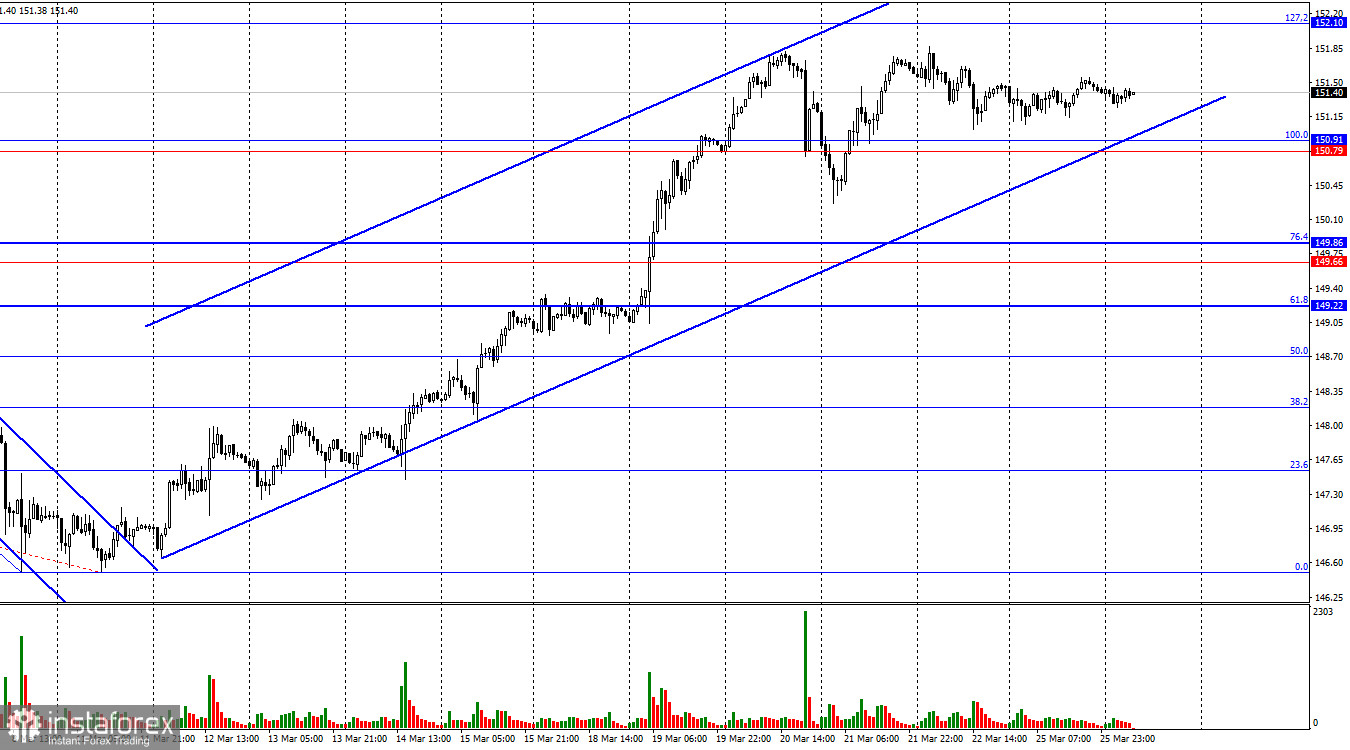

On the hourly chart, the USD/JPY pair showed no movement on Monday. Throughout the day, the price remained in a horizontal movement, not even attempting to test the nearest levels. After consolidating above the resistance zone of 150.79–150.91, traders can continue to anticipate growth towards the corrective level of 127.2%–152.10. If the pair's rate consolidates below the ascending trend corridor, it will favor the Japanese currency and allow for expectations of strong growth.

The wave situation recently fully supports the bulls. Exactly three waves were formed downward (one of them corrective), so a new "bullish" trend is beginning to form now. The new upward wave easily broke the peak of the previous wave, so I have no reason to speak about the completion of the "bullish" trend. For signs of its completion to appear, a new downward wave is required to break the low from March 11. The next upward wave should not surpass the last peak, which has yet to be formed, as the current wave is incomplete.

On Monday, the information background was virtually absent in Japan and the United States, which explains the low activity of traders. The only report on new home sales in the United States did not affect the actions (or rather, inaction) of traders during the day. However, the bull attack has stopped, and soon, the pair may close below the corridor. I believe it is necessary to wait for confirmation in the form of a close below the zone of 150.79–150.91 and then count on a sharp decline in the pair. The Bank of Japan may continue to raise interest rates at its upcoming meetings and may also introduce currency interventions due to the sharp decline in the yen. This factor keeps bullish traders from making new purchases.

