Although the single currency is still moving downward, it is not as active as it was before. In general, we believe that the pair is only following the previous momentum. Especially since the economic calendar was empty on Friday. But take note that the dollar's bullish momentum is gradually fading. In theory, we may see an attempt at consolidation around the levels reached at the end of last week. However, the scale and pace of the dollar's strength is worth only a hint of a rebound, and the corrective movement will do its own job. In other words, most likely the euro will rise.

The downward cycle has slowed down around the level of 1.0800. As a result, the volume of short positions has decreased, leading to a price rebound.

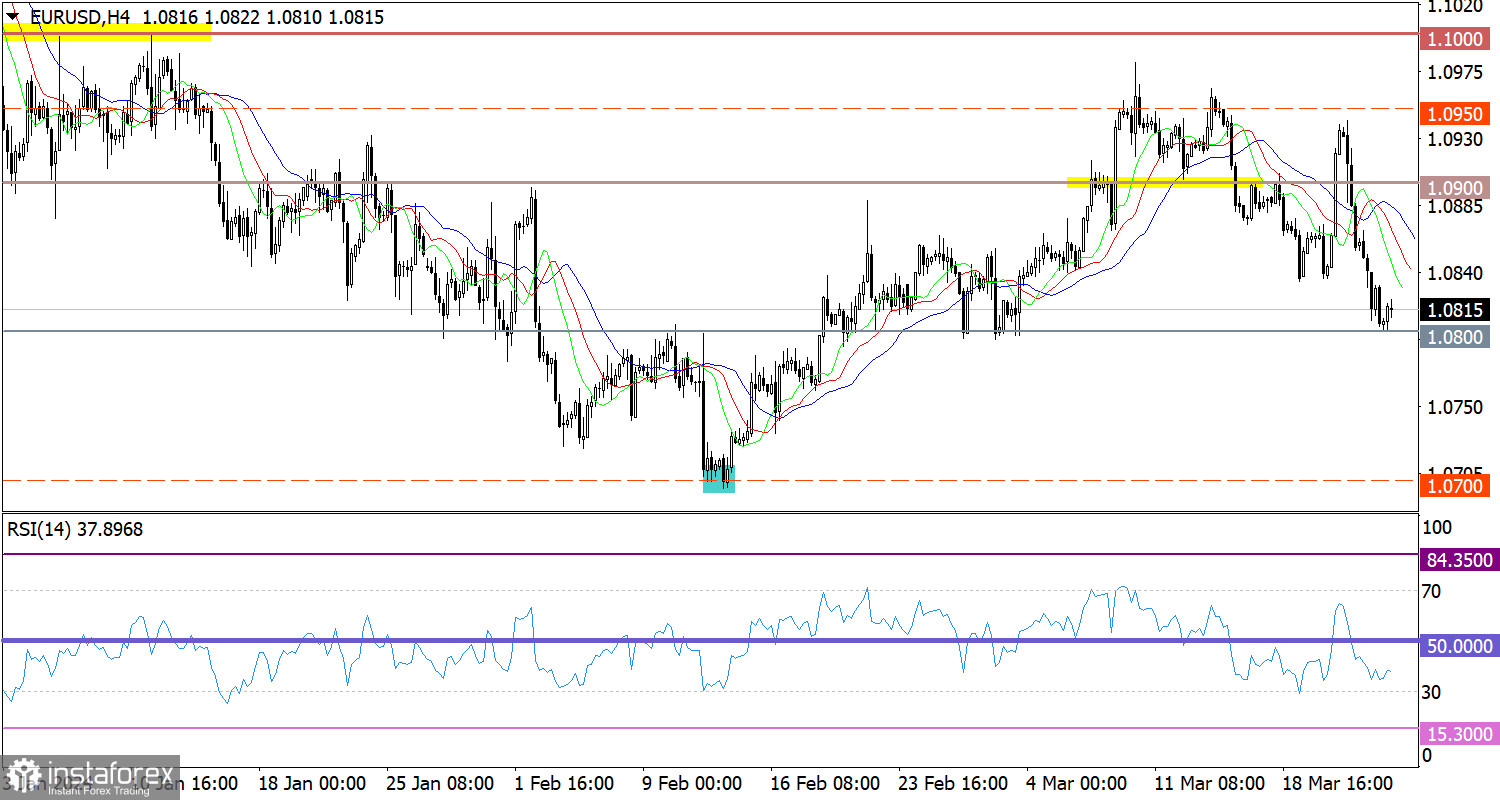

On the 30M and 1H charts, we observed signals of the euro's overbought conditions using the RSI technical indicator, which indicates a rebound. On the 4-hour chart, the indicator is hovering in the lower area of 30/50, which suggests that the downward cycle persists.

On the 4-hour chart, the Alligator's MAs are headed downwards, which corresponds to the direction of the corrective cycle.

Outlook

In order to raise the volume of short positions during the current corrective cycle, the price must settle below the 1.0800 level by the end of the day. Until then, due to the euro's overbought condition, the pair may start to bounce.

Complex indicator analysis suggests a rebound from the 1.0800 level in the short-term. Meanwhile, indicators still indicate a downward cycle in the short-term.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română