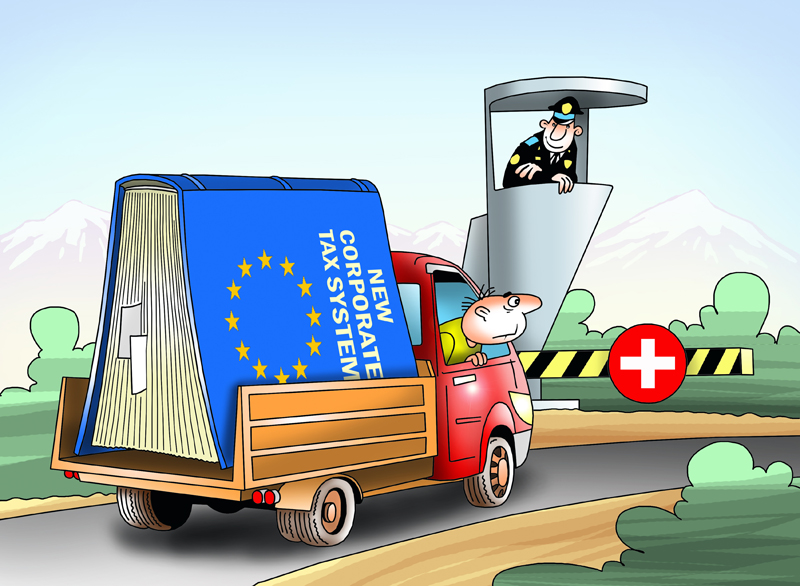

Switzerland had a referendum in which voters rejected the corporate tax reform plan.

According to Reuters, the Swiss government now has to introduce the new proposal as it needs to abolish special tax rates for multinational companies and simultaneously avoid their massive outflow.

Most people in Switzerland acknowledge that the country needs a tax reform, but the proposed plan aimed to compensate for the loss of the special status sparked controversy.

According to preliminary voting results, more than 59% of voters rejected a corporate-tax-overhaul plan backed by the government and business, in a blow to the country's hopes to bring its tax policies in line with international norms. According to estimates of opponents of the reform in its current form, it will cost federal and regional budgets $3 billion.

Meanwhile, the plan’s supporters, which include the government and the majority in Parliament, said that it would be possible to cover the deficit by government subsidies and later by foreign investments.

According to Swiss Finance Minister Ueli Maurer, the country will lose its attractiveness as a competitive business location after the reform. He said Switzerland must fulfill its promise given to the Organization of Economic Cooperation and Development to end special low tax rates by 2019.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română