GBP / JPY pair

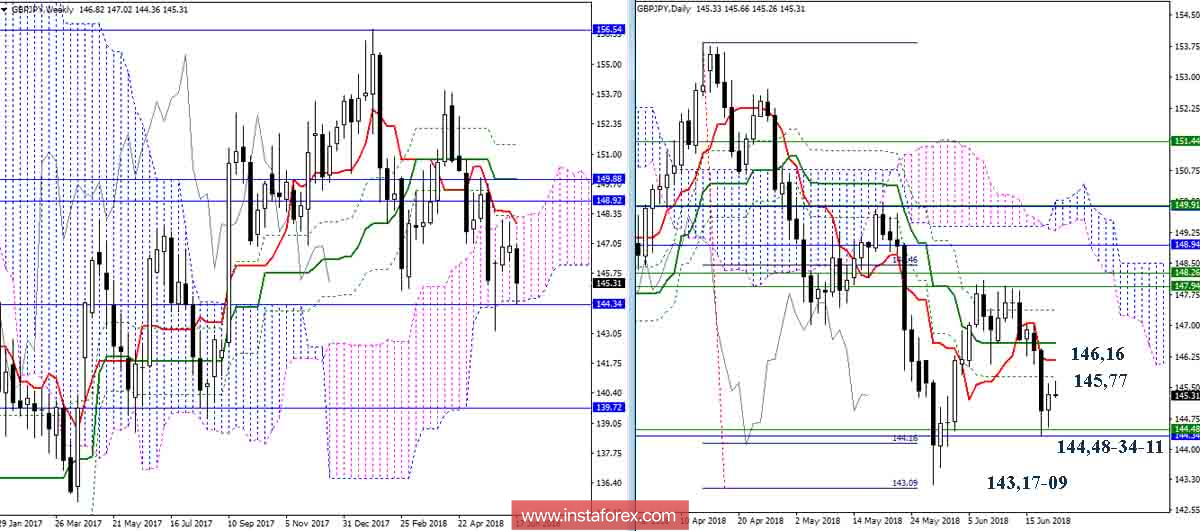

Over the past 24 hours, the situation has not changed significantly. Conclusions and expectations of the previous analysis have remained relevant. Prolonged inhibition promotes the development of an ascending correction. The closest benchmarks for recovery now are the levels of the daytime cross (Fibo Kijun 145.77 + Tenkan 146.16 + Kijun 146.57). The main task for bears at the moment is to overcome the support in the area of 144.48-34-11 (the week-old Senkou Span B + the monthly Kijun + 100% target H4), the recovery of the downtrend (minimum extremum 143.17) and 100% working on the daily goal (143.09).

Players on the rise at lower timeframe have reached an important zone of resistance (145.77 - 146.16) today. Breakdown and consolidation above will significantly change the current balance of power in favor of bulls since this will eliminate the dead cross of H4 and formed an upward target for the breakdown of the H1 cloud. Therefore, the resistance of 145.77 - 146.16 is now an excellent milestone for the completion of the upward correction and the resumption of the downtrend.

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chikou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

Color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română