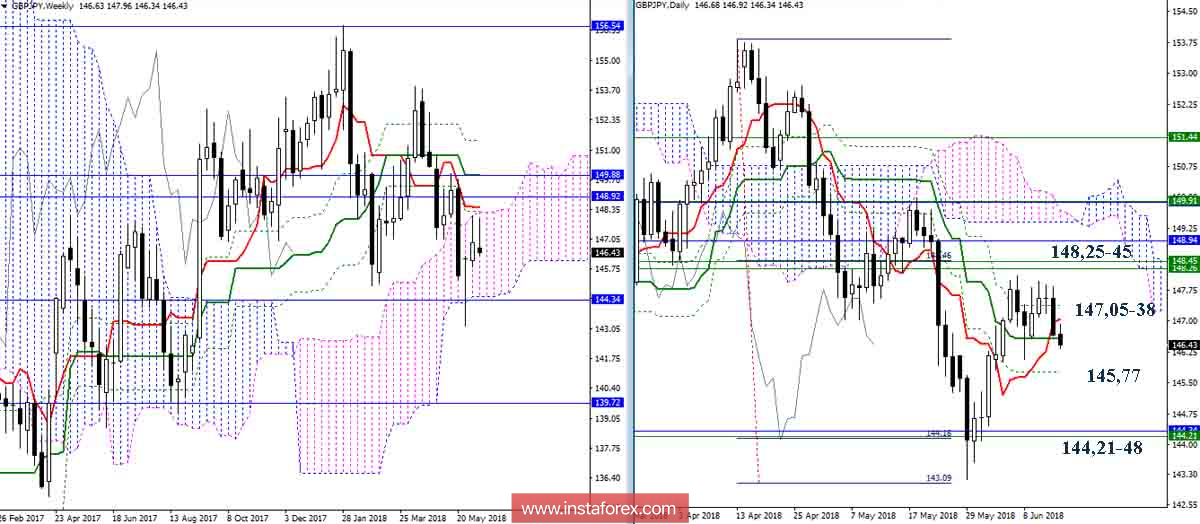

GBP/JPY

Players on the rise and could not continue to climb. As a result, as expected, by the end of the week, opponents benefited from the weakness of the bulls. At the moment, the support of the daytime Kijun (146.57) is met. Strengthening bearish sentiment and continuing decline, the following support can be noted at 145.77 (daytime Fibo Kijun), will today contribute to the emergence of another opportunity to return to testing the lower limit of the weekly cloud (144.48) and the monthly Kijun (144.21), with the purpose of breakdown of these supports and the emergence of new benchmarks.

Closing the week over the levels of the newly-born golden cross (daytime Tenkan 147.05 + Fibo Kijun 147.38) and consolidating the pair in the bull zone, with respect to the clouds younger halves may return the chances for the resumption of lifting and testing important weekly resistance in the area 148.25-45.

Indicator parameters:

all time intervals 9 - 26 - 52

Color of indicator lines:

Tenkan (short-term trend) - red,

Kijun (medium-term trend) - green,

Fibo Kijun is a green dotted line,

Chinkou is gray,

clouds: Senkou Span B (SSB, long-term trend) - blue,

Senkou Span A (SSA) - pink.

Color of additional lines:

support and resistance MN - blue, W1 - green, D1 - red, H4 - pink, H1 - gray,

horizontal levels (not Ichimoku) - brown,

trend lines - purple.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română