On Thursday the market burst into high volatility due to a series of high-impact macroeconomic data. Next day, the market again came to a standstill. Traders took no notice of the data on industrial production in the US despite the fact that the factory activity slowed down. Analysts had projected industrial output to grow from 0.0% to 0.2%. Instead, production logged a decline of 0.2%. However, there was a small trick that made the data even look positive. We are talking about a downward revision of the previous indicator to -0.3%. So, it seems like the rate of decline has even slowed down. But in any case, these data had no impact on the currency market, which was simply treading water. Moreover, today this range-bound will most likely continue. The only important economic data in the economic calendar today is the inflation report in the euro area. But it will be revised data published. The CPI will almost certainly coincide with the preliminary estimate, which has already been taken into account by the market.

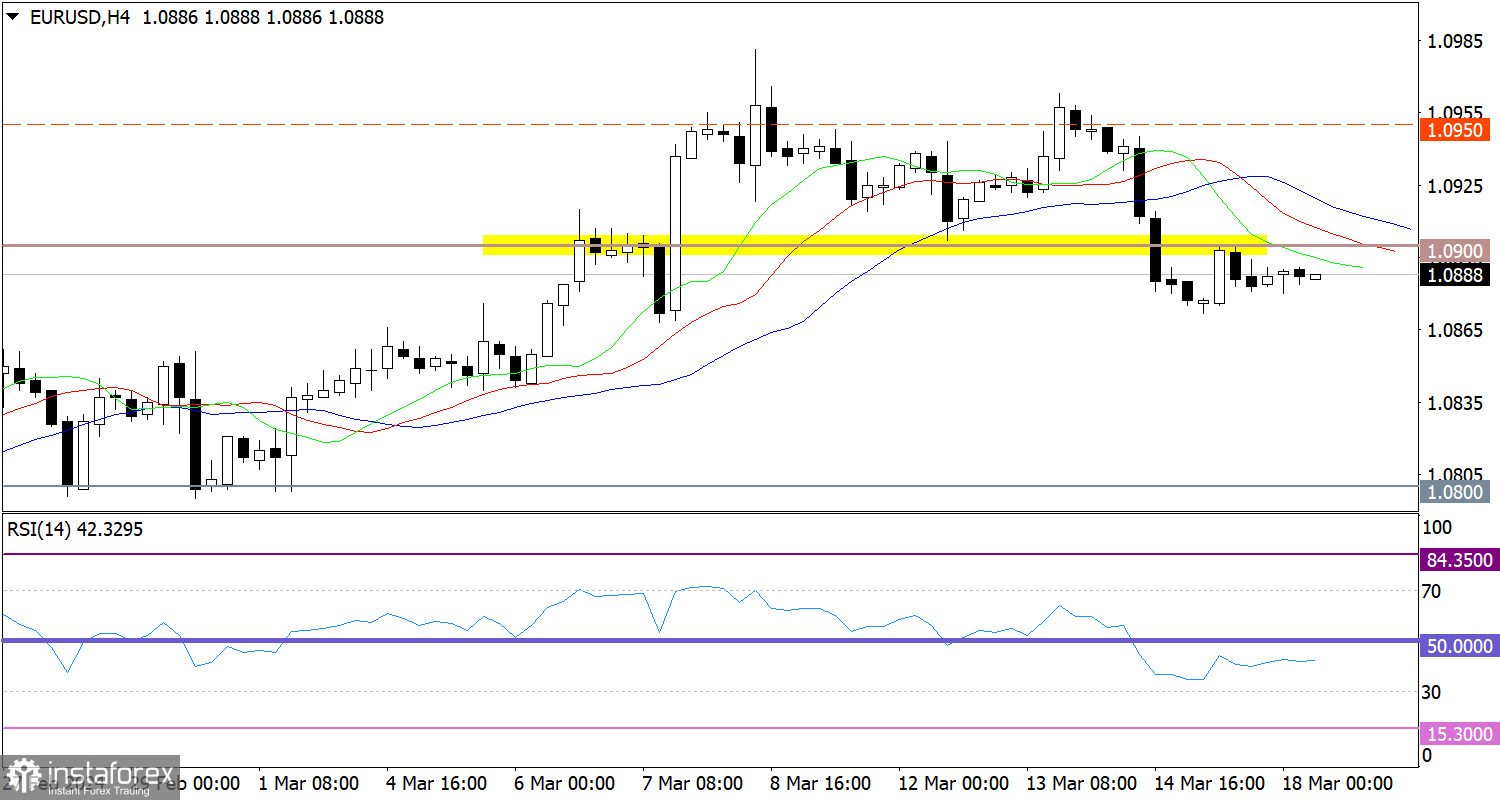

The EUR/USD pair slowed down the correction cycle in the area of 1.0870. The price rebounded to the previously passed level of 1.0900. The subsequent fluctuations were characterized as a sideways movement at 1.0870/1.0900.

From the point of view of the RSI H4 instrument, there is a movement of the indicator in its lower 30/50 area, which indicates a possible increase in the volume of short positions in EUR/USD.

As for the Alligator indicator, the moving MA lines in the H4 timeframe are directed downward, which corresponds to the direction of the corrective cycle.

Outlook and trading tips

In this situation, the current stagnation indicates the accumulation of trading forces, which in turn allows for new price swings. The reasonable strategy in terms of technical analysis is trading outside one or another established borders of the trading range. As a result, EUR/USD could trade with higher volatility which will lead to a recovery of the euro's forex rate. Otherwise, EUR/USD might prolong the current correction cycle.

Complex indicator analysis indicates sideways trading in the short-term and intraday.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română