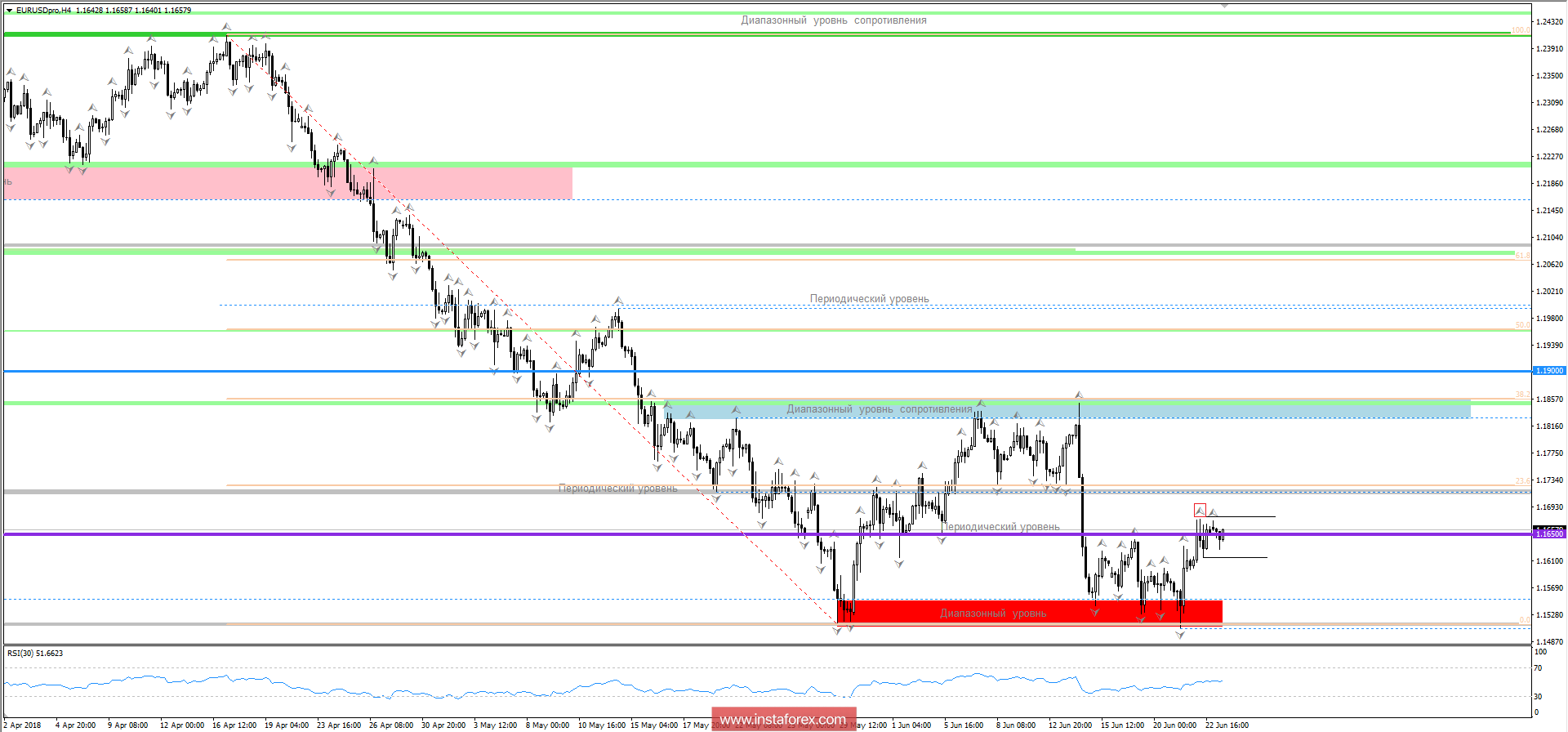

The previous week was saturated for the market. It's for you and Mario Draghi, and America with the UK. What do we have at the moment? As I argued in the previous review, the quote is still moving within the range of 1.1510-1.1650. At the moment, the quotation in double-digit is wagging near the upper border, drawing interesting levels for the delivery of pending orders, but more on this later. Now, the US-EU trade war is quite actively discussed, where Donald Trump is already ready to introduce new duties on the import of cars from the eurozone, referring to the fact that it is necessary to produce cars in the United States of America. Naturally, all these manipulations will lead to reciprocal actions, which will further exacerbate the situation and affect the European currency.

Further vision

The current two-digit bolt within the level of 1.1650 will be preserved, drawing us the time limits of 1.1615 / 1.1675. Trading recommendations at the moment are:

At the moment, we are out of the market, as there is no point in being in a bump, but we get interesting levels to enter, in which the current stagnation is helping us.

The position on the purchase is laid above the morning fractal on June 22, 1.1675. It is desirable to fix the price before the entrance, the prospect of the move is a periodic level of 1,1720, where Fibo 23.6 is also located. The further move will be considered only after reaching the first point (1.1720) and fixing above it.

The position on the sale is pawned after fixing the price below 1.1615. In this case, the basic range movement of 1.1510-1.1650 remains and we move to the lower border.

