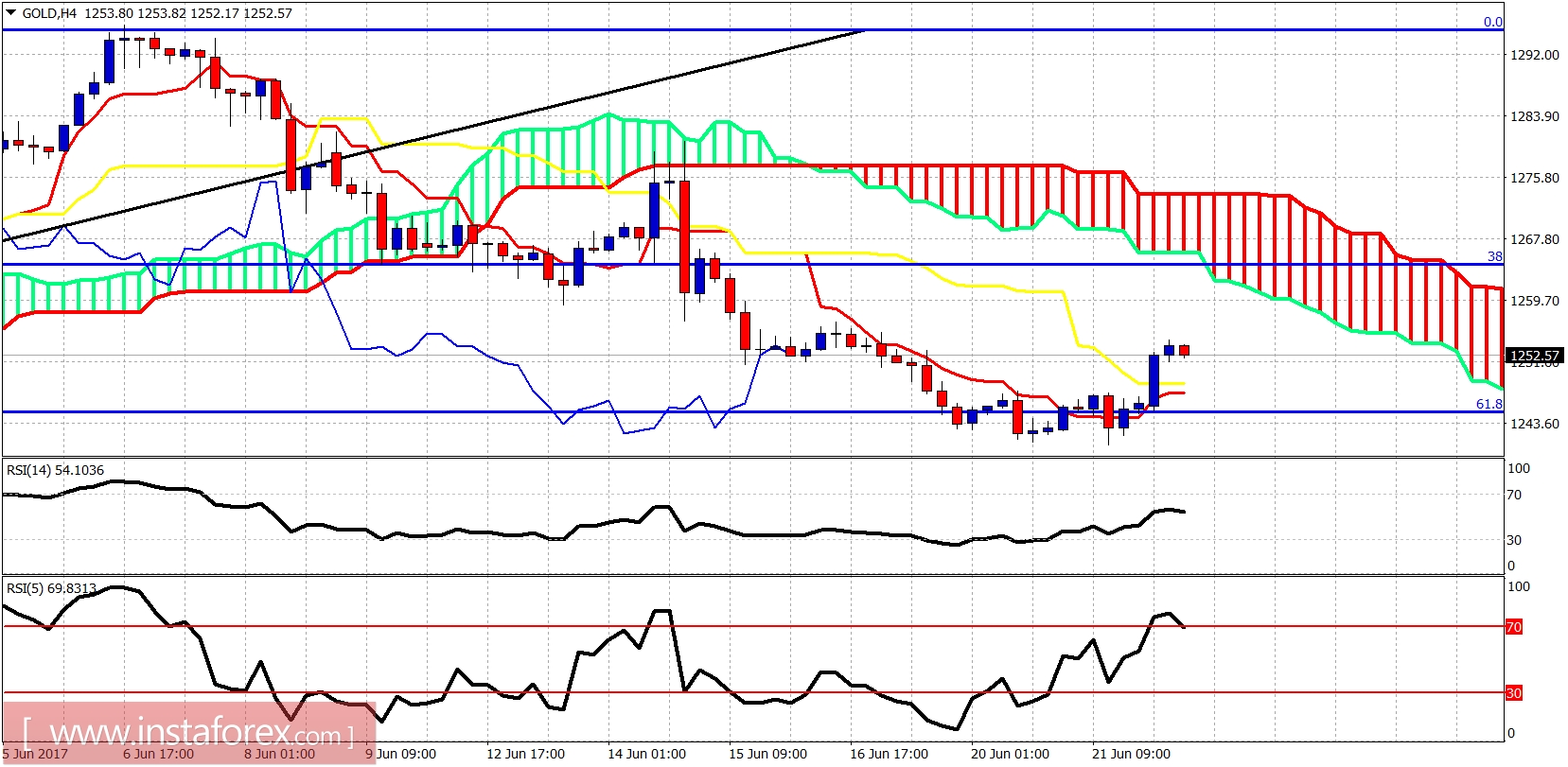

Gold price bounced off the 61.8% Fibonacci retracement and the $1,245-40 area as expected. Price should test the $1,260 short-term resistance area. A rejection there will open the way for a push towards $1,200, but if the week closes around $1,260 and higher, we could have a bullish reversal sign on a weekly basis.

Blue line - long-term support

Gold weekly chart could shape up to be a very bullish one as the candle formation of this week touched the weekly Kumo (cloud) support as expected and bounced higher. This long-tailed candle is a bullish reversal sign and will strengthen the higher we close this week. I'm short-term and longer-term bullish about Gold.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română