EUR/JPY is currently quite bearish in nature. The price is expected to push sink lower in the coming days. Though JPY has been indecisive amid the recent economic reports, EUR is struggling for gains due to weak data from the eurozone.

Ahead of ECB President Draghi's speech today, EUR is expected to treat water. The ECB has not provided much of precise information about tapering of its bond-buying program. Any hawkish message in today's speech might inject certain volatility in the pair. Moreover, today German PPI report is going to be published as well which is expected to decrease to 0.4% from the previous value of 0.5%.

On the JPY side, despite the unchanged BOJ Policy Rate published at -0.10%, JPY continued to gain momentum without much fallback in the process. Today, the Bank of Japan is due to release the minutes of the policy meeting. Amid expectations, EUR/JPY is expected to trade with higher volatility, but the bias is expected to be unchanged in the process.

Though Japan's economic reports have been quite mixed recently, the ongoing struggle of EUR is viewed as the only cause for the dominant bearish pressure in the pair. As for the current scenario, JPY is expected to sustain the bearish momentum in the pair which may lead to further impulsive bearish pressure in the coming days.

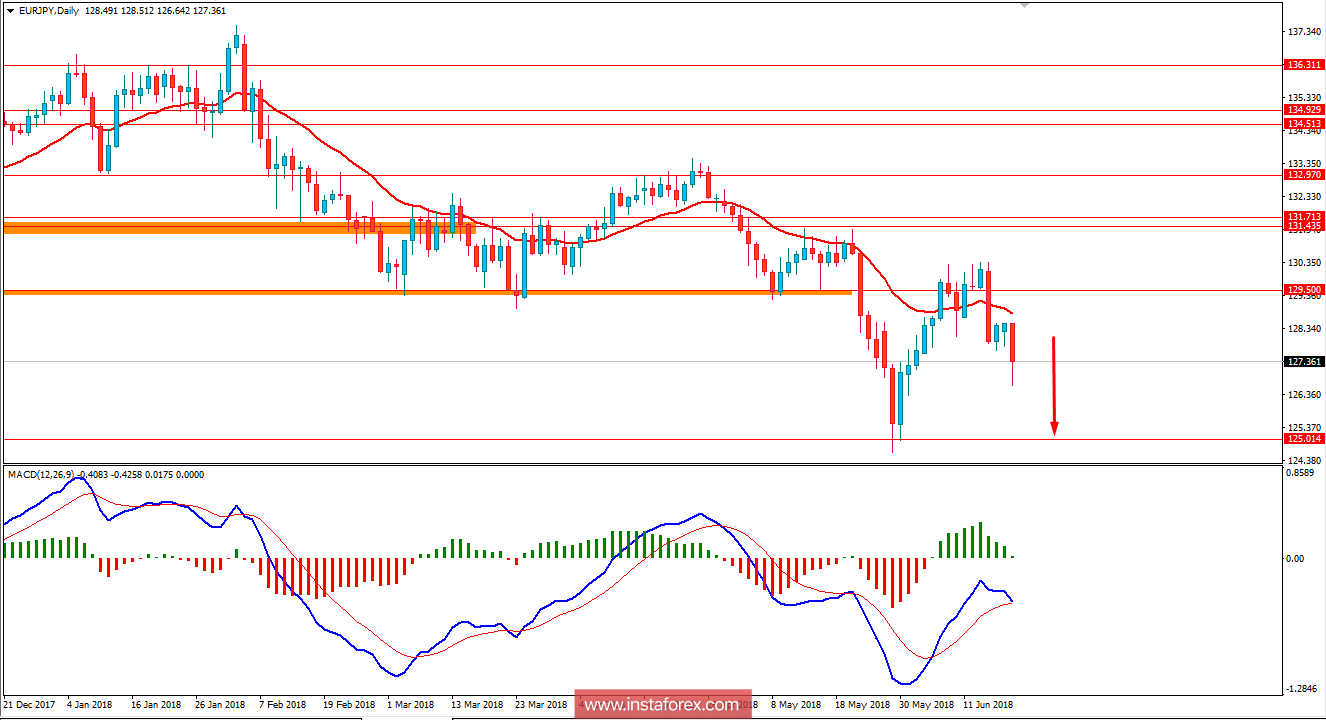

Now let us look at the technical view. The price is currently quite bearish with the daily candle which is expected to push lower towards 125.00 area in the coming days. The price is residing below the dynamic level of 20 EMA after bouncing off the 129.50 area with certain corrections in the process. As the price remains below 129.50, the bearish bias is expected to continue further.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română