Yesterday turned out to be much more eventful than expected. The focus was on the euro area inflation data, which showed that the Harmonized Index of Consumer Prices (HICP) rose 2.4% in March, slowing from a 2.6% increase in February. In addition, US private payrolls increased by 184,000, against a forecast of 125,000. And the icing on the cake was Federal Reserve Chair Jerome Powell saying that the US central bank has time to assess data before it makes a decision on rate cuts. In general, everything pointed to an inevitable and sharp rise in the dollar. However, for some unknown reason, the euro was rising. Contrary to all the reports and official statements. And we can't explain why this happened. Unfortunately, these things happen occasionally. And in this case, it was better to just acknowledge this fact rather than build conspiracy theories trying to explain everything. Obviously, such a thing could only happen in the event of a massive capital outflow from the dollar to the euro. Only a handful of investment funds and banks can do such a thing. But if there is no confirmation on their part, it isn't worth making accusations. Fortunately, as I mentioned above, these things rarely happen. Moreover, fundamentally, such price jumps do not change the situation and the market quickly returns to its usual course.

In fact, it may even do so today. The formal reason could be the eurozone producer prices data, the rate of decline of which is likely to slow down from -8.6% to -8.3%. Movement towards stabilizing inflationary processes will convince the market that the European Central Bank will be the first to start lowering its interest rates. So basically, the prospects for the euro are not as bright as they might seem.

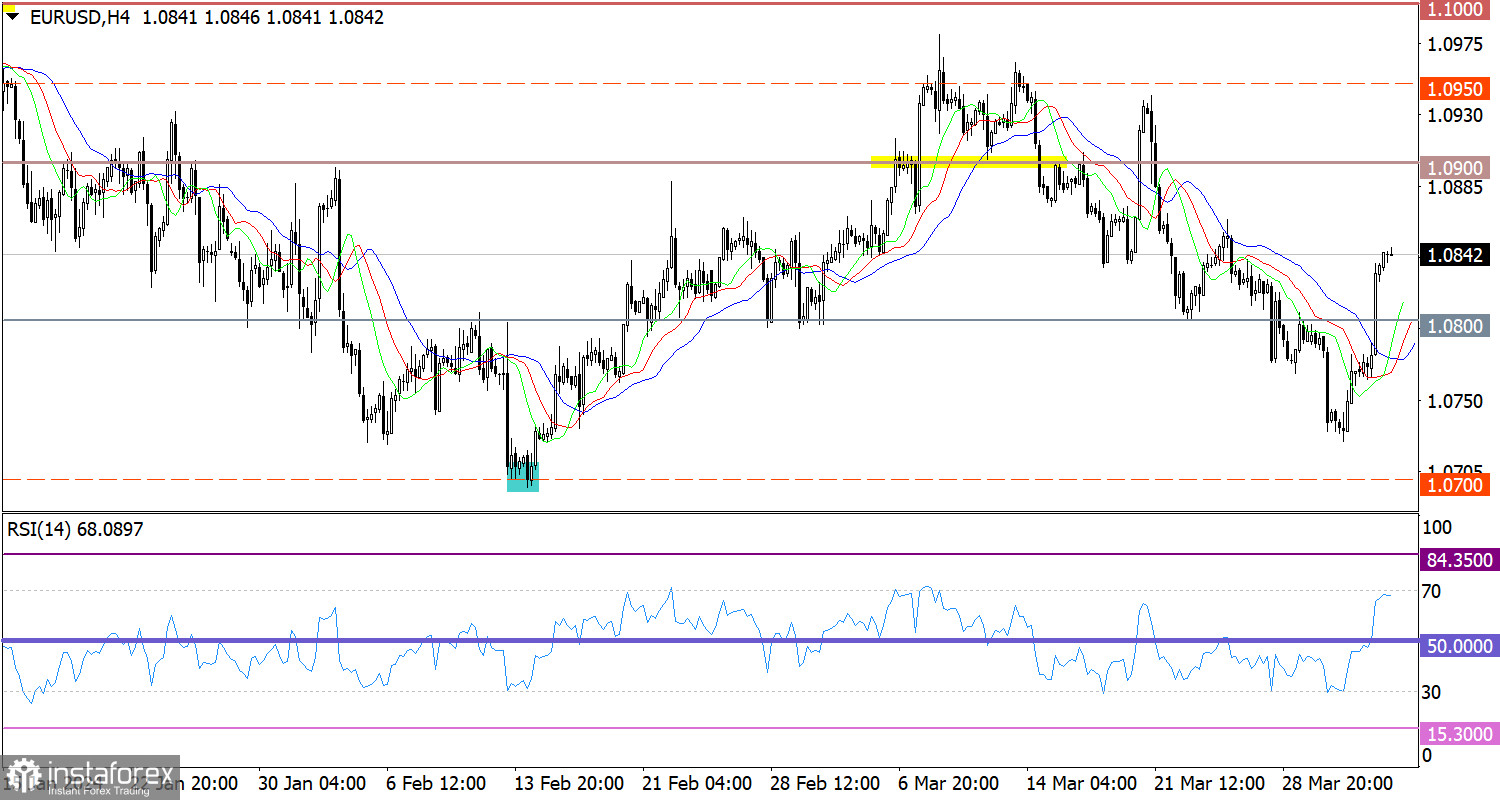

The EUR/USD pair surged above the 1.0840 mark, against the logic of fundamental analysis. From a technical perspective, the volume of long positions could have increased after the price upwardly breached the 1.0800 level.

On the 30M, 1H and 4H charts, the RSI technical indicator shows signs of the euro's overbought conditions.

On the 4-hour chart, the Alligator's MAs are headed upwards. It changed direction when the price suddenly jumped.

Outlook

In this situation, the euro is clearly showing overbought conditions, which suggests a possible slowdown in the upward cycle and a retracement to follow. However, speculators may also ignore the overbought conditions and follow the current momentum. In this case, the quote could move towards the 1.0900 level.

In terms of complex indicator analysis, indicators point to a bullish momentum in the short term and intraday periods.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română