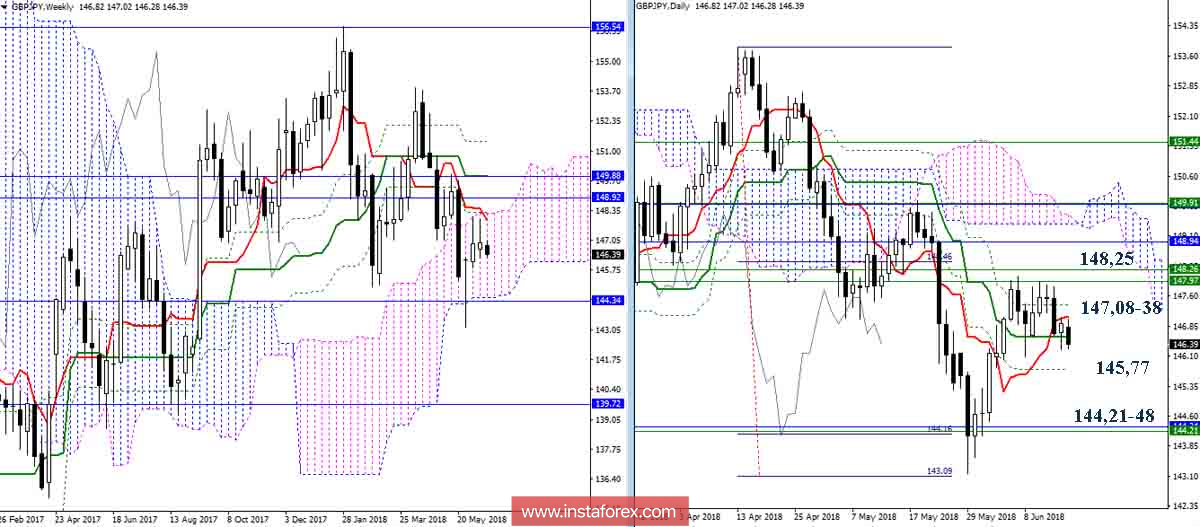

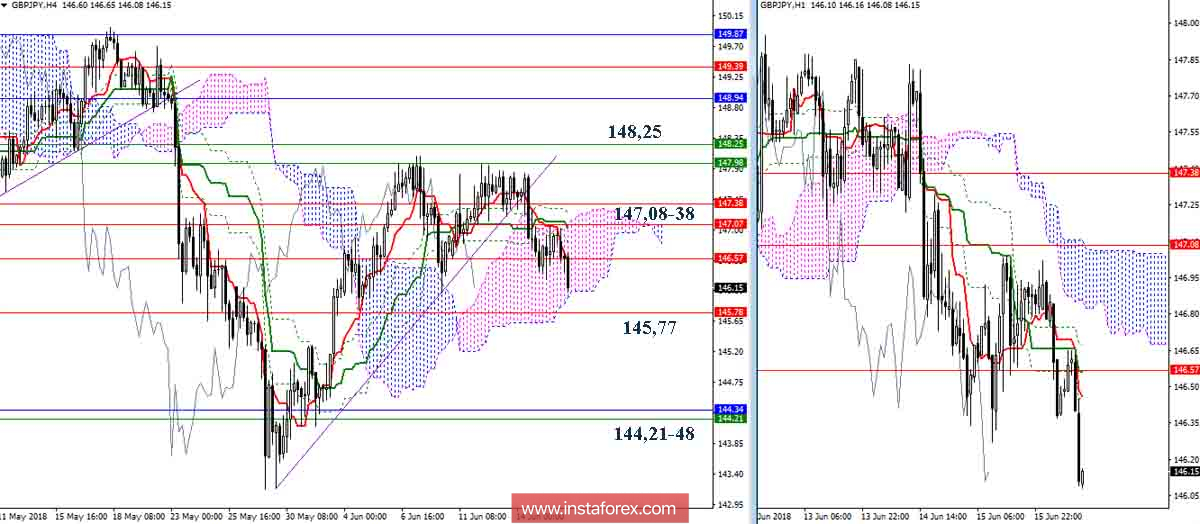

GBP / JPY pair

The Day Cross exerts resistance (Tenkan 147.08) and the attraction (Kijun 146.57). As a result, on the last day of last week, we failed to form a retreat but we saw a breakout instead. At lower time intervals, it is clear that the players to fall continues to decline now and needs to go into the bear zone against the H4 cloud. The formation of a new downside target for the breakdown of the H4 cloud will make it possible to liquidate the day's golden cross (Fibo Kijun 145,77) formed in favor of the bulls. After which, expect an interaction with the support zone in the region of 144.21-48 (the monthly Kijun + lower border of a week cloud).

At the same time, it should be noted that in case of prolonged braking and returning of full support to bullish interests by the Ichimoku day cross (Tenkan 147.08 + Fibo Kijun 147.38). There will be opportunities to test the key resistance zone 147.97-148.25 (a cluster of weekly levels) with the aim of breakdown, increasing sentiment and creating new prospects for players to rise.

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chikou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

Color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română