Formally, the dollar weakened on Monday, but the scale of its decline, at best, could be considered symbolic. It's probably a continuation of the retracement after the US dollar's impressive growth. Especially since there were no other reasons why the quote would move this way. The final estimate of the Eurozone inflation report certainly didn't contribute to this movement, as this report simply confirmed the first estimate that the market has already factored in. And, for the most part, it was clear from the second half of the trading day that the market had come to a standstill, naturally awaiting tomorrow's Federal Open Market Committee meeting. Fortunately, the economic calendar is practically empty before such a significant event. Unless we consider the UK inflation report. But this will be released tomorrow morning. And even then, we don't expect this report to have a significant impact on the pair. Therefore, the pair will likely remain flat until tomorrow evening.

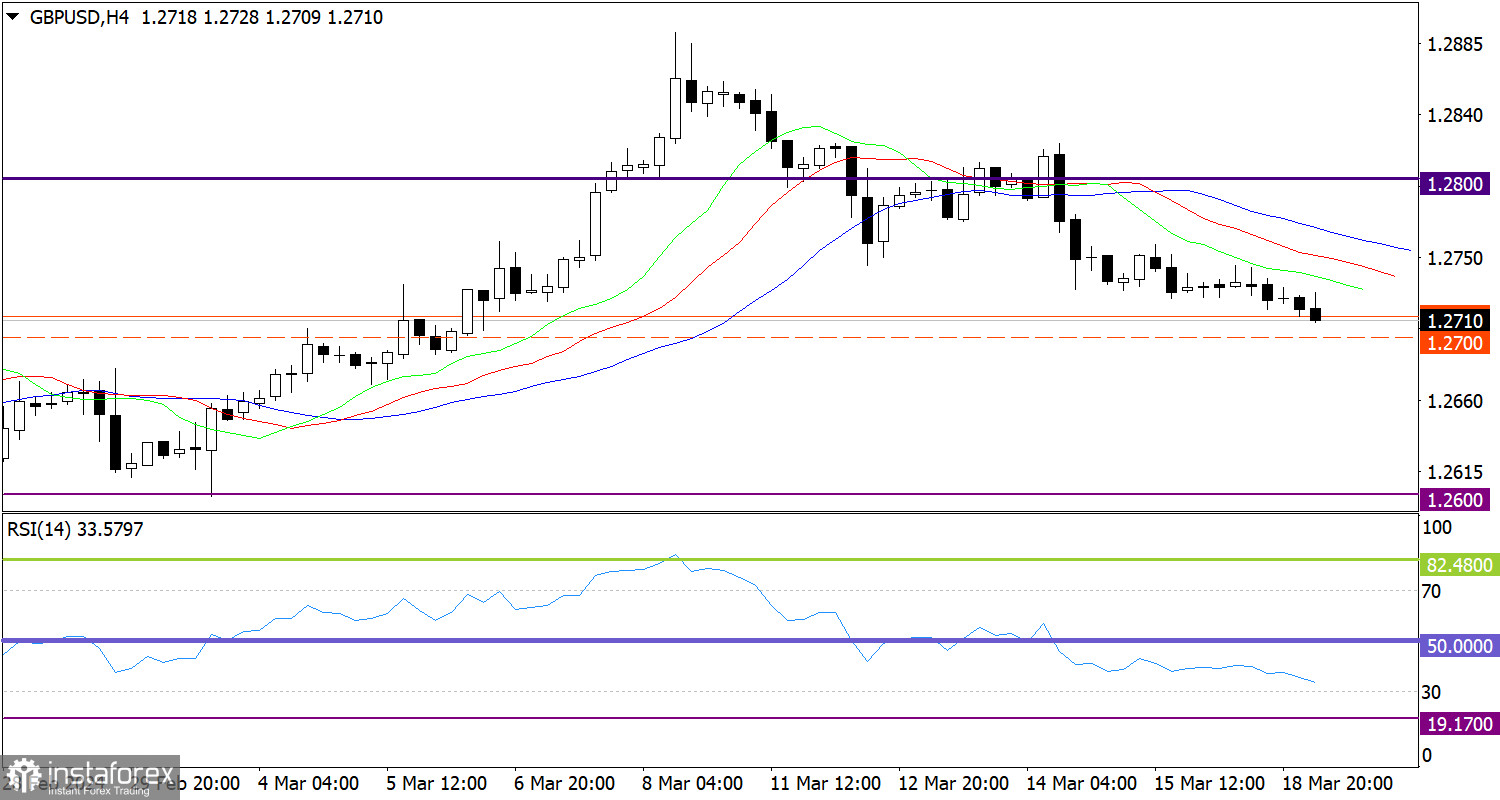

The volume of short positions on the GBP/USD pair increased, which extended the current corrective movement.

On the four-hour chart, the RSI indicator is moving in the lower area, indicating an increase in selling volumes.

On the same time frame, the Alligator's MAs are headed downwards, corresponding to the direction of the corrective cycle.

Outlook

Sellers may consider the level of 1.2700 as a possible support, which may slow down the pace of the pound's decline. However, in case the price breaches the support level, this will strengthen short positions and extend the corrective movement.

The complex indicator analysis points to a downward cycle in the short-term and intraday periods.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română