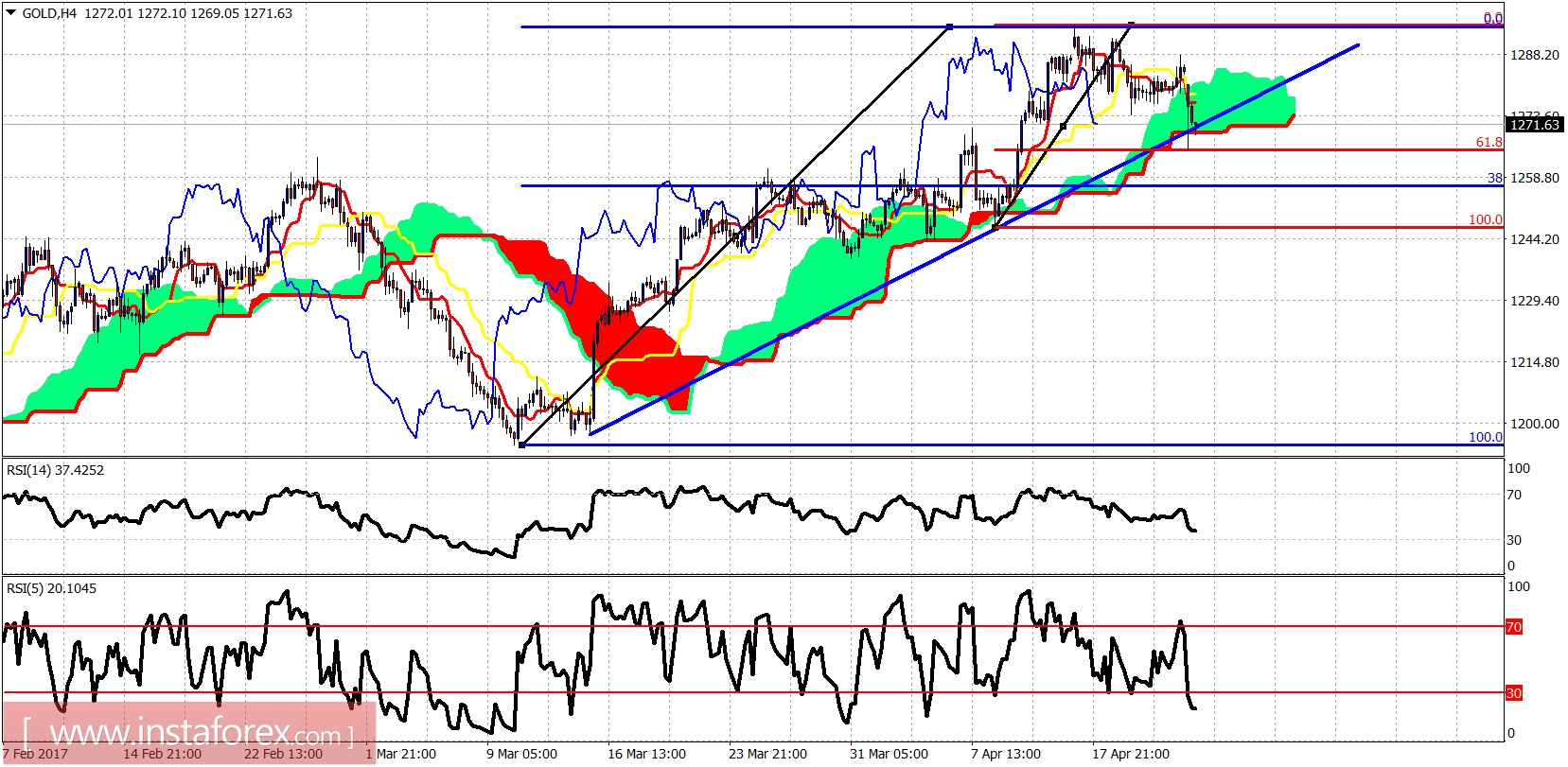

Gold price as expected is pushing lower towards $1,260 as we justified a correction from last week. The causation today are the French election results. Technically Gold price could continue lower towards $1,260 or even $1,250 but my longer-term view remains unchanged.

