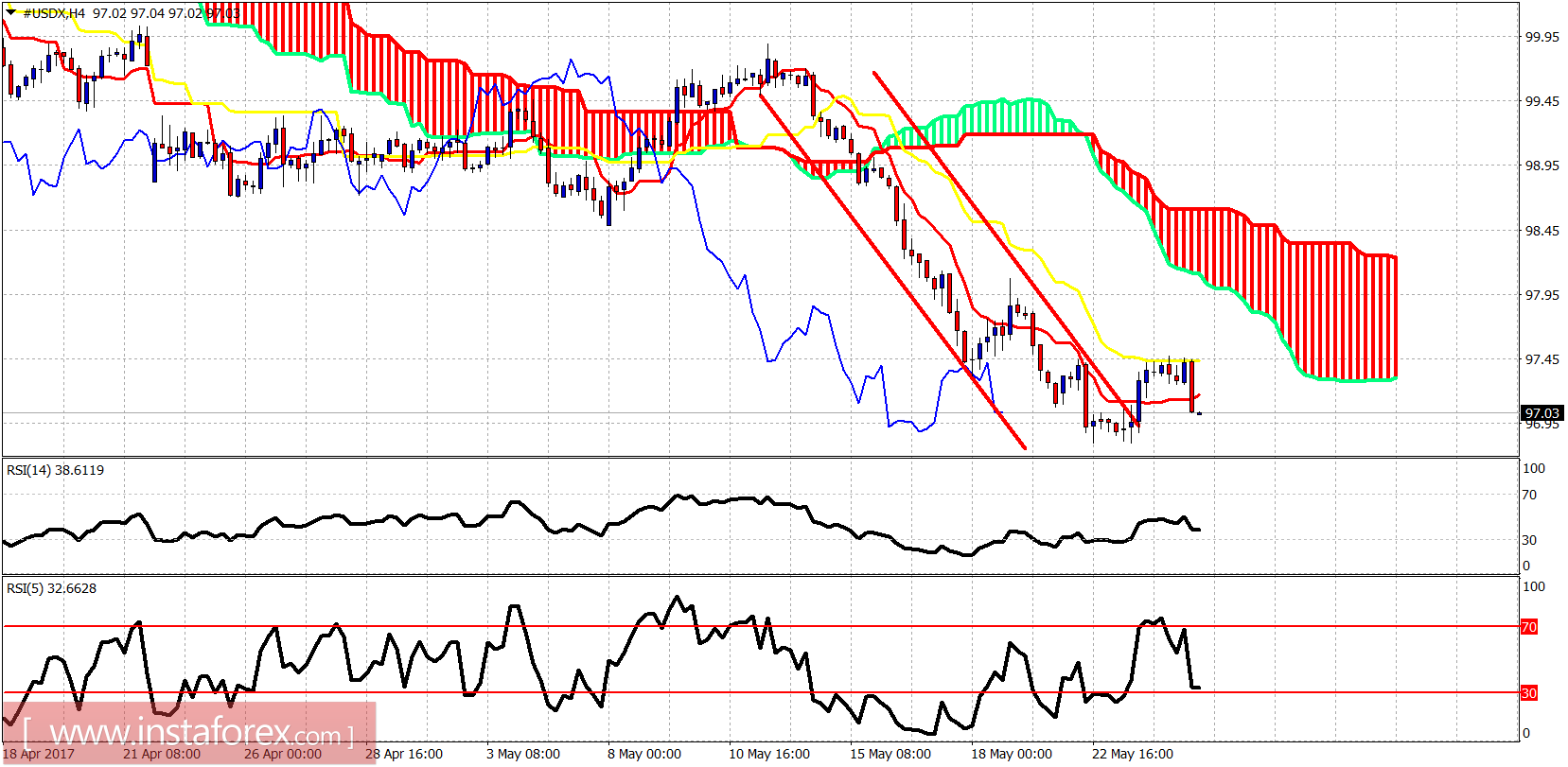

The US dollar index bounced as expected but found formidable resistance at 97.50 and got rejected. As long as we hold above the May lows, bulls have some hopes for a bigger bounce towards 99.

Though the price broke out of the bearish channel, the bounce reached only the kijun-sen (yellow line indicator) in the 4 hour chart but not the Kumo (cloud) as we hoped. However, the bounce might still be incomplete so we have to be patient as long as we trade above the May lows.

