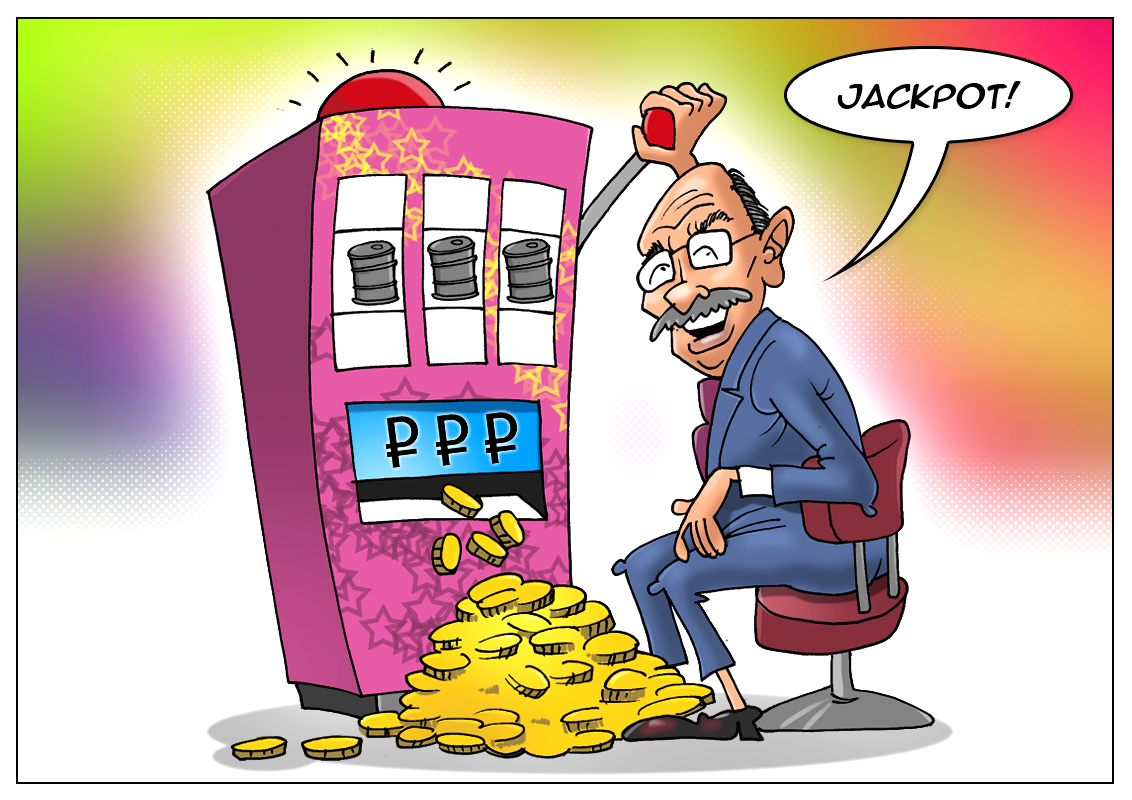

At present, Russia celebrates a steady oil rally which was triggered by the agreement on oil production cuts signed by OPEC and major oil exporters outside the cartel, including Russia, in November 2016. Moreover, the participants report their commitments to individual quotas which came into force since January. Russia’s economy benefits from rising oil prices as oil and gas account for over 60% of Russia’s exports and make up over 30% of the country’s GDP.

Since crude oil entered the bull market, the government’s fiscal revenue has expanded by 1.5 trillion rubles. “Painstaking talks and a long-awaited deal made by OPEC and non-OPEC countries in November 2016 gave oil prices a boost at the year end, thus crude oil jumped to $55 a barrel from $30 before the agreement,” Vladimir Voronkov, Russia’s representative at international organizations in Vienna, made a comment. However, Russia’s budget is now threatened with the least expected problem. Recently, the Russian ruble has firmed by more than 5% against the US dollar despite headwinds. The Kremlin is not interested in the solid national currency, so the central bank was ordered to adopt measures to prevent further strengthening of the ruble.

The ruble is considered a “petrocurrency”, so the oil rally is certainly bullish for the Russian currency. Commodity analysts do not expect a notable rise in crude prices. The current price level has invited US oil companies to ramp up shale oil output, whereas OPEC and other large oil producers fulfil their commitments. To sum up, a huge increase in US oil inventories and output is likely to jeopardize the benign impact of the OPEC deal.

বাংলা

বাংলা

Русский

Русский English

English Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română