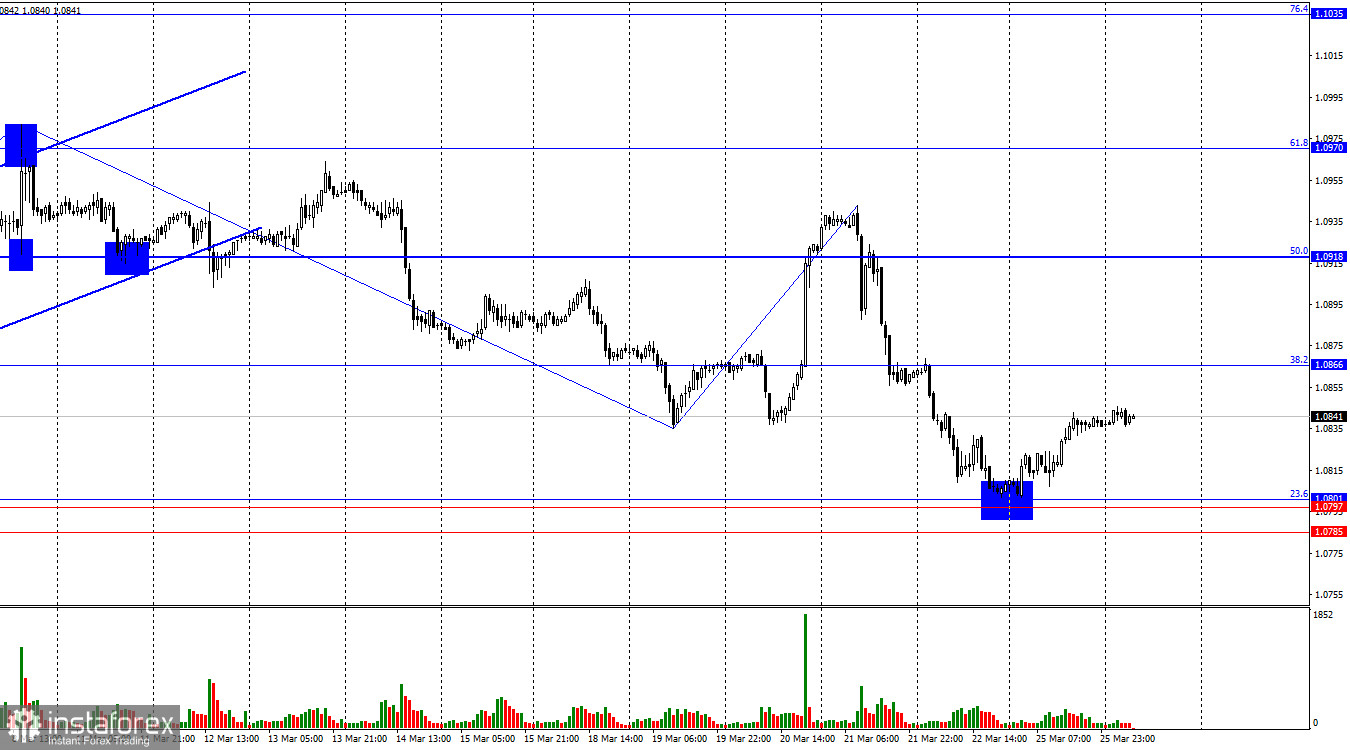

The EUR/USD pair on Monday rebounded from the support zone of 1.0785–1.0801, reversed in favor of the European currency, and began the process of growth towards the Fibonacci level of 38.2%–1.0866. A rebound of quotes from this level will favor the US dollar and a resumption of decline towards the zone of 1.0785–1.0801. Consolidation above the level of 1.0866 will increase the probability of further growth towards the corrective level of 50.0%–1.0918. But the trend remains "bearish."

The wave situation remains quite clear. The last completed upward wave failed to break the peak of the previous wave (from March 8), but the next downward wave broke the low of the previous wave (from March 19). Thus, we are currently dealing with a "bearish" trend, and there is currently no sign of its completion. For such a sign to appear, the new upward wave must be able to break the current last peak (from March 21). Until then, I expect the quotes to continue to decline.

The news background on Monday was very weak. Christine Lagarde's speech did not provide any new information to traders. The report on new home sales in the US showed a value slightly lower than market participants expected. Bulls dominated the market all day, but as I have already mentioned, the growth was corrective. And it was hardly caused by the only report of the day – on new home sales in the US. Most likely, we encountered a usual correction that cannot influence the overall trend and traders' sentiment. Thus, I expect the US dollar to resume its growth this week. The news background will be quite weak in the remaining days, so I do not expect a strong rise in the US currency. However, the results of the FOMC meeting and the latest inflation report in the US indicate that the dollar may continue to rise further.

