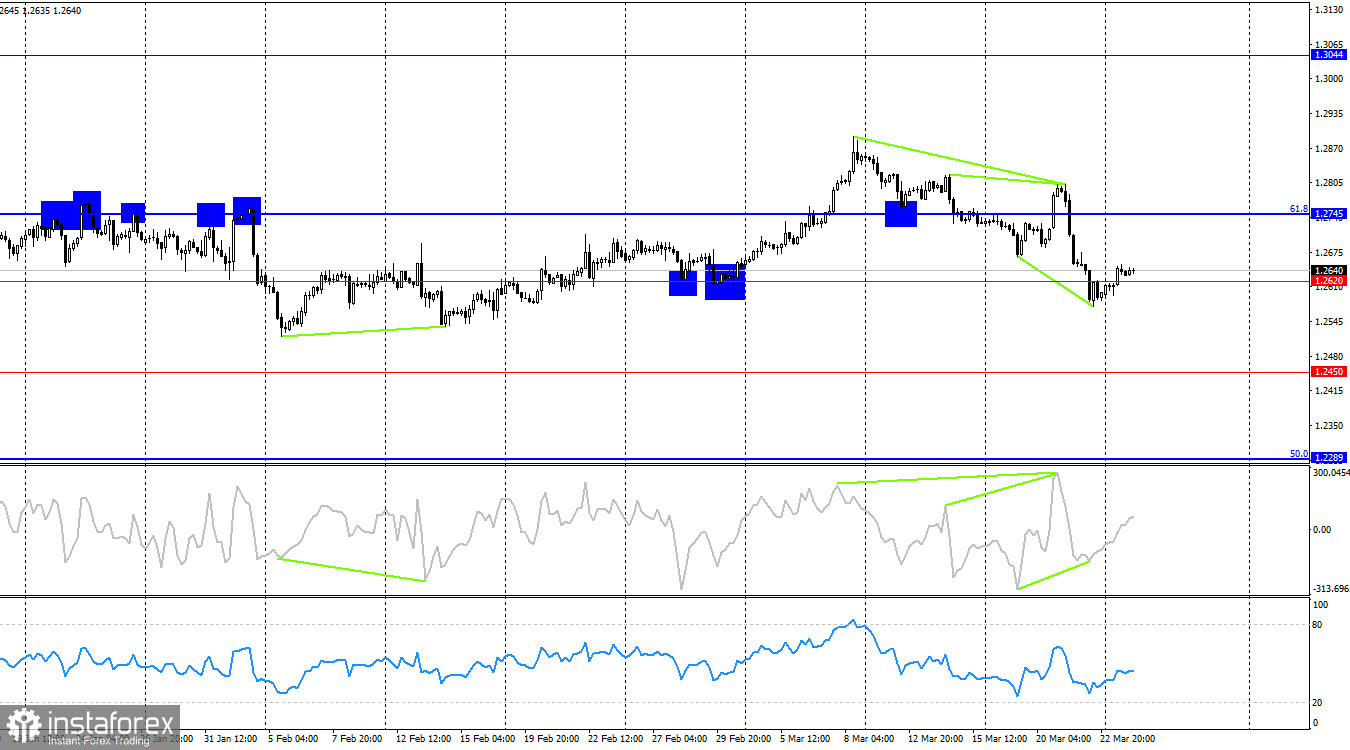

On the hourly chart, the GBP/USD pair on Monday rebounded from the support zone of 1.2584–1.2611 and reversed in favor of the pound. The process of growth towards the resistance zone of 1.2705–1.2715 has begun. The descending trend corridor characterizes traders' sentiment as "bearish." Therefore, I do not expect a strong rise in the pound. Consolidation of the pair's rate below the zone of 1.2584–1.2611 will favor the resumption of the decline towards the level of 1.2517.

The wave situation recently does not raise any questions. The last completed upward wave failed to reach the peak of the previous wave, and the new downward wave (forming at the moment) easily broke the last low (from March 19). Thus, the trend for the GBP/USD pair is currently "bearish." There are no signs of its completion; it has only just begun. The first sign of bulls transitioning to an offensive could be a breakthrough of the peak on March 21. However, bulls need to overcome a distance of about 200 pips to reach the zone of 1.2788–1.2801, which may take a lot of time, given the current trader activity.

On Monday, there was no significant news in the UK or the US. There were no news releases, so traders used this day to take profits, and the pair corrected slightly upward. However, the trend remains "bearish," and the descending trend corridor may not allow bulls to go far up. After the results of the Bank of England and FOMC meetings became known last week, I am betting on further growth of the US currency. The FOMC will take an even tougher stance in the coming months than before. There is currently no talk of a new rate hike, but if inflation continues to rise, I would not be surprised if the FOMC decides on an emergency tightening of monetary policy.

On the 4-hour chart, the pair has made a new reversal in favor of the pound and consolidated above the level of 1.2620 after the formation of a "bullish" divergence on the CCI indicator. Thus, the process of growth may continue towards the next corrective level of 61.8%–1.2745. No new impending divergences were observed in any of the indicators. The key zone now is 1.2584–1.2611 on the hourly chart.

