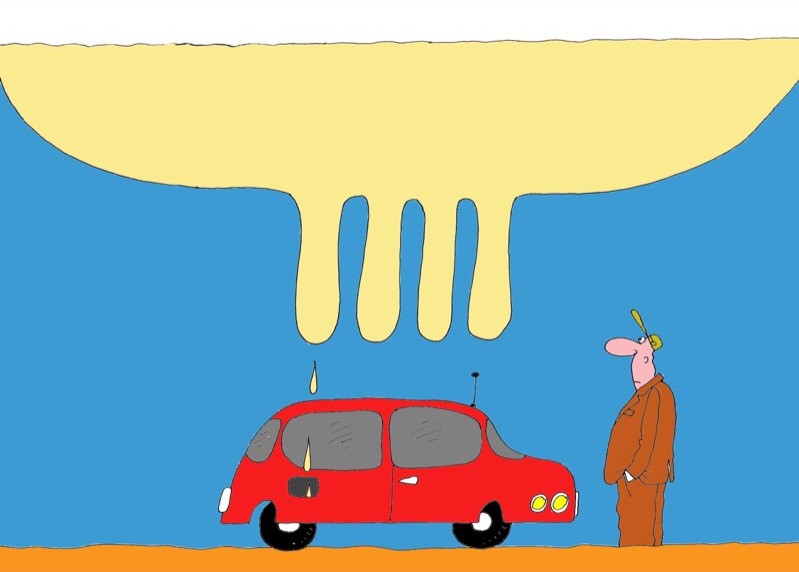

According to analysts, record gasoline storage levels in the United States could crash the oil market despite OPEC’s efforts to keep prices afloat. Rising levels of the US oil production and the biggest gasoline glut in 27 years drag down the oil market. The US is sitting on 259 million barrels of gasoline in storage, the latest EIA report showed.

The main reason behind the glut is the high level of production. Before 2014, the US produced 8.5-9.5 million barrels a day, but after the plunge in oil prices it boosted output to 9-10 million barrels a day.

The increase came to satisfy rising demand, which should have solved the problem of excess supply. Currently, the rise in demand in the US has slowed down.

In January, US gasoline demand fell to 8.2 million barrels a day, while sales dropped by 4% from a year before. Meanwhile, refiners have cut gasoline production in recent weeks, but gasoline storage levels continue to rise.

Some analysts speculate that lower demand stand behind rising prices. However, prices hover at the same level that a few years ago.

The gasoline glut made producers divert tankers from New York Harbor to ports in the Caribbean. However, the move did not resolve the problem of excess supply in the US east coast.

According to experts, in case demand does not rebound, gasoline inventories will continue to rise. This would result in higher prices, which would make refiners cut production. Consequently, buying of crude oil would decline and prices would fall.

বাংলা

বাংলা

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română