BoE is "driven" by the recession in the British economy. But at the same time, inflation isn't low enough for the Bank to consider rate cuts. Therefore, GDP and inflation reports are crucial now, as they could convince the market of one scenario or another. The values of the PMI data are currently low.

There won't be any more events in the UK. On the other hand, the US will certainly release economic reports, which we will discuss in the next overview. However, it appears that the upcoming British events are unlikely to have any impact on the pound's exchange rate. Perhaps this is a good thing, as the market has geared up for new short positions at the end of the week, and there is a strong desire not to move away from its intended path.

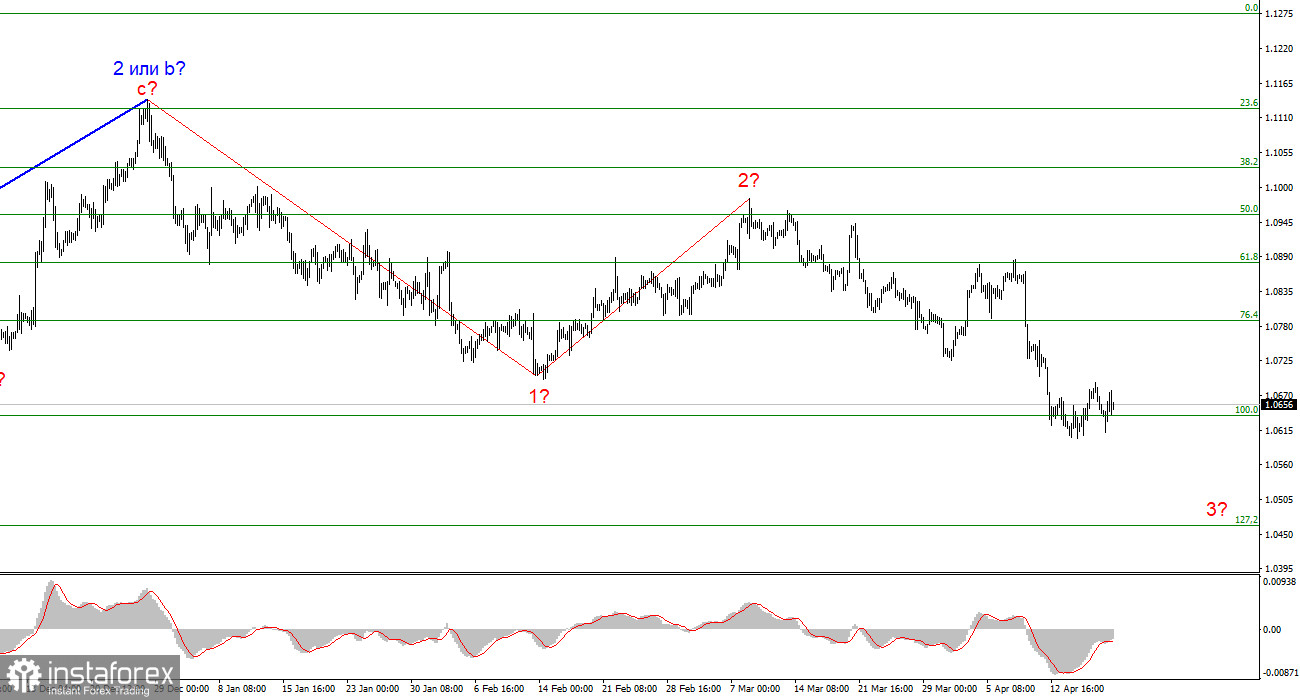

Wave analysis for EUR/USD:

Based on the conducted analysis of EUR/USD, I conclude that a bearish wave set is being formed. Waves 2 or b and 2 in 3 or c are complete, so in the near future, I expect an impulsive downward wave 3 in 3 or c to form with a significant decline in the instrument. I am considering short positions with targets near the 1.0463 mark, as the news background works in the dollar's favor. The sell signal we need near 1.0880 was formed (an attempt at a breakthrough failed).

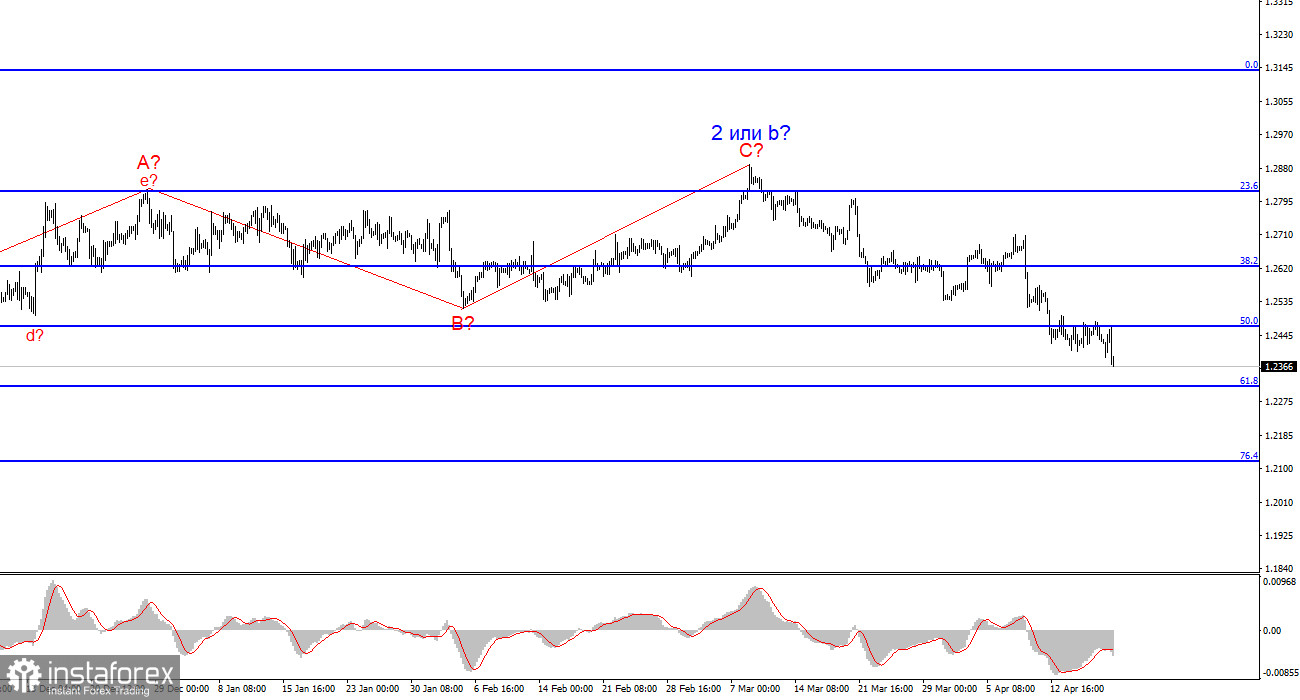

Wave analysis for GBP/USD:

The wave pattern of the GBP/USD instrument suggests a decline. I am considering selling the instrument with targets below the 1.2039 level, because I believe that wave 3 or c has started to form. A successful attempt to break 1.2472, which corresponds to 50.0% Fibonacci, indicates that the market is ready to build a descending wave.

Key principles of my analysis:

Wave structures should be simple and understandable. Complex structures are difficult to work with, and they often bring changes.

If you are not confident about the market's movement, it would be better not to enter it.

We cannot guarantee the direction of movement. Don't forget about Stop Loss orders.

Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română