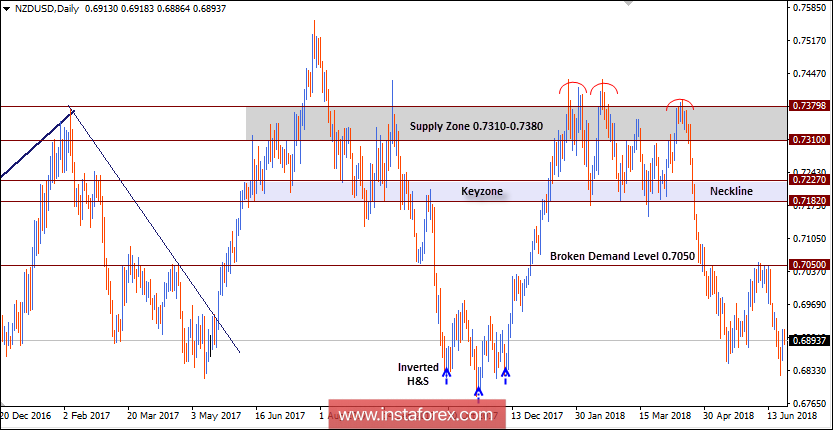

Since January, the price zone of 0.7310-0.7380 has been standing as a significant supply zone during the recent bullish pullback. The bulls failed to execute a successful breakout above 0.7400 during previous consolidations.

The NZD/USD pair had been trapped between the price levels of 0.7170 and 0.7350 until a bearish breakdown of 0.7200 occurred.

Since April 13, significant bearish pressure has been applied. This probably turns the short-term outlook for the NZD/USD pair into bearish giving considerable significance to the multiple-top reversal pattern.

That's why, a bearish breakdown of 0.7220-0.7170 (the neckline zone) was needed to confirm the depicted reversal pattern. Bearish target levels around 0.7050 and 0.7000 have been achieved already.

The bearish scenario needed obvious bearish persistence below 0.7050 to maintain significant bearish momentum towards 0.6860 and 0.6820. That's why, the price level of 0.7050 was considered a key level for the NZD/USD bears.

As anticipated, the recent bullish pullback towards the price level of 0.7050 (Broken Demand Level) offered a good opportunity for sellers to have a valid SELL entry. It's already running in profits. S/L should be lowered to 0.6925 to secure some profits.

Currently, the price levels of 0.6820-0.6780 are the next destination for the NZD/USD pair to be reached. These price levels should be watched for bullish rejection and a target level for current sellers.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română