USD/CAD has been quite impulsive with the bullish gains recently after having certain volatility along the way. USD has been quite impulsive with the gains despite the mixed economic reports published this week, whereas upcoming Canada's high impact economic reports to be published today are expected to have a limited impact on the USD gains.

Today, Canada's Employment Change report is going to be published which is expected to increase to 19.1k from the previous figure of -1.1k, Unemployment rate is expected to be unchanged at 5.8%, Housing Starts is expected to increase to 219k from the previous figure of 215k, and Capacity Utilization Rate is expected to increase to 86.3% from the previous value of 86.0%.

On the other hand, today US Final Wholesale Inventories report is expected to be unchanged at 0.0%.

As for the current scenario, CAD is expected to gain certain momentum over USD today if the economic reports from Canada are better than expected. Today's US economic report is likely to make a mimor impact on further USD gains that is expected to facilitate the upcoming gains on the CAD side.

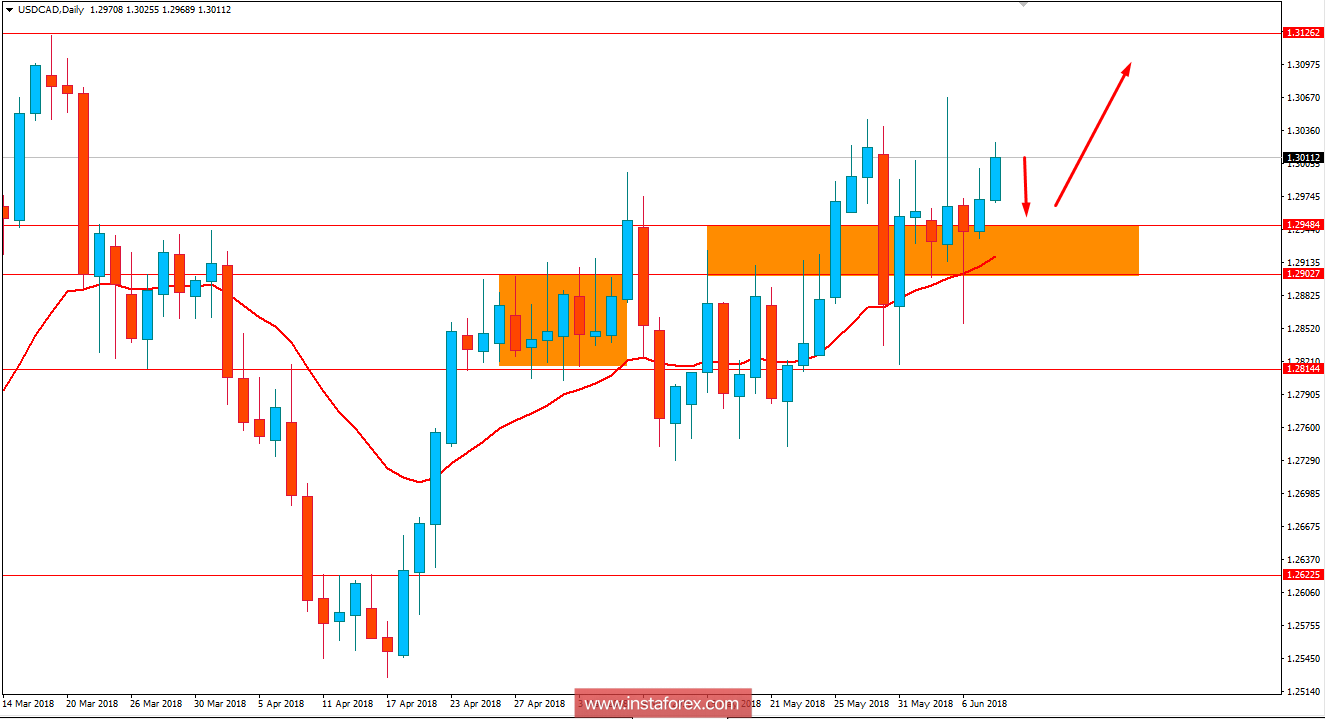

Now let us look at the technical view. The price has been quite volatile at the edge of 1.2900-50 area from where it is expected to push higher in the future. As Canada is due to release economic reports on Employment, certain bearish pressure is expected in this pair, making the price retrace lower towards 1.2900-50 area and then proceed higher towards 1.31 resistance area in the coming days. As the price remains above 1.29 with a daily close, further bullish pressure is expected in this pair.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română