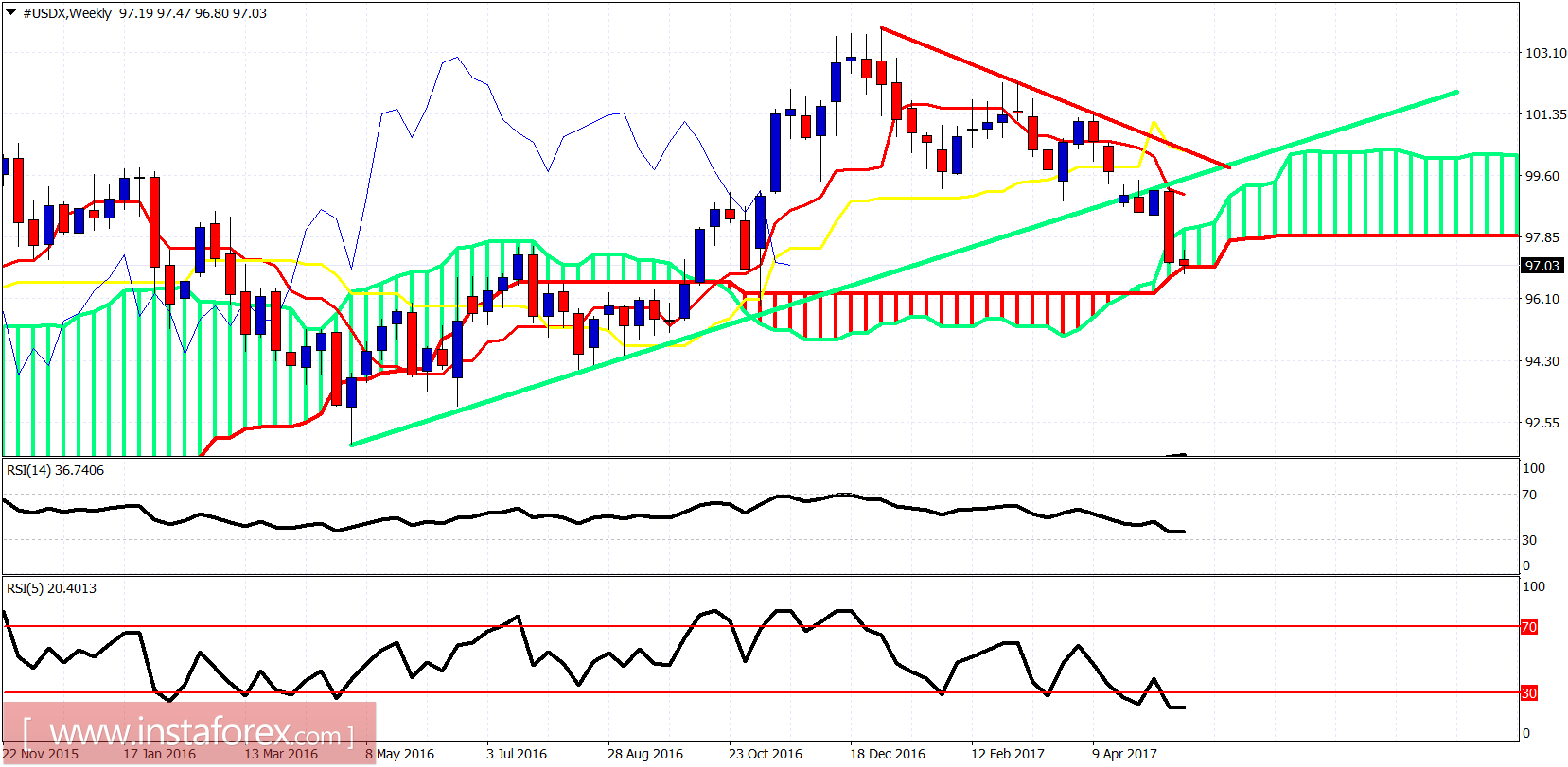

Green line - support

The weekly chart is dangerously turning weekly trend to bearish, especially if this week closes below the Kumo cloud. We are at the very important weekly support. I continue to believe that a bounce is quite possible towards 99. One need to be patient and wait and see.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română