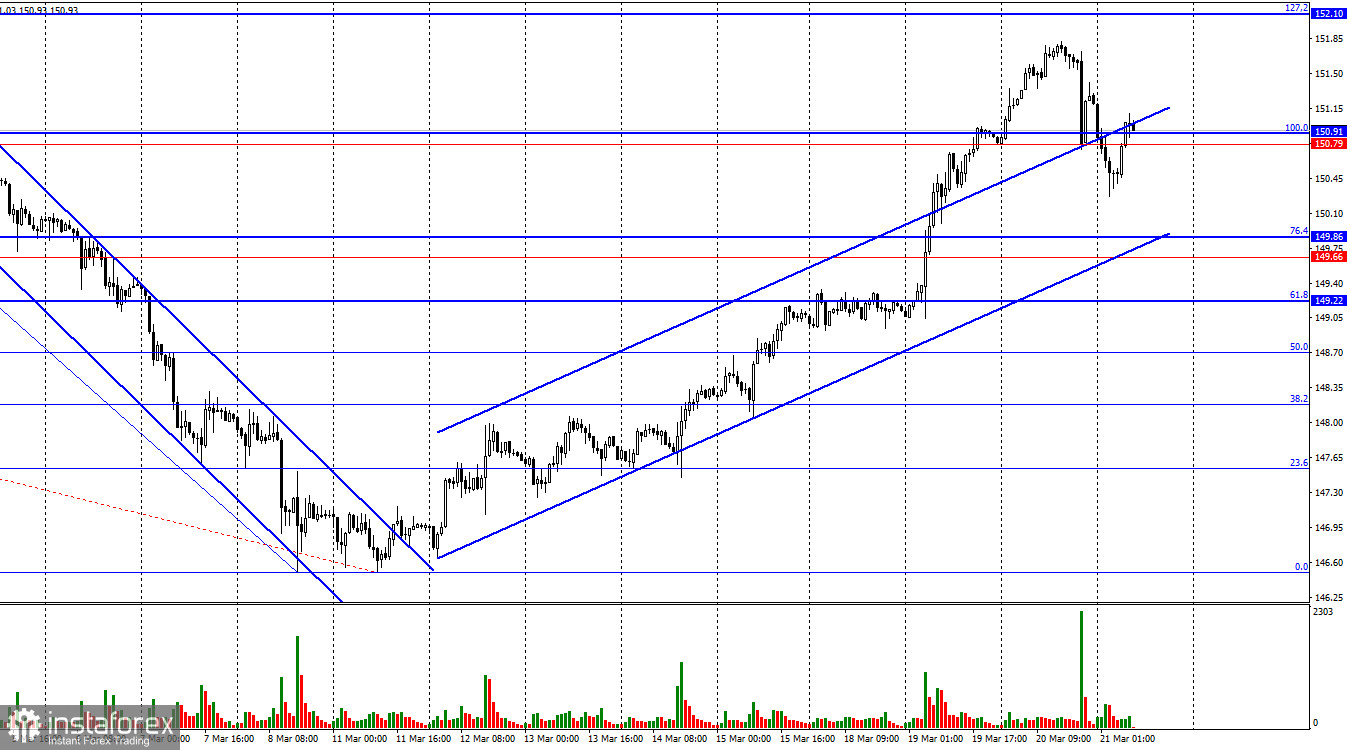

On the hourly chart, on Wednesday, the USD/JPY pair reversed in favor of the yen and consolidated below the support zone of 150.79–150.91. However, today, on Thursday, a reversal in favor of the US dollar occurred with a close above this zone. Thus, the upward movement may continue toward the corrective level of 127.2%–152.10. I will not expect a strong decline in the pair until it consolidates below the ascending trend channel.

The wave situation recently fully supports the bulls. Exactly three waves were formed downwards (one of them corrective), so a new "bullish" trend may be forming now. The new upward wave easily exceeded the peak of the previous wave, so I see no reason to talk about the end of the "bullish" trend yet. We need a new downward wave that breaks the low from March 11 to see signs of its completion. The next upward wave should not exceed the last peak, which has not yet formed, as the current wave is incomplete.

On Wednesday evening, traders learned the results of the FOMC meeting. It can be said that traders expected more "hawkish" outcomes, but they didn't materialize. The Japanese yen has weakened against the dollar for weeks, months, and even years. Therefore, the rise of the Japanese currency could have been more-lived. Overnight in Japan, business activity indices were released, showing a significant increase in March compared to February. However, these data also cannot stop the decline of the yen. Tomorrow night, the inflation report for Japan will be released, but there is no doubt that it will also not affect the chart pattern. Expecting the yen to strengthen will only be possible after it consolidates below the corridor on the hourly chart. The information background will not cause a strong yen rally. The Bank of Japan should intervene with interventions.

