The absence of significant macroeconomic reports from Australia suggests that the Australian dollar will keep trading in sync with the market, primarily reacting to the news from the United States and the dollar's dynamics.

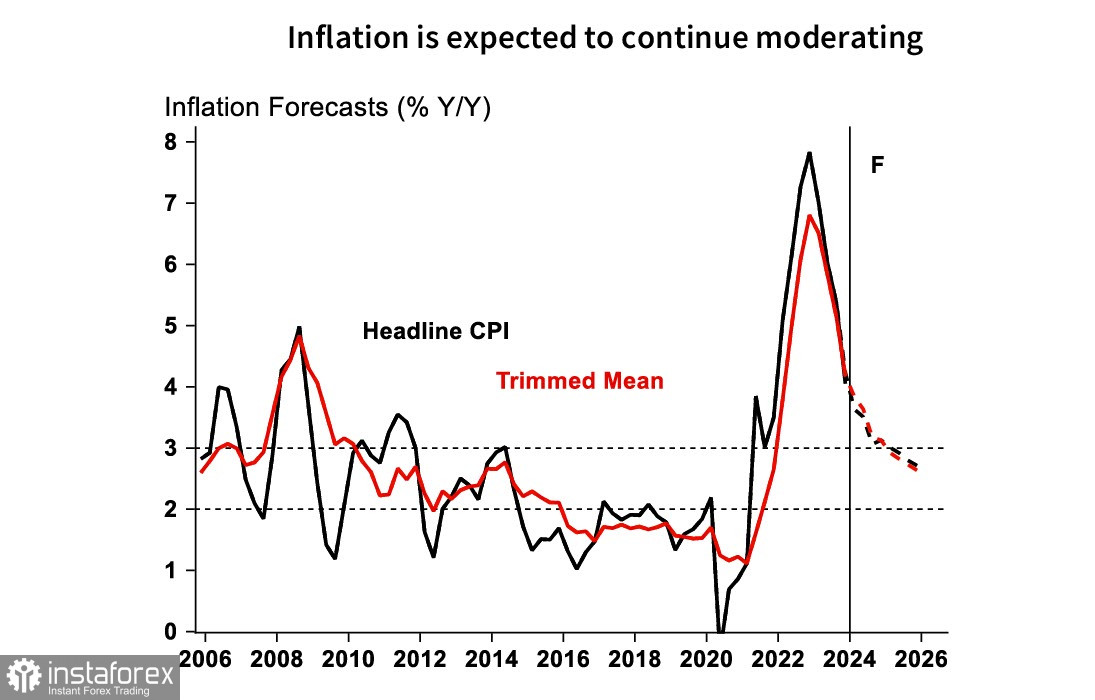

The first rate cut by the RBA is projected for November, as inflation is expected to show a slight increase in the first quarter. With the expectations for a Fed rate cut pushed to September, the Aussie is likely to remain under pressure for objective reasons until the fall.

One of the main factors affecting domestic inflation remains the labor market. The very low unemployment rate paves the way for high wage growth rates, and improvements are not expected quickly—if unemployment was at 3.7% in February, it is expected to rise to 4.25% by the end of the year. The process of slowing average wage growth is too slow for the RBA to ignore this inflationary factor. Thus, the regulator will not cut rates until it is confident that wage growth has sufficiently slowed.

Prices for Australia's key export commodities (iron ore, LNG, and coal) have decreased in recent months, putting pressure on the trade balance, despite higher prices for oil and most industrial metals. A rise in copper and aluminum quotes, supporting commodity currencies, is primarily linked to a surge of interest in artificial intelligence and is not related to the Australian economy.

Further uplift in the global industrial cycle and/or additional stimulus in China could help reverse the situation, but at the moment, there is no reason to abandon a bear case scenario.

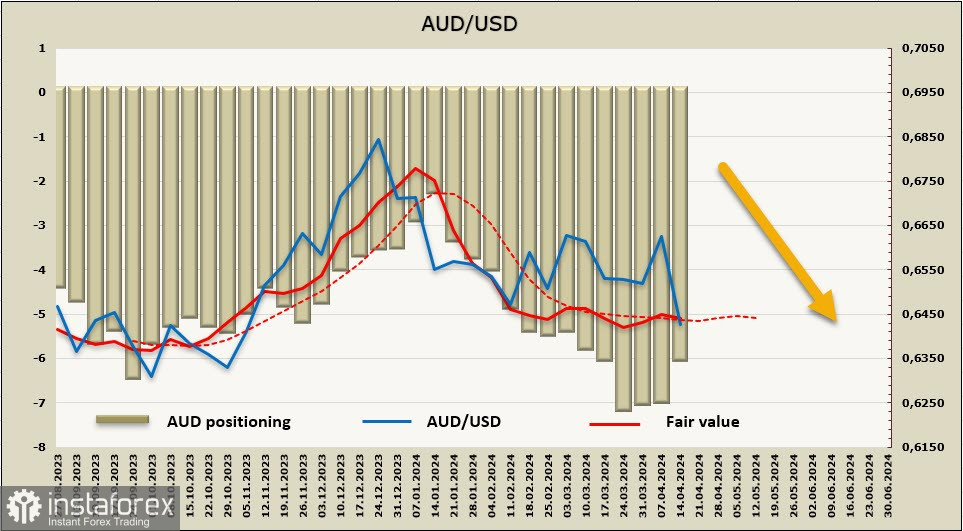

The net short position on AUD decreased by $572 million over the reporting week to -$6.121 billion. A decline in the volume of short positions allowed the price to stay near the long-term moving average, but overall positioning remains bearish.

The AUD/USD pair fell in sync with the market, ending its February-March correction. If the price fixes below the support level of 0.6444, the pair is expected to extend losses and head towards the support area of 0.6320/30. In case of a rebound after a week-long decline, the pair will face resistance at 0.6444. A rise above this level seems unlikely.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română