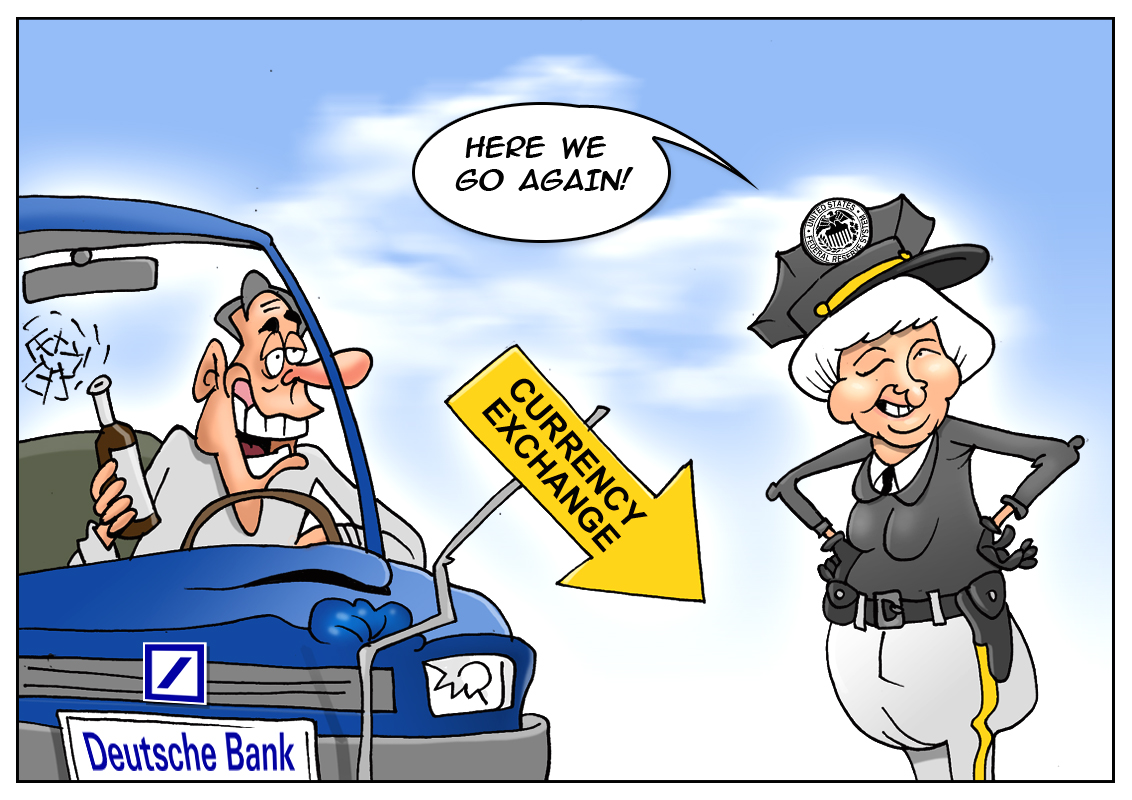

Deutsche Bank was caught in the middle of another scandal which resulted in a heavy fine, as it usually happens. The Federal Reserve imposed a penalty for violating foreign exchange rules and the Volcker rule which is a part of the Dodd–Frank act.

Deutsche Bank’ specialists should better refresh their knowledge about the principles of the Volcker rule which places certain restrictions on the banks, operating on the territory of the United States. This rule forbids financial institutions to conduct operations with securities using their own funds. The Fed has revealed some supervisory gaps and a lack of internal control. The bank’s traders performed currency transactions, neglecting the Volcker rule. Specifically, they bought and sold currency for the organization’s accounts and for some clients. Along with that, those traders used chat rooms to communicate with competitors, but the executives of Deutsche Bank have seemingly ignored this fact. Now the bank has to improve supervision. To settle this issue, Deutsche Bank undertook the commitment to pay 3.1 billion dollars. Besides, it pledged to transfer 4.1 billion dollars to the American clients to recoup their losses.

Deutsch

Deutsch

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română