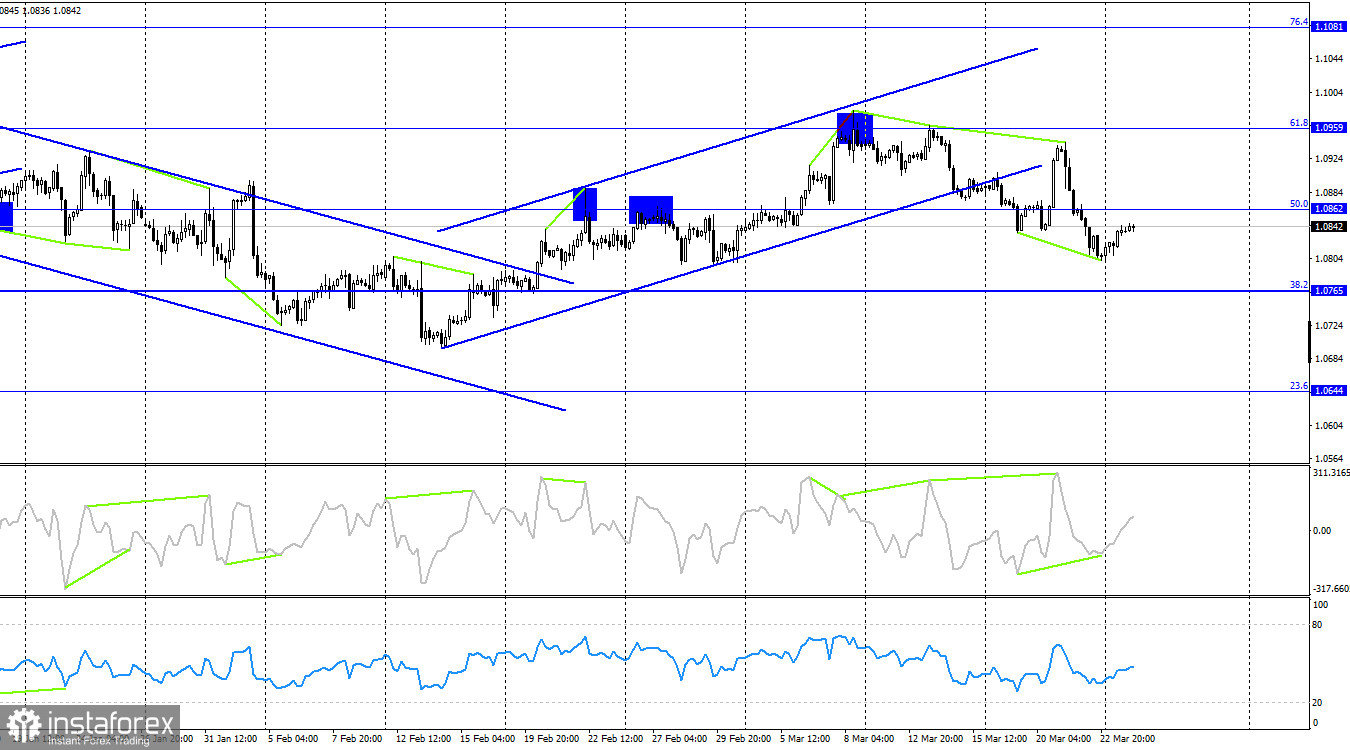

On the 4-hour chart, the pair made a reversal in favor of the euro after the formation of a "bullish" divergence on the CCI indicator and started the process of returning to the corrective level of 50.0%–1.0862. A rebound of the pair's rate from this level will favor the US currency and a resumption of decline towards the Fibonacci level of 38.2%–1.0765. Consolidation above 1.0862 will increase the probability of further growth towards the next corrective level of 61.8%–1.0959. However, I do not expect such a development, as consolidation below the ascending trend corridor indicates the completion of the "bullish" trend.

