EUR/JPY

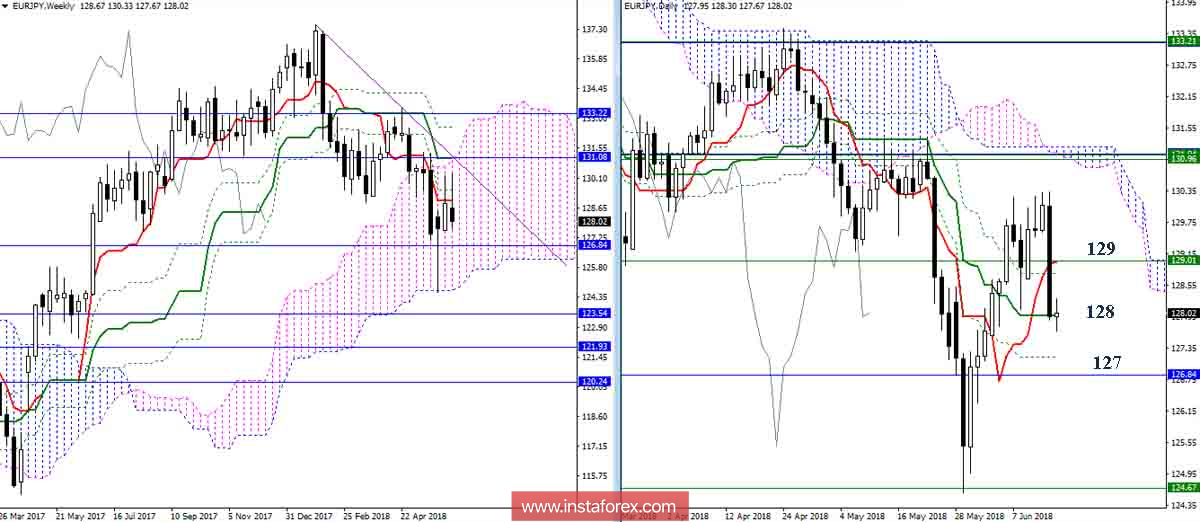

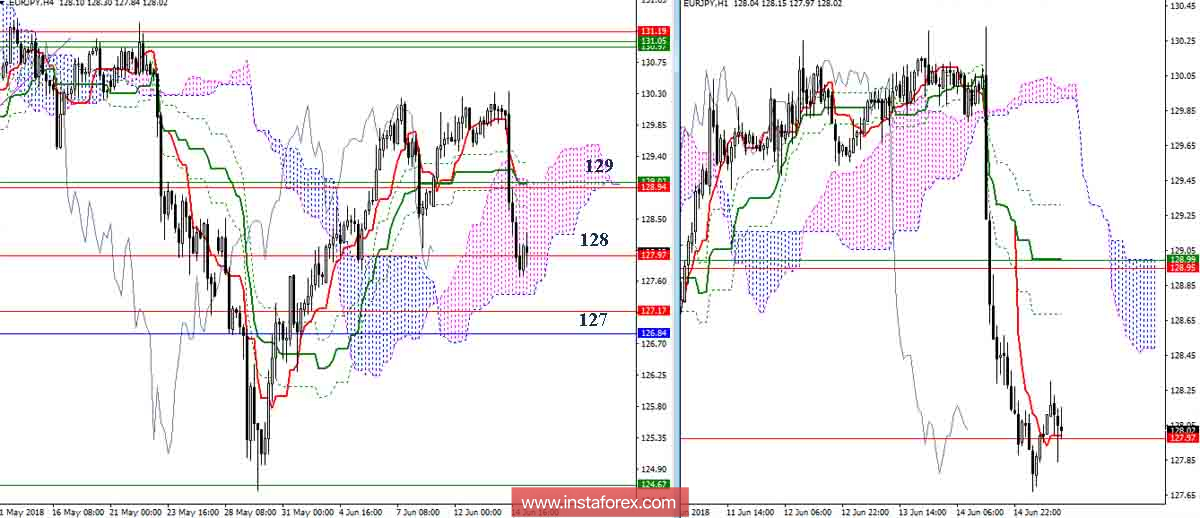

Weakness of players to increase by the end of the week has indeed led to a corrective decline, which was executed quite actively and effectively. To date, support has been reached for 128 (daily Kijun). This support (128) is a kind of equilibrium point, so it can have an attraction and contribute to a longer braking. An important zone of resistance now stands in the area of 129, here the levels of junior and senior times have merged. The consolidation above will contribute to the emergence of some prospects for the recovery of bullish benefits. The breakdown of the H4 cloud and supports (daily Fibo Kijun + monthly Fibo Kijun) in the 127 area will lead to the emergence of new downward benchmarks.

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chinkou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

Color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română