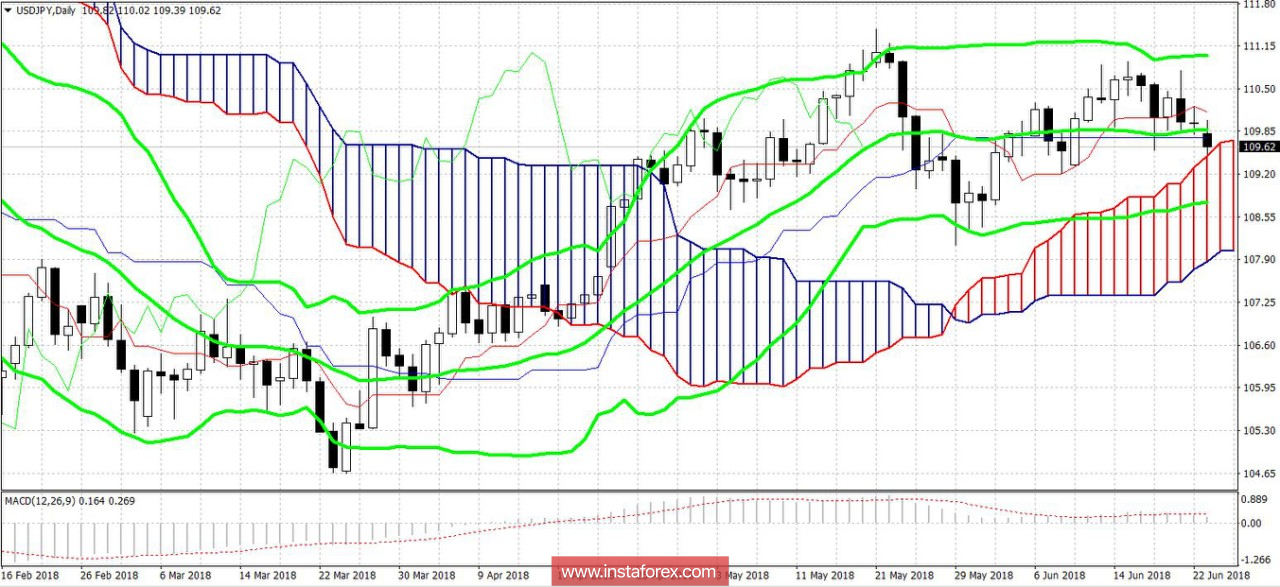

Over the past two weeks, the dollar/yen has held above the 110th mark, trying to develop further growth. However, last Thursday, the upward momentum stalled, after which the price gradually began to roll back. Today, bearish sentiment has increased, and the pair finally settled in the 109th figure, with further potential for decline.

At the moment, the yen should be considered solely as a defensive tool. It is the external fundamental background that determines the level of demand for the Japanese currency. Domestic macroeconomic events have little impact on the dynamics of quotations. The Bank of Japan recently made it clear that in the foreseeable future it will adhere to a soft monetary policy – at least until the end of this year.

Therefore, the indicator of Japanese inflation growth published on Friday left traders indifferent, despite the slight growth of the indicator (+0.7% against the previous value +0.6%). The dynamics of growth is too weak to affect the resolve of the regulator's members, especially since the core inflation index (excluding food and energy prices) fell to 0.3%, that is, to a six-month low. All this suggests that the Bank of Japan will keep the current parameters of monetary policy at subsequent meetings, and if there are any changes-only in the direction of further easing.

The stable "viability" of the yen against the background of the central bank's policy is explained by the growing tensions in the world due to the aggressive decisions of Donald Trump in the sphere of foreign trade. In fact, the US president opened two "fronts" of trade war-against the EU and against China. Brussels and Beijing have taken retaliatory measures, but the situation has not exhausted itself: trump "plays on the rise", when each response step is perceived as an excuse for further action.

To date, the disposition of the parties is as follows. In March, the Americans imposed a duty of 25% on steel imports and 10% on aluminum imports. Immediately after that, the so-called "White List", which included countries enjoying preferential treatment. The list included the European Union, but in June the White house did not extend this regime for the EU, and the new tariffs for the Alliance countries came into force.

Three weeks later, on June 22, the European Union responded with fines of more than three billion dollars. New duties have been imposed on an impressive list of goods – from steel products to jeans and whiskey.

Furthermore. Over the weekend, Trump voiced the threat to introduce new 20-percent duties on European cars. In principle, the idea is not new: the US President at the beginning of the year spoke about such intentions, but then it sounded casual, without any ultimatum requirements. Today, the situation is different - duties are a means of trade war, and in the current conditions, "the ball is on the side of the United States."

When Trump will decide to strike back the economic blow, it is unknown, but, according to the vast majority of experts, this step is inevitable. After the G7 summit and the spring US-China talks, it became clear that the summit did not help resolve trade conflicts, while Trump's conditions are in the nature of peremptory ultimatums. For example, Trump addressed all countries of the world via Twitter, demanding to abandon trade barriers and duties. At the same time, he threatened "serious retaliatory measures" on the part of Washington, if the rest of the world does not hear him. Here, as they say, without comment.

On the Chinese "front" the situation is also heating up. Beijing responded symmetrically to the imposed duties (countermeasures, however, have not yet entered into force), but the US President is playing to increase. The white house set additional tariffs on Chinese goods worth $200 billion. In addition, according to the American press, Trump plans to ban Chinese companies from investing in American technological enterprises, while banning the export of American technology to China. Moreover, the Americans will not draw any distinction between public and private Chinese structures.

As you can see, Donald trump is not going (yet) to make concessions and compromises, completely uncovering the tools of the trade war. The first mutual strikes have already been made, but the scale of further actions will increase exponentially. It is not surprising that in such conditions, traders "remembered" the yen, which is considered a safe haven currency. The downward dynamics of the USD/JPY pair will depend on the realization of the intentions voiced by Trump. Long positions on the pair are extremely risky, given the external fundamental background. The nearest target of the downward movement is 108.75 (the lower line of the Bollinger Bands indicator on the daily chart). The resistance level is the local price high and the 110.90 mark.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română