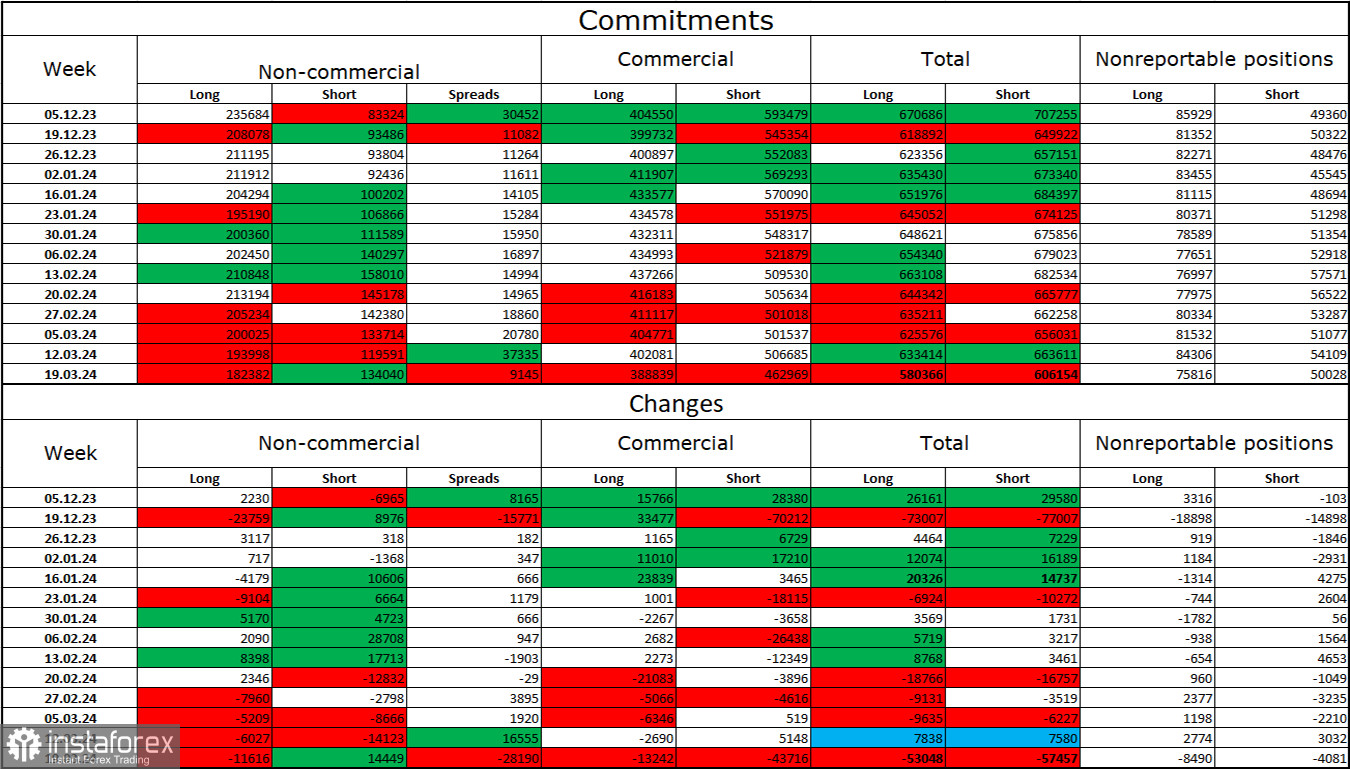

Commitments of Traders (COT) report:

During the last reporting week, speculators closed 11616 long contracts and opened 14449 short contracts. The sentiment of the "non-commercial" group remains "bullish" but continues to weaken. The total number of long contracts held by speculators now stands at 182 thousand, while short contracts amount to 134 thousand. The situation will continue to change in favor of bears. In the second column, we can see that the number of short positions has increased from 83 thousand to 134 thousand over the past 2.5 months. During the same period, the number of long positions decreased from 235 thousand to 182 thousand. Bulls have dominated the market for too long, and now they need a strong news background to resume the "bullish" trend. I do not see such a scenario in the near future.

News calendar for the US and EU:

EU – German Consumer Climate Index (07:00 UTC).

US – Change in Durable Goods Orders (12:30 UTC).

On March 26, the economic events calendar contains two entries, with the American one standing out. The impact of the news background on traders' sentiment today may be of moderate strength, but only in the second half of the day.

Forecast for EUR/USD and trader advice:

Selling the pair was possible on the hourly chart upon closing below the level of 1.0918, with targets at 1.0866 and 1.0801. Both targets have been reached. New sales – upon closing below the zone of 1.0785–1.0801, with a target of 1.0696. Or upon a rebound from the level of 1.0866. Buying the pair was possible upon a rebound from the zone of 1.0785–1.0801 on the hourly chart, with targets at 1.0866 and 1.0918. Deals with the first target can be left open.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română