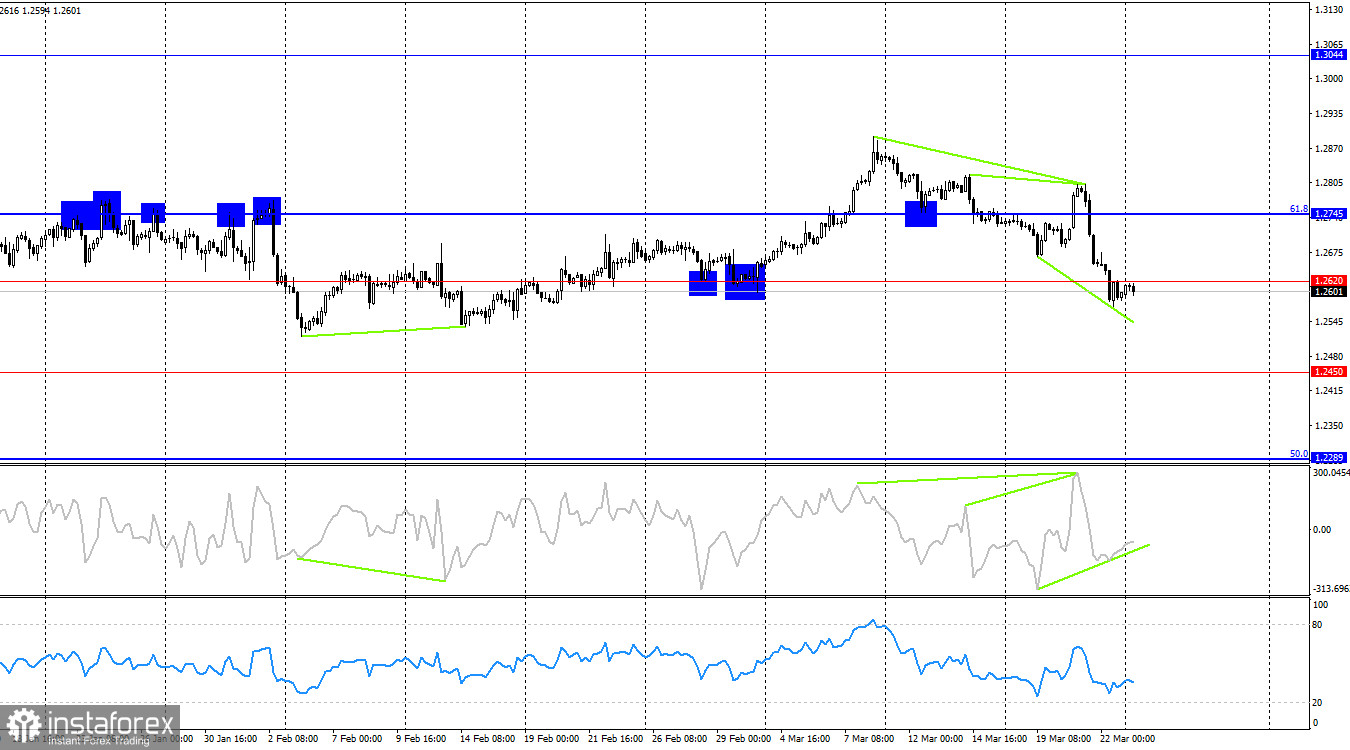

On the hourly chart, the GBP/USD pair continued its downward movement on Friday towards the support zone of 1.2584–1.2611. A rebound of quotes from this zone will favor the British currency and lead to some growth towards the resistance zone of 1.2705–1.2715.

Consolidation of the pair's rate below the zone of 1.2584–1.2611 will increase the likelihood of further decline towards the next level of 1.2517. The downward trend channel has been broken, but bears maintain the initiative after the Fed and Bank of England meetings. The wave situation has been clear lately. The last completed upward wave failed to reach the peak of the previous wave, and the new downward wave (which is forming at the moment) easily broke the last low (from March 19). Thus, the trend for the GBP/USD pair is currently bearish. There are no signs of its completion; it has only just begun. The first sign of a bullish transition could be a breakthrough of the peak on March 21. However, bulls need to cover a distance of about 200 pips to reach the zone of 1.2788–1.2801.

There was little important news on Friday, but traders learned the results of the Bank of England's meeting on Thursday. According to most economists, they can be considered "dovish," which allowed bears to continue their advance. The Bank of England allowed a rate cut soon, even though inflation is still far from the target. However, consumer prices are slowing down, allowing the regulator to consider options for rate cuts. Also, the MPC voted on the rate, and it turned out that none of the nine acting members supported tightening anymore. There were two at the previous meeting. This also tells traders about the regulator's softer approach to monetary policy. Thus, the pound's decline on Thursday and Friday corresponded to the background information.

On the 4-hour chart, the pair made a new reversal in favor of the dollar and consolidated below the level of 1.2620 after the formation of two "bearish" divergences at the CCI and RSI indicators. Thus, the process of decline may continue toward the next level of 1.2450. A "bullish" divergence is currently forming in the CCI indicator but has not yet formed. The current key zone is 1.2584–1.2611 on the hourly chart.