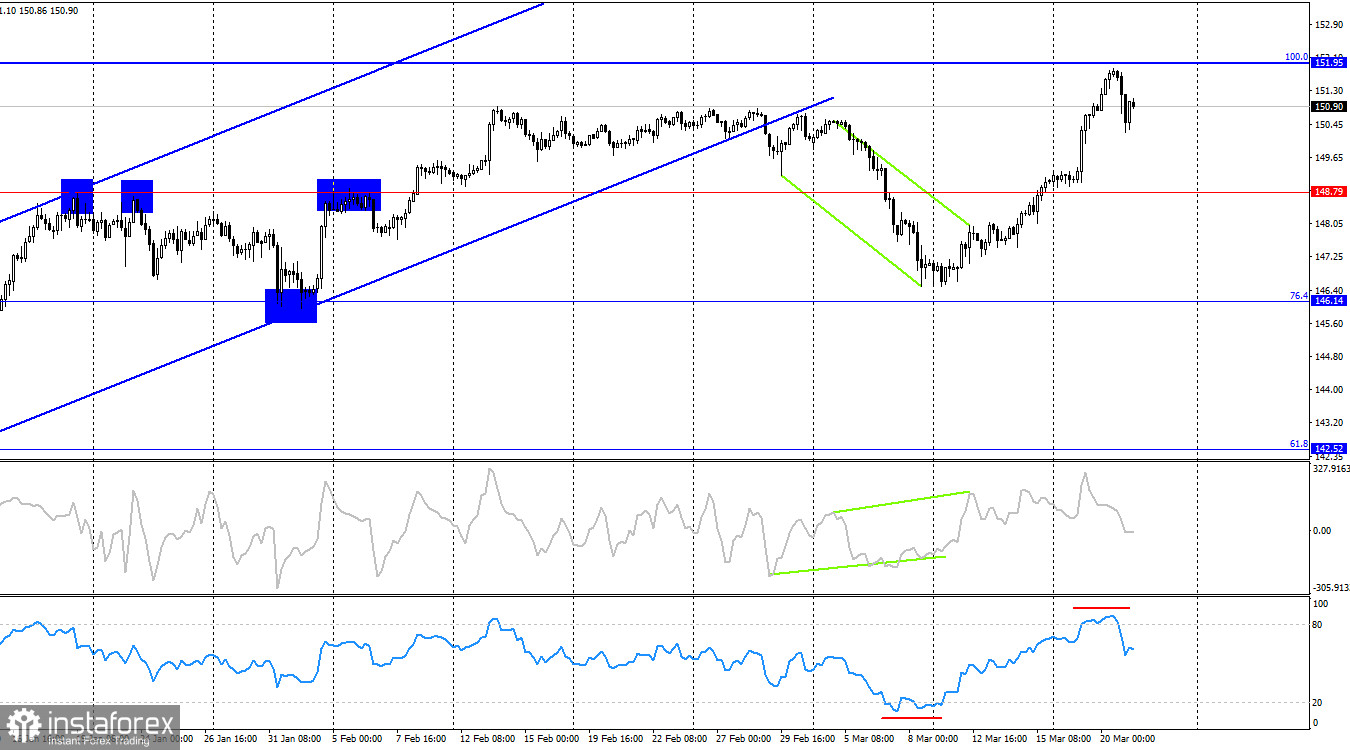

On the 4-hour chart, the pair executed a new reversal in favor of the US currency and consolidated above 148.79. Thus, the upward movement may continue towards the next Fibonacci corrective level of 100.0%–151.95, which we are observing now. After consolidating below the ascending trend channel, the bears were in a more advantageous position for a couple of days, but on the hourly chart, the bulls are leading. Consolidation of the pair's rate above the level of 151.95 will increase the probability of further growth towards the next Fibonacci level of 127.2%–158.66.

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became slightly less "bearish" over the past reporting week. The number of long contracts held by speculators increased by 252 units, while the number of short contracts decreased by 16269. The overall sentiment of major players remains "bearish," and the advantage of sellers is enormous. There is an almost threefold gap between the number of long and short contracts: 55 thousand versus 157 thousand.

In my opinion, the yen still has excellent prospects for further decline. Still, the significant gap between long and short contracts may also indicate the proximity of the end of the "bearish" trend for the Japanese currency. In other words, bullish speculators may start to retreat from the market. On the 4-hour chart, we already see a significant break in the "bullish" trend, but the dollar may continue to rise in the short term.

News Calendar for the US and Japan:

Japan – Manufacturing Purchasing Managers' Index (00:30 UTC).

Japan – Services Purchasing Managers' Index (00:30 UTC).

US – Initial Jobless Claims (12:30 UTC).

US – Manufacturing Purchasing Managers' Index (13:45 UTC).

US – Services Purchasing Managers' Index (13:45 UTC).

US – Existing Home Sales (14:00 UTC).

Japan – Consumer Price Index (23:30 UTC).

Thursday's economic events calendar contains many entries. Regardless of the background of the information, bulls may continue to attack today. The impact of the information background on market sentiment for the remainder of the day may again be strong.

Forecast for USD/JPY and Trading Tips:

Selling the yen today can be considered a rebound from 151.95 on the 4-hour chart or from 152.10 on the hourly chart with a target of 150.90. Buying opportunities were possible on a close above 148.55 on the hourly chart and on a close above 148.79 on the 4-hour chart with targets of 149.66 and 150.89. Both targets have been reached, and the upward trend continues; buys can be held with a target of 151.95. Consolidation above this level will allow maintaining buys with targets of 152.10 and 153.63.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română