To open long positions for GBP / USD, you need:

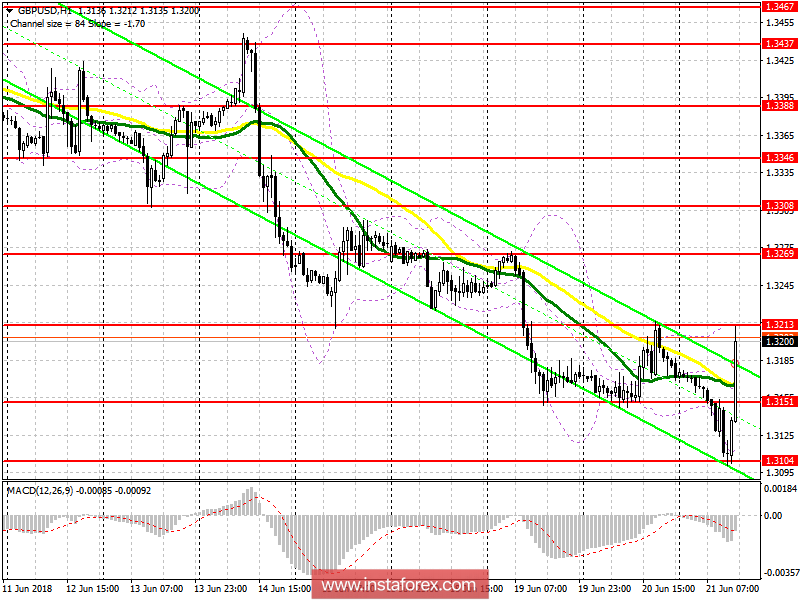

The buyers clearly worked out the morning support level of 1.3104, which I paid attention to in my morning review, and after the decision of the Bank of England on interest rate trading moved to the upper boundary of the lateral channel of 1.3213. The breakthrough and consolidation at this level will be a good signal for new purchases of GBP / USD in the resistance area of 1.3269, where I recommend fixing the profits. In the case of a pound drop in the afternoon, long positions can be returned to a rebound from 1.3151.

To open short positions for GBP / USD, you need:

Only the formation of a false breakout and a return to the level of 1.3213 in the second half of the day will be the first signal to sell the pound with the main goal of returning to the support level of 1.3151, where I recommend fixing the profits. If the pound is higher than 1.3213, you can sell for a rebound of 1.3269.

Description of indicators

MA (average sliding) 50 days - yellow

MA (average sliding) 30 days - green

MACD: fast EMA 12, slow EMA 26, SMA

Bollinger Bands 20

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română