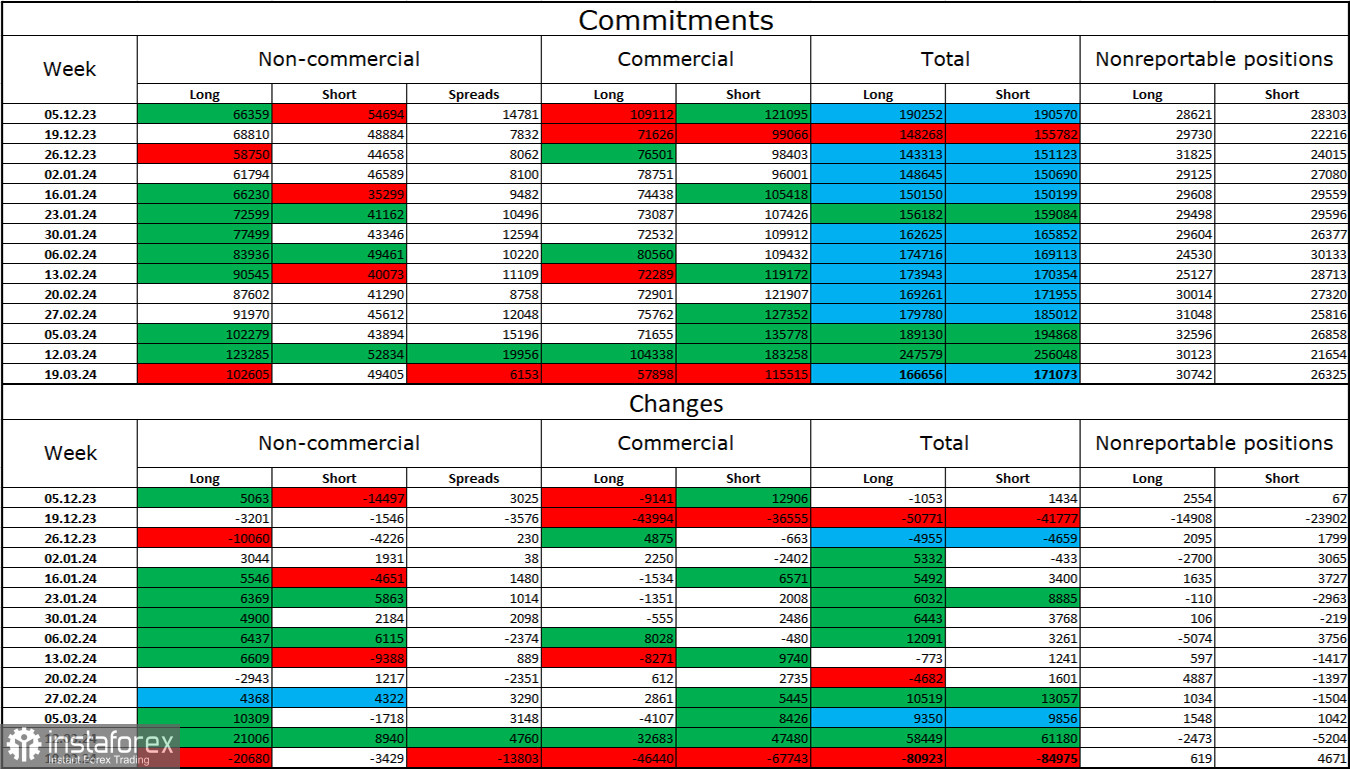

Commitments of Traders (COT) report:

The sentiment of the "non-commercial" trader category became less "bullish" during the last reporting week. The number of long contracts held by speculators decreased by 20680 units, while the number of short contracts decreased by only 3429 units. The overall sentiment of major players remains "bullish" and continues to strengthen, although I do not see any specific reasons for this. There is a more than two-fold gap between the number of long and short contracts: 102 thousand versus 49 thousand.

There are prospects for a decline in the pound, but over the past 2.5 months, the number of long contracts has increased from 66 thousand to 102 thousand, while the number of short contracts has hardly changed. Over time, bulls will start to get rid of their buy positions, as all possible factors for buying the British pound have already been exhausted. However, bears continue to demonstrate their weakness, which prevents the pound from starting to decline. The overall number of long and short contracts has been almost equal for several months, indicating a general balance in the market.

News calendar for the US and UK:

US – Change in Durable Goods Orders (12:30 UTC).

On Tuesday, the economic events calendar contains only one entry, but it is quite important. The impact of the news background on market sentiment today may be of moderate strength, but only in the second half of the day.

Forecast for GBP/USD and trader advice:

Selling the pound could have been considered today on a rebound from the zone of 1.2788–1.2801 on the hourly chart, with targets at the zone of 1.2705–1.2715 and the level of 1.2620. All targets have been reached. New sales – on consolidation below the zone of 1.2584–1.2611, with targets at 1.2517 and 1.2453. Buying was possible on a rebound on the hourly chart from the zone of 1.2584–1.2611, with targets at the zone of 1.2705–1.2715. For now, these trades can be left open.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română