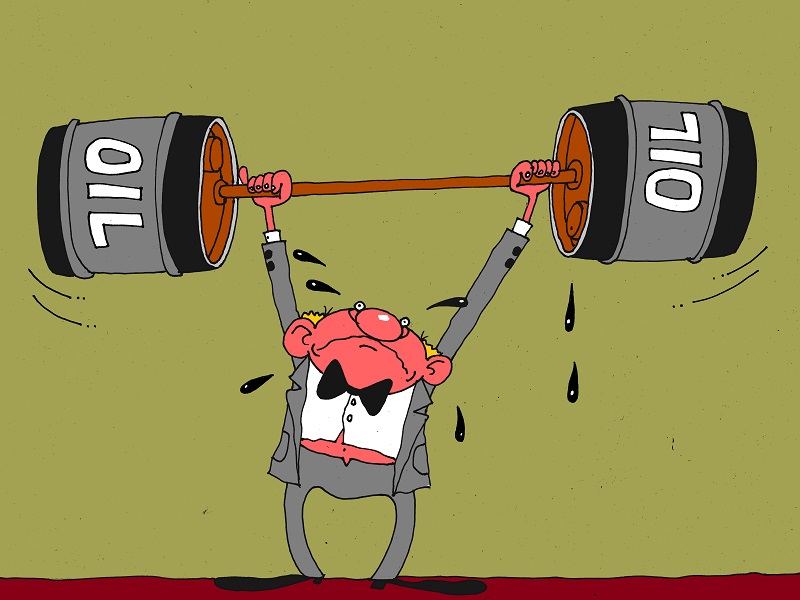

Oil market speculators expressed less confidence in growing prices for WTI crude. According to the US Commodity Futures Trading Commission (CFTC), hedge funds’ net-long position on WTI dropped by 4% in the week ended March 21, while short position advanced by 13%.

Thus, the difference between bets on a price increase and wagers on a decline fell by 9.8% to 260,577 futures and options.

The data from the CFTC showed that the net-long position dropped by 37% from a February’s record on the back of growing oil production and rising crude inventories in the US.

In the week ended March 17, US crude stockpiles rose to 533.1 million barrels, the highest level since 1982. Oil production rose to 9.13 million barrels a day, the highest since February last year.

According to Baker Hughes, active oil-rig count in the United States rose by 21 to 652 last week, touching the highest level since September 11, 2015. The total active US rig count, which includes oil and natural-gas rigs, also jumped higher by 20 to 809.

বাংলা

বাংলা

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română