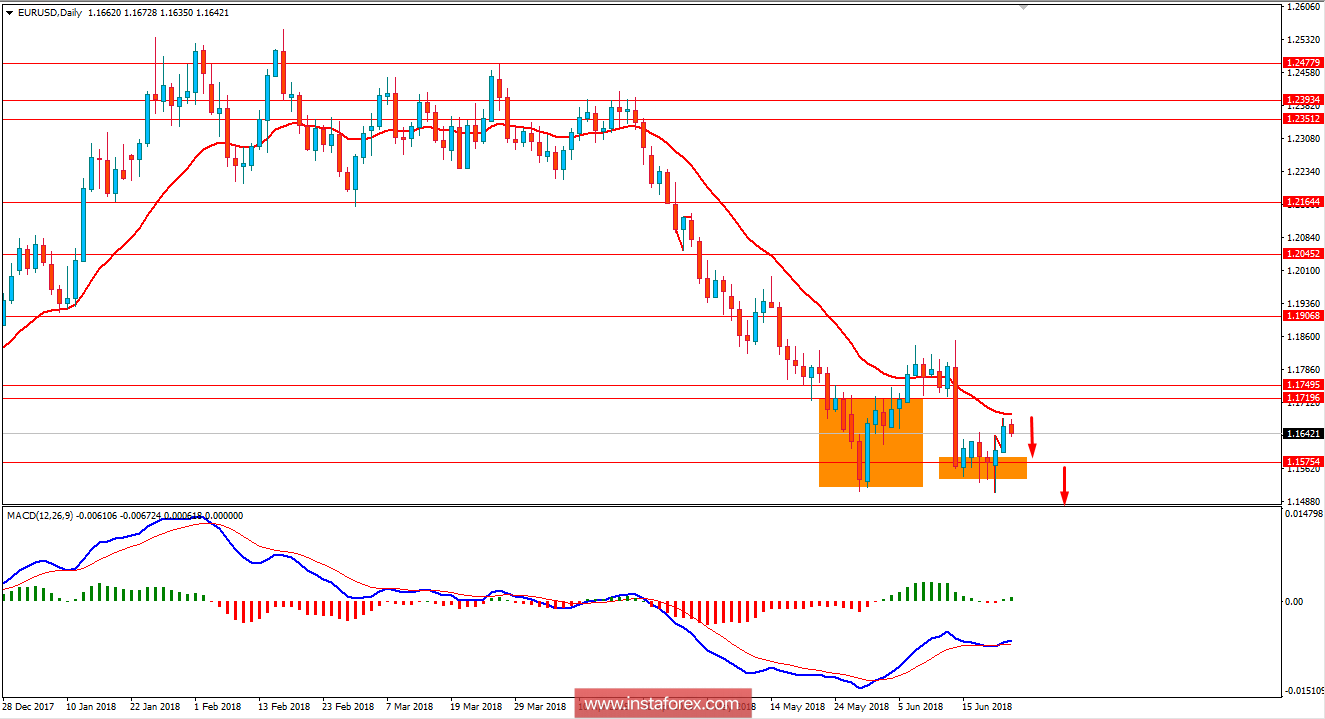

EUR/USD has been quite bullish recently after bouncing off the 1.1550 support area with a daily close. As the bearish trend is still existing in the market, the price is expected to push lower again in the coming days.

EUR has been quite mixed with the recent economic reports and events where no rate hike issue on recent ECB meetings has been a big blow for the currency itself. Despite having mixed economic reports, EUR gained momentum having USD struggling with the recent worse economic reports. Today EUR German Ifo Business Climate report is going to be published which is expected to decrease to 101.9 from the previous figure of 102.2.

On the other hand, today USD New Home Sales report is going to be published which is expected to increase to 665k from the previous figure of 662k. Ahead of the upcoming Final GDP report which is expected to be unchanged at 2.2%, USD may regain strength based on today's economic report to be published.

As of the current scenario, EUR do not have much to offer this week whereas upcoming GDP report on the side may play a vital role for the further gains on the USD side for the coming days. As the days unfold, USD is expected to have an upper hand over EUR in the future.

Now let us look at the technical view. The price is currently rejecting off the dynamic level of 20 EMA below the resistance area of 1.1700-50. As the price remains below the 1.1700-50 area with a daily close having no evidence of upcoming impulsive bullish momentum, the price is expected to push lower towards 1.1550 and later towards 1.1300 support area in the coming days.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română