Blue line - support

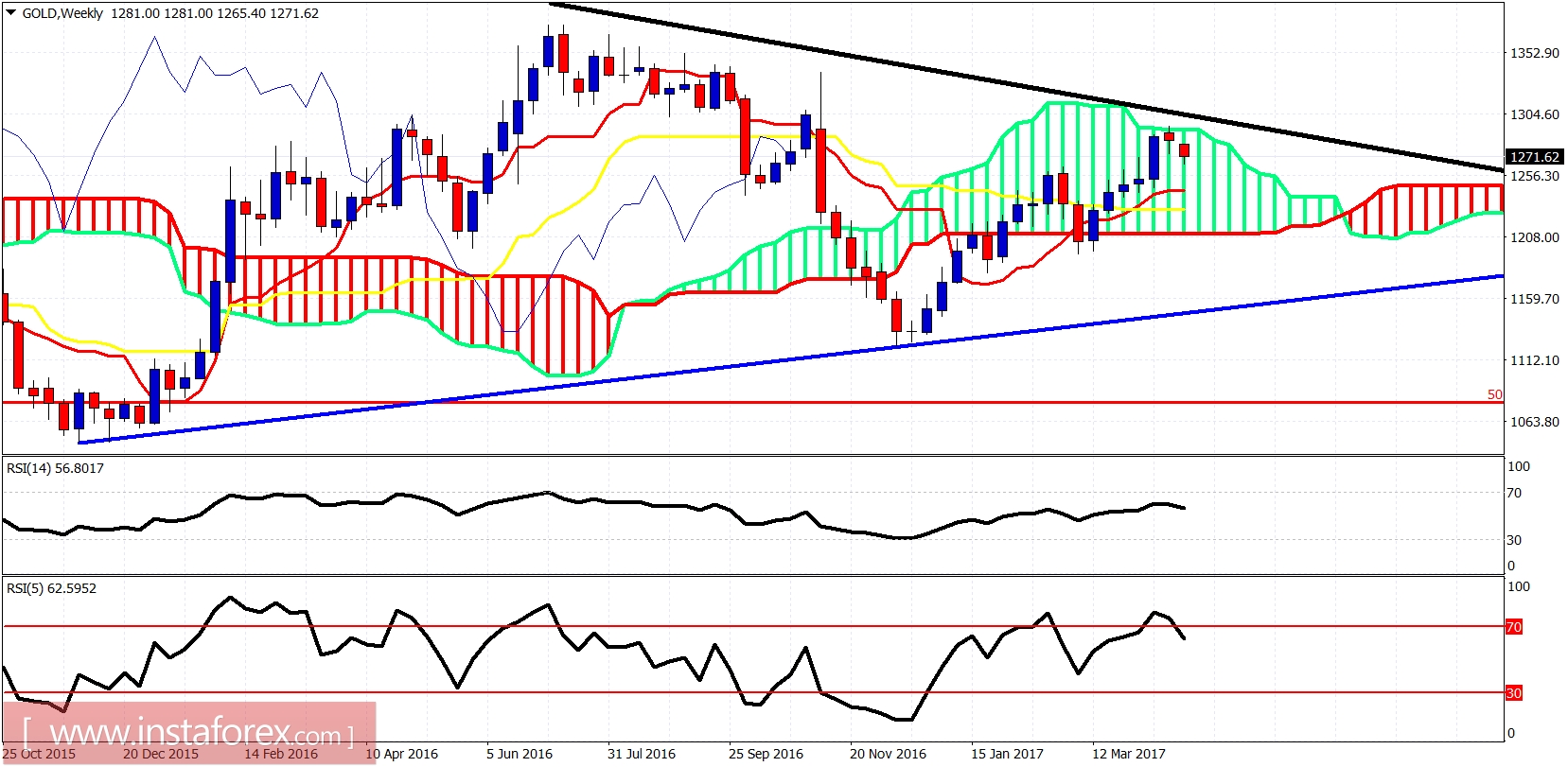

As we expected from last week Gold price got rejected at the upper cloud boundary and at the black long-term trend line resistance. Weekly support is at the red tenkