EUR/USD

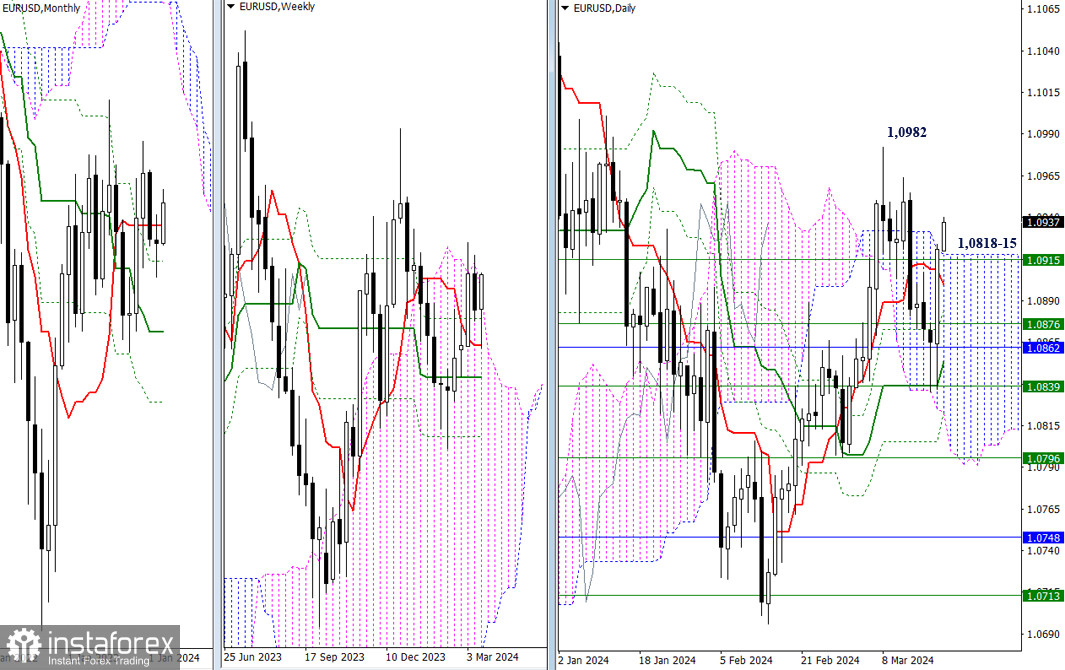

Higher Timeframes

Bullish players were able to confirm yesterday that the long lower shadow formed the day before was not a coincidence. By now, the market has moved beyond the Ichimoku clouds (1.0818-15), so it is crucial for the bulls to maintain the achieved level and hold the height. The next task in this direction will be to update the correction high (1.0982).

In case of failure, all the bears' efforts will again be directed towards the area of support that has maintained its position so far, ranging from 1.0876 to 1.0862 to 1.0839. The intraday short-term trend (1.0899) may provide intermediate support along this path.

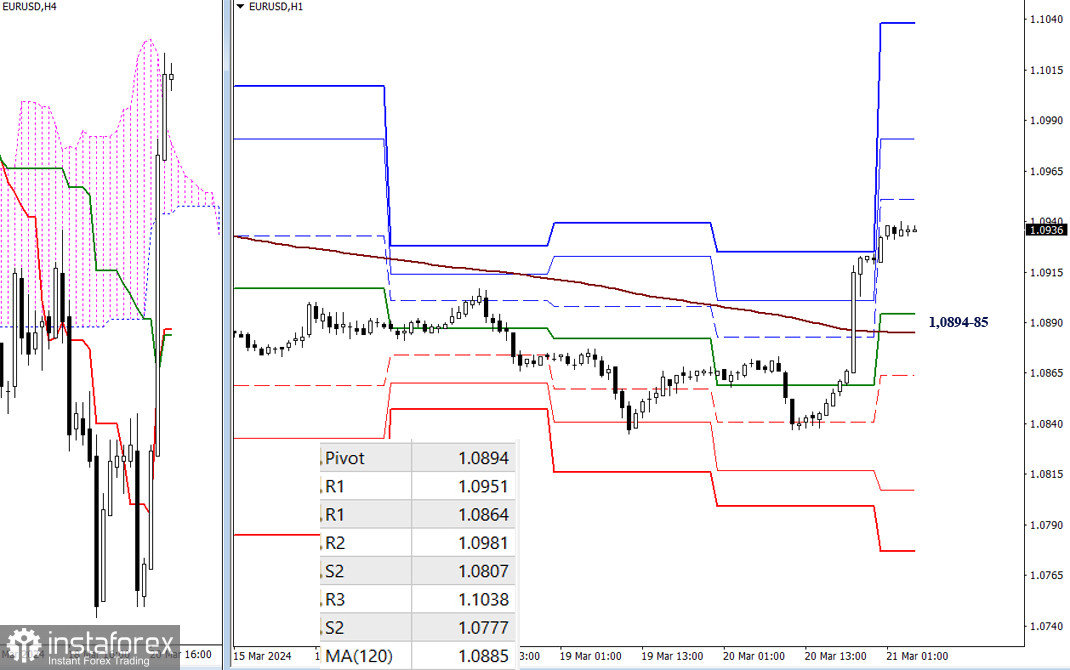

H4 - H1

Bulls swiftly surpassed key levels and shifted the balance of power in their favor. While continuing their ascent, they may focus their attention within the day on the resistances of classic pivot points (1.0951 - 1.0981 - 1.1038).

The development of a downward correction could bring the market back to key levels, which currently serve as the main reference points for the correction and are located at 1.0894 - 1.0895 (central pivot point + weekly long-term trend). A consolidation below this level is likely to change the balance of power once again, giving the upper hand to the bearish players. Subsequently, the support levels of the classic pivot points (1.0864 - 1.0807 - 1.0777) will act as downward targets.

