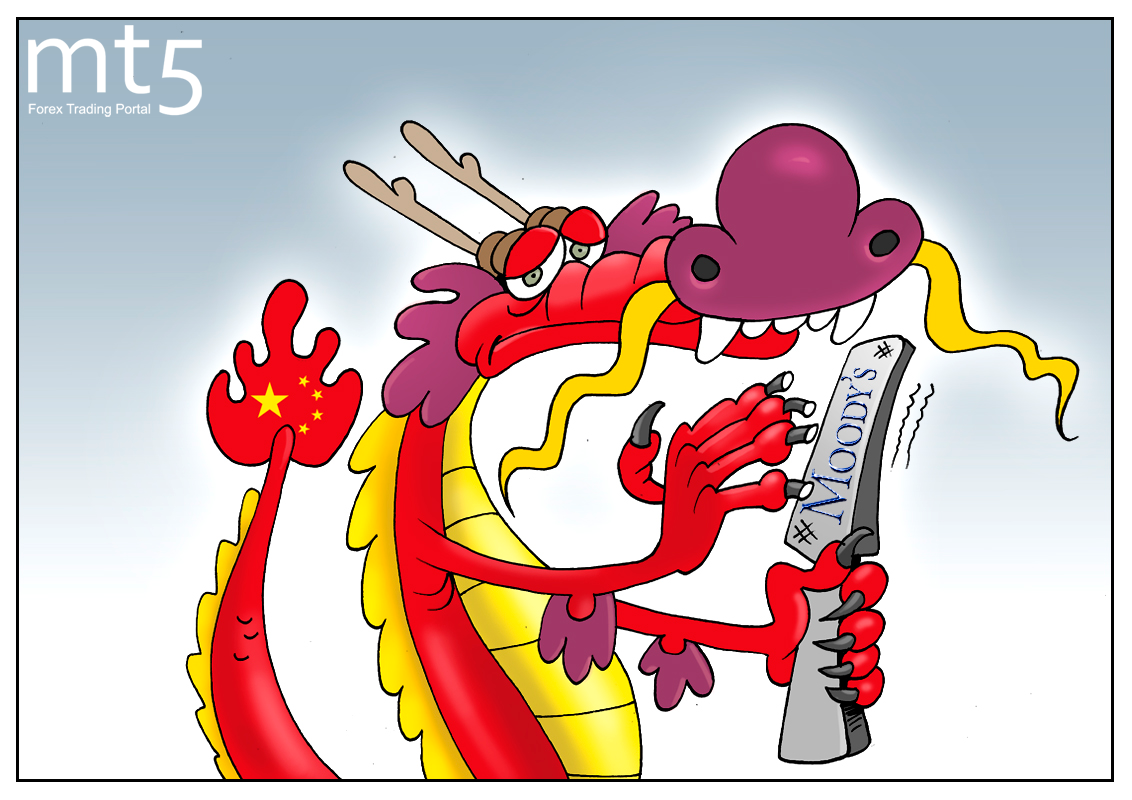

One of the world's leading rating agencies, Moody's, has downgraded China's credit rating for the first time since 1989.

Moody's experts expect that China’s debt will be rising and economic growth will slow. The agency cut the country's long-term currency issuer rating to A1 from Aa3. The company also changed its outlook to stable from negative. "The stable outlook reflects our assessment that, at the A1 rating level, risks are balanced," Moody's said. – "The erosion in China’s credit profile will be gradual and, we expect, eventually contained as reforms deepen".

Stocks of Chinese companies fell sharply to 8-month lows amid this news. Meanwhile, a large part of the PRC sovereign debt is kept by domestic investors and that protects the country from a negative impact of such changes in ratings. The current situation shows clearly that China's government should use all possible economic measures to ensure that the growth rate is not lower than 6.5 percent year-on-year.

So, this decision to downgrade the country's rating can be considered more as psychological pressure on Beijing at the moment. Moreover, S&P currently rates China’s foreign and local-currency long-term debt at AA- with a negative outlook, while Fitch places an A+ rating with a stable outlook.

বাংলা

বাংলা

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română