To open long positions for EUR / USD pair, you need:

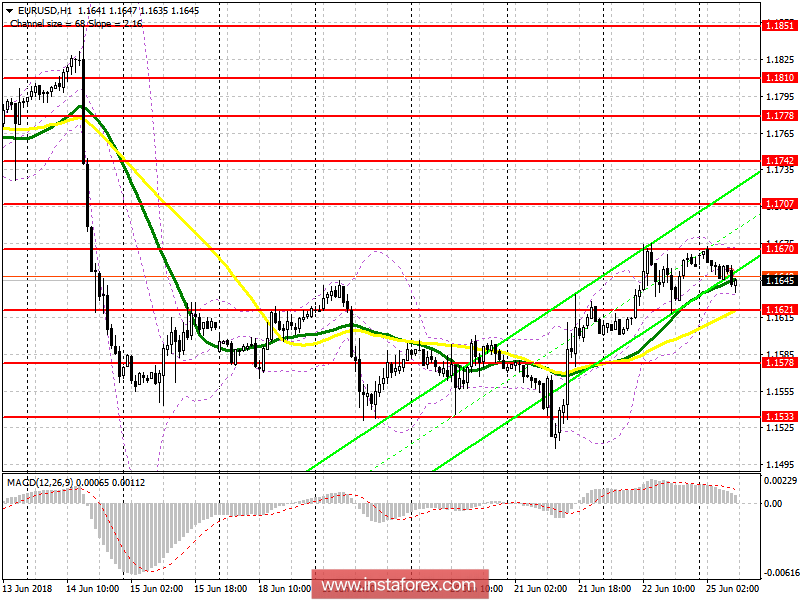

It is best to return in buying the euro today after a decline to the support level of 1.1621 and the formation of a false breakdown on it or a rebound from the level of 1.1578. The main task for long positions will be a breakout and consolidation above 1.1670, which opens a direct road to the area of new weekly highs to areas 1.1707 and 1.1778, where fixing profits are recommended.

To open short positions for EUR / USD pair, you need:

Failure to consolidate and return to the level of 1.1670 will be the first signal for euro sales to reduce the side channel 1.1621 to the lower border area. A breakthrough of which will lead to a larger sellout of EUR / USD with the update of support at 1.1578, where fixing profits are recommended. In case of growth above 1.1670, short positions on euro can be opened for a rebound from 1.1707 and 1.1742.

Description of indicators

- MA (average sliding) 50 days - yellow

- MA (average sliding) 30 days - green

- MACD: fast EMA 12, slow EMA 26, SMA 9

- Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română