***

GBP/USD

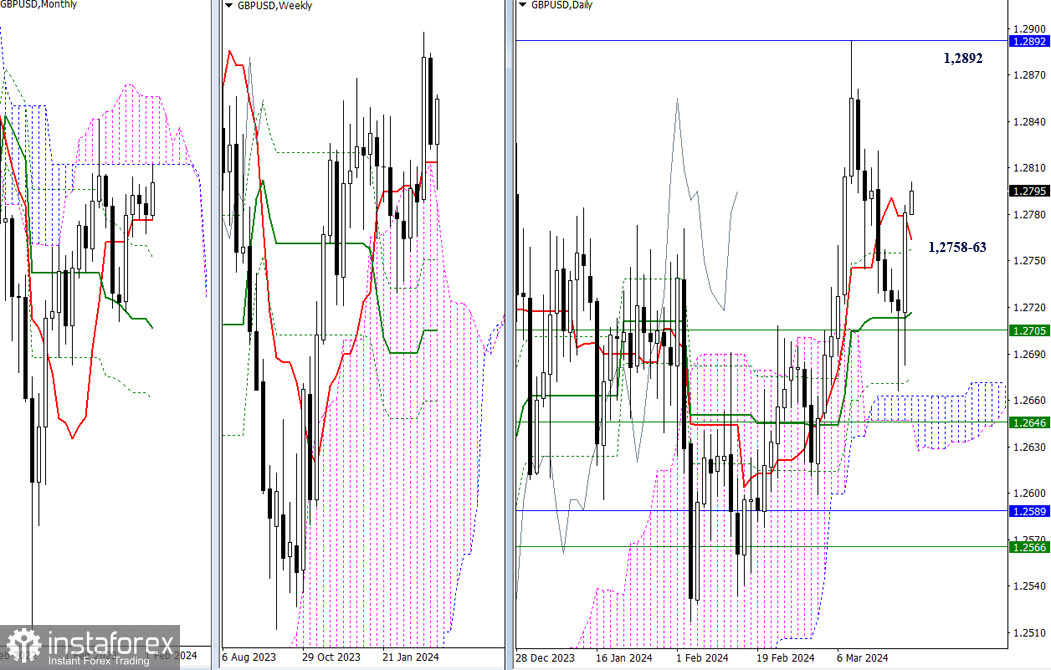

Higher Timeframes

Yesterday, the bulls confirmed and developed a rebound from the previous day, realized when encountering support at 1.2671 - 1.2713-05 (daily and weekly levels). Moreover, the working day closed above daily resistances.

Today, the breached levels have turned into supports, ready to meet the market around 1.2758 - 1.2763 (intraday short-term trend + Fibonacci Kijun). In continuation of the ascent in this section of the chart, the primary significance still lies in testing and breaking through the lower boundary of the monthly cloud (1.2892).

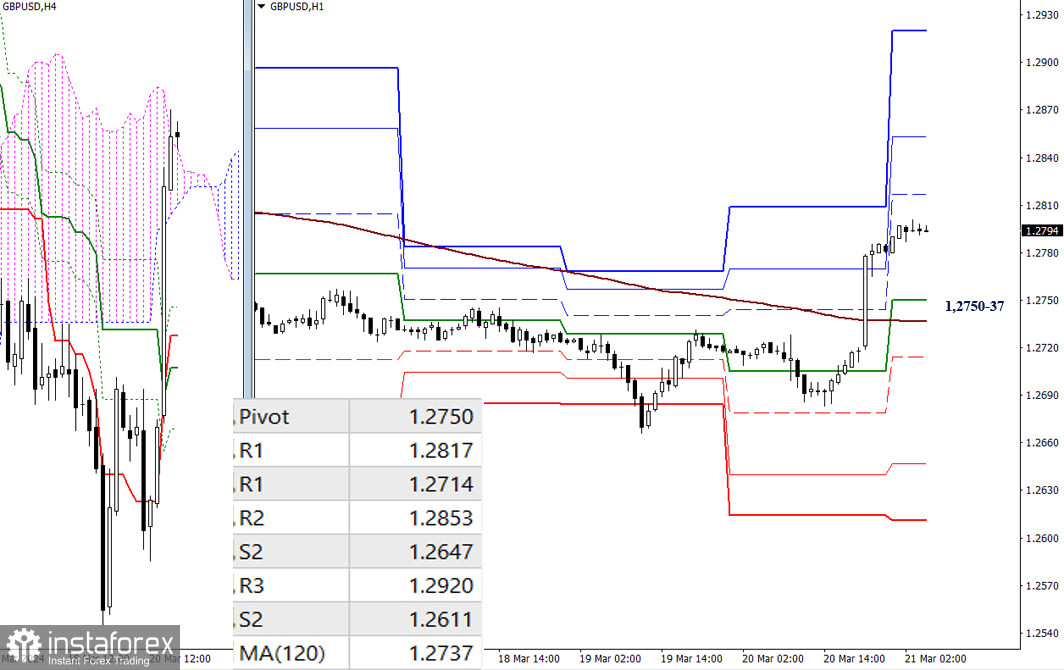

H4 - H1

On lower timeframes, the bulls have gained a significant advantage, leaving behind key levels, which today serve as the nearest supports in case of corrective decline. During the correction, key levels will encounter the market around 1.2750–37 (central pivot point of the day + weekly long-term trend). If the key levels are breached and bears continue the descent, the support levels of the classic pivot points (1.2714 - 1.2647 - 1.2611) will serve as further downward targets within the day. Conversely, if the bulls continue their ascent, they will encounter resistance at the classic pivot points (1.2817 - 1.2853 - 1.2920).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română