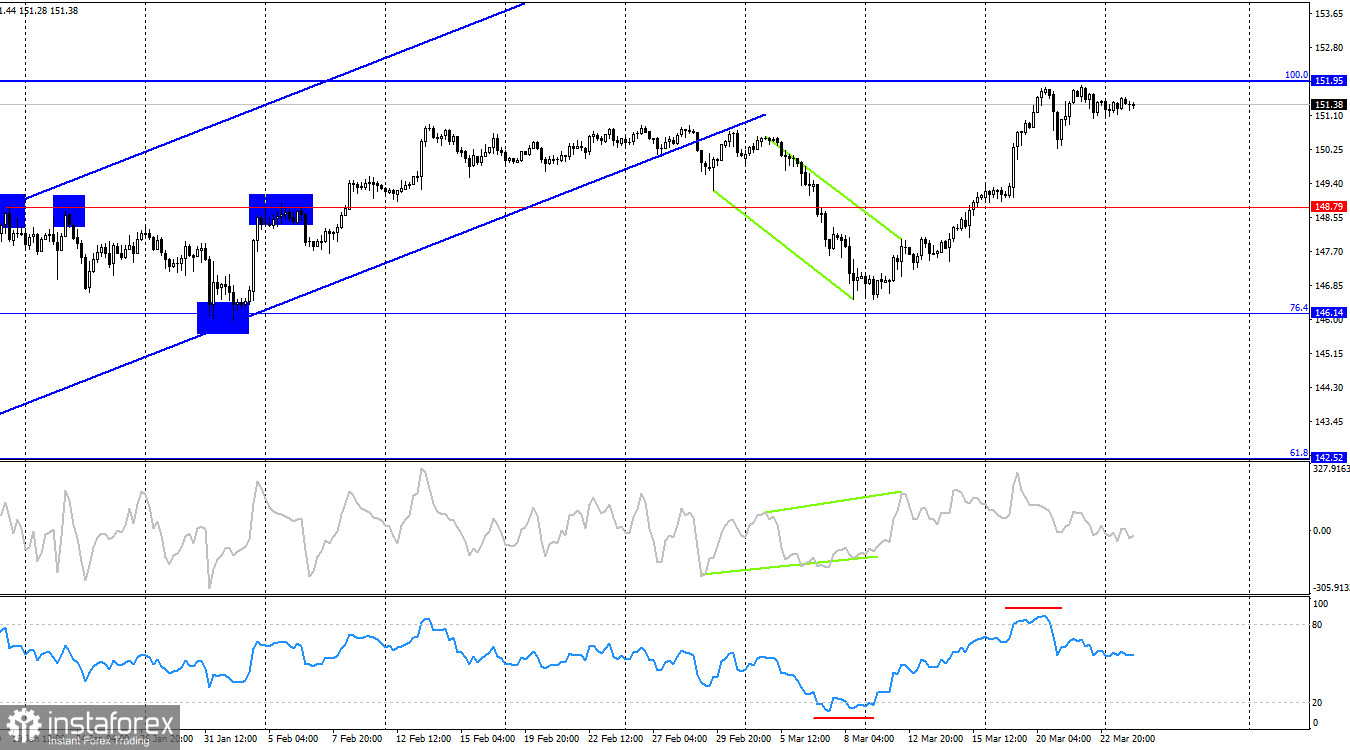

On the 4-hour chart, the pair continues to rise towards the corrective level of 100.0%–151.95. After consolidating above the ascending trend corridor, bears were in a more favorable position for a couple of days, but on the hourly chart, bulls are taking the lead. Consolidating the pair's rate above the level of 151.95 will increase the likelihood of continued growth towards the next Fibonacci level of 127.2%–158.66.

Commitments of Traders (COT) report:

The sentiment of the "non-commercial" trader category became even more "bearish" than before during the last reporting week. The number of long contracts held by speculators increased by 11351 units, while the number of short contracts increased by 25041 units. The overall sentiment of major players remains "bearish," and the advantage of sellers is huge. There is almost a threefold gap between the number of long and short contracts: 66 thousand versus 182 thousand.

There are excellent prospects for further yen depreciation. Still, the significant gap between long and short contracts may also indicate the proximity of the completion of the "bearish" trend for the Japanese currency. In other words, bullish speculators may begin to retreat from the market. On the 4-hour chart, we already see an important break in the "bullish" trend, but in the short term, the dollar may continue to rise.

News calendar for the United States and Japan:

US – Change in Durable Goods Orders (12:30 UTC).

On Tuesday, one report is planned for both Japan and the United States. The impact of the news background on market sentiment for the rest of the day may be weak.

Forecast for USD/JPY and trader advice:

Selling the yen today can be considered a rebound from the level of 151.95 on the 4-hour chart with a target of 150.90 or on a close below the zone of 150.79–150.91 on the hourly chart with a target of 149.86. Buying was possible on a close above the level of 148.55 on the hourly chart and a close above the level of 148.79 on the 4-hour chart, with targets at 149.66, 150.89, and 151.95. In my opinion, the first two targets have been reached, and there is no need to wait for the third to be reached.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română