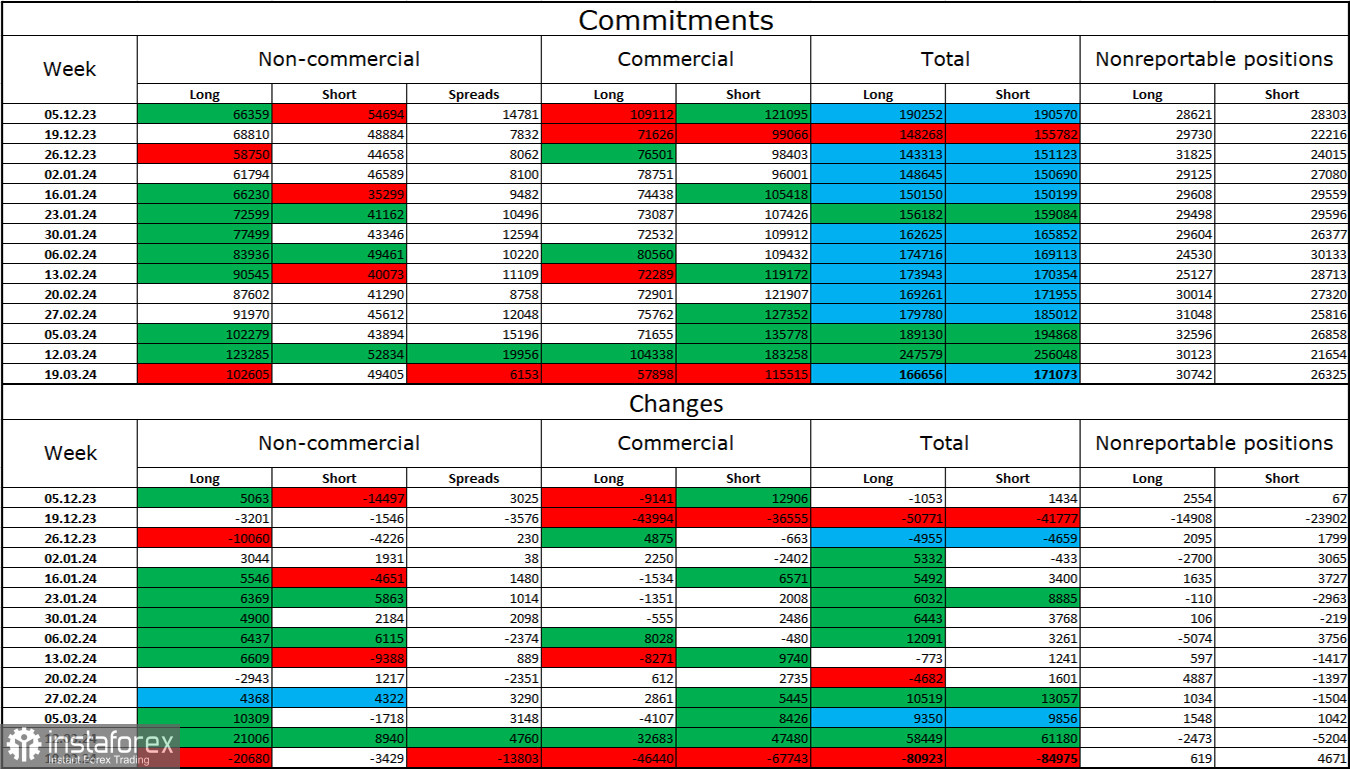

Commitments of Traders (COT) report:

The mood of the "non-commercial" trader category became less "bullish" over the past reporting week. The number of long contracts held by speculators decreased by 20,680 units, while the number of short contracts decreased by only 3,429. The overall sentiment of major players remains "bullish" and continues to strengthen, although I don't see any specific reasons for this. There is more than a twofold gap between the number of long and short contracts: 102,000 versus 49,000.

The prospects for a decline in the pound are still intact, but over the past 2.5 months, the number of long positions has increased from 66,000 to 102,000, while the number of short positions has remained practically unchanged. Over time, bulls will start getting rid of their buy positions, as all possible factors for buying the British pound have already been worked out. However, bears continue to demonstrate their weakness, which hinders the pound from starting to fall. The total number of long and short positions coincided for several months, indicating a general market balance.

News Calendar for the US and the UK:

US – New Home Sales (14:00 UTC).

On Monday, the economic events calendar contains only one entry, far from the most important. The impact of the information background on market sentiment today will be very weak or absent.

Forecast for GBP/USD and trading recommendations:

Sales of the pound could be considered today on a rebound from the zone of 1.2788–1.2801 on the hourly chart, with targets at the zone of 1.2705–1.2715 and the level of 1.2620. All targets have been reached. New sales are possible with consolidation below the zone of 1.2584–1.2611, with targets at 1.2517 and 1.2453. Purchases are possible today on a rebound on the hourly chart from the zone of 1.2584–1.2611, with a target at 1.2705–1.2715.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română