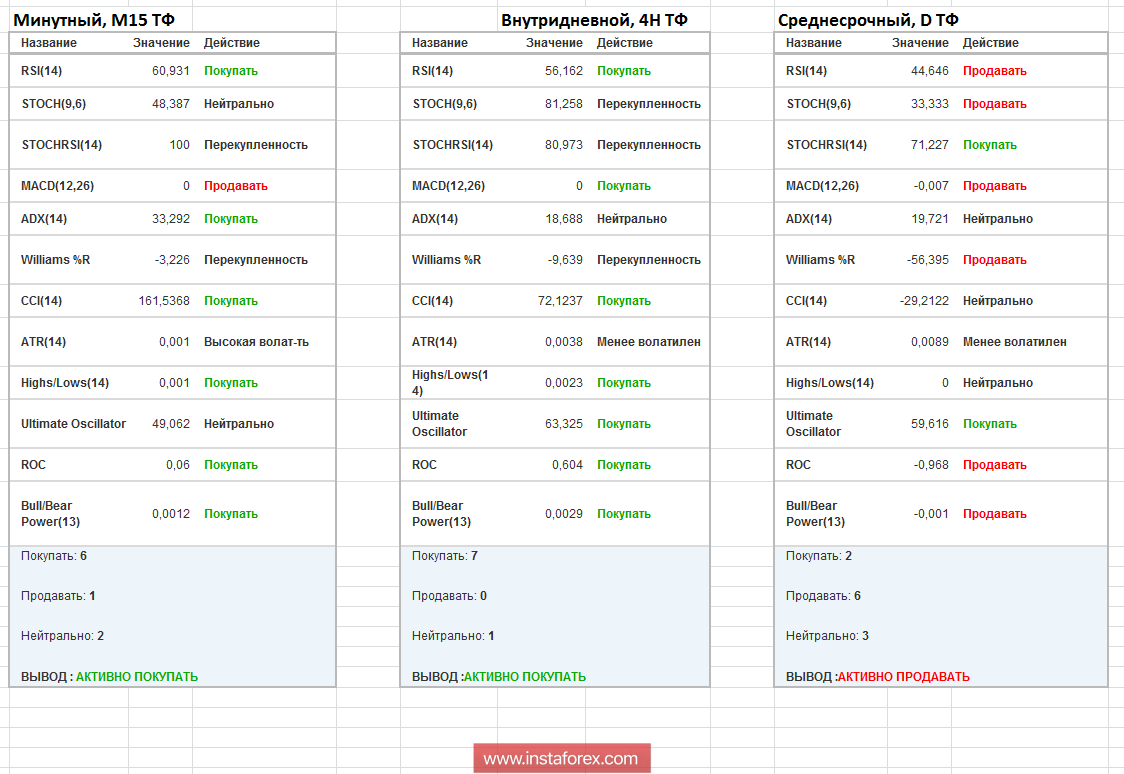

Indicator analysis

Analyzing the different sector of timeframes (TF), we see that in the short and intraday perspective indicators are inclined to a further upward move, and in the medium term, the downward trend remains. Once again, I remind you that the price is currently in a bump, and it is risky to enter the position, wait for clear fixations.

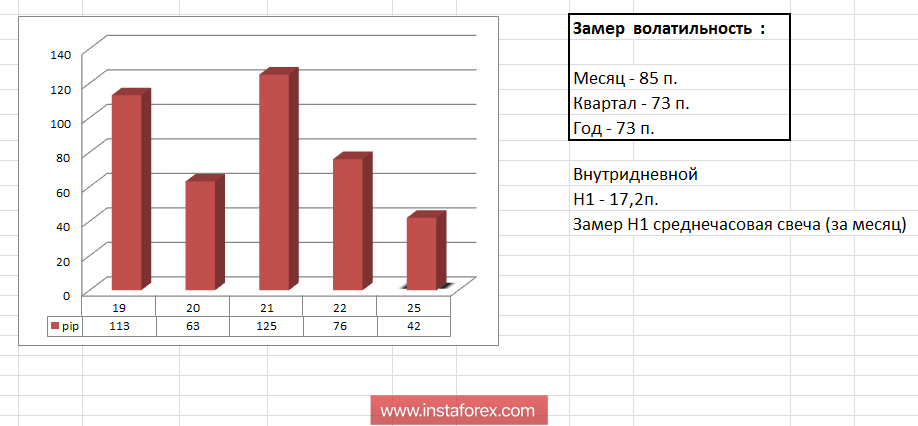

Weekly volatility / Volatility measurement: Month; Quarter; Year

The measurement of volatility reflects the average daily fluctuation, with the calculation for the Month / Quarter / Year.

(June 25 was built taking into account the publication date of the article)

Key Levels

Resistance zones: 1,1650 *; 1,1725 *; 1,1830 *; 1.1900; 1,2100

Support zones: 1,1550 ** (1,1510 / 1,1550); 1.1440; 1,1300 **

* Periodic level

** Range level

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română