The market cannot stand still for long, especially when reports on US inflation and Eurozone industrial production are released. Moreover, in both cases, these reports supported the dollar. Sooner or later, the situation had to reach a point where even a minor event would tip the balance, and the market would simply explode. However, it wasn't something insignificant that triggered the market, but retail sales data in the United States, which was up 0.6% in February. A significant pick up in consumer activity, which is essentially the engine of economic growth, certainly encouraged investors. Especially since this is the third series of extremely important data that has been released recently. It is practically impossible to ignore them at this point.

At the same time, yesterday's movement hints at what awaits us today. Most likely, the market will remain indifferent if the growth rate of US industrial production accelerated from 0.0% to 0.2%. Firstly, the changes are quite insignificant. Secondly, yesterday, the dollar was actively rising, playing out the previous events. To some extent, such a movement is emotional in nature. So not only does the market need to calm down, but maybe it also needs to pull back a bit. However, good industrial output data will most likely allow the dollar to consolidate around the levels it reached.

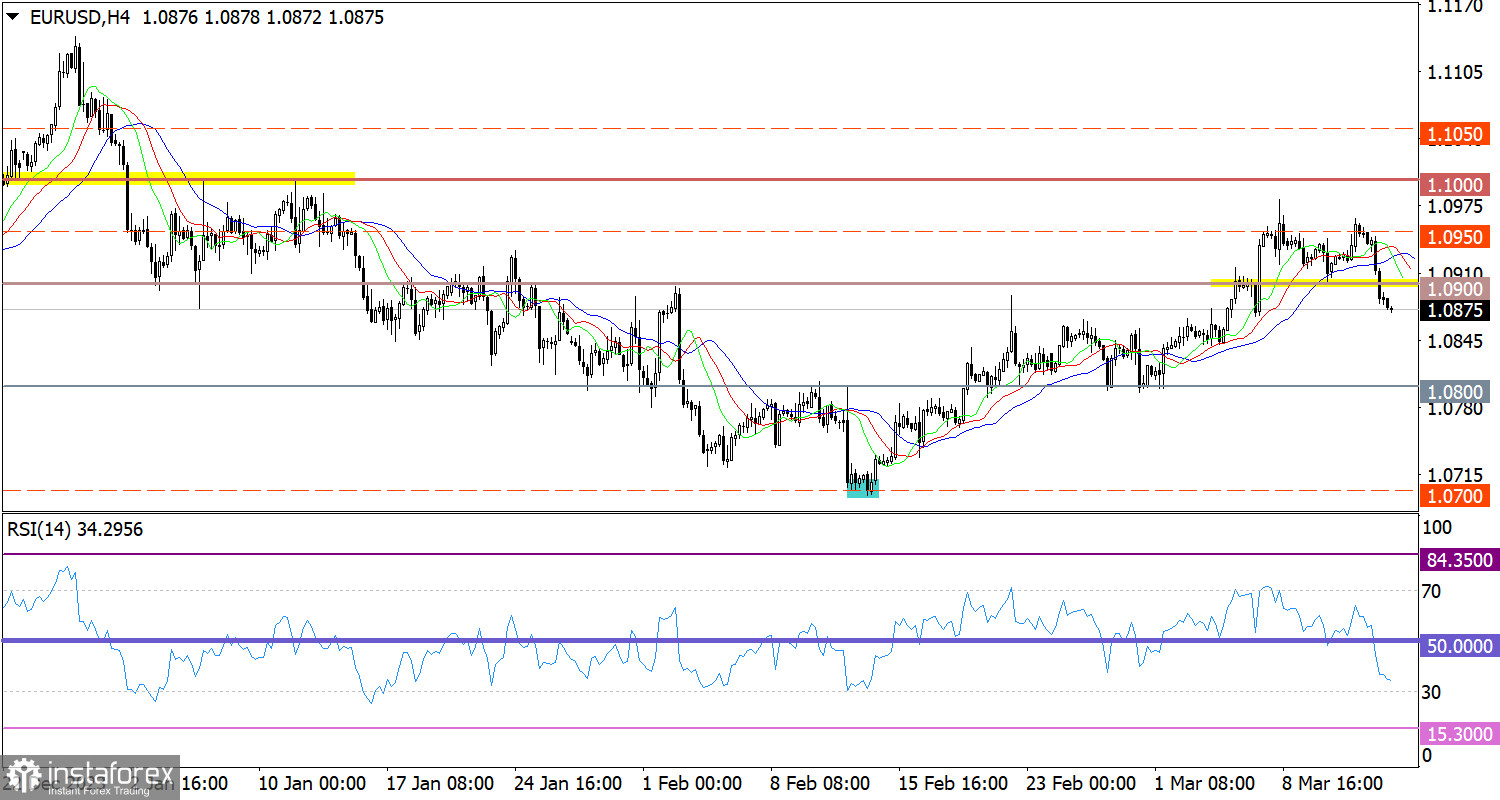

During an intense downward movement, EUR/USD breached the level of 1.0900. As a result, this extended the current corrective cycle from the level of 1.1000.

The RSI is hovering around the oversold zone on the 4-hour chart, suggesting that the instrument is due for a price correction.

The Alligator moving averages are headed down on the 4-hour and 1-hour charts,

Outlook

In this situation, the euro is already showing oversold conditions in the short term, which points to the possibility of a slowdown in the downward cycle. However, from a technical perspective, these oversold conditions may be ignored. In this case, the EUR/USD could therefore weaken further.

Complex indicator analysis points to bearish sentiment in the short-term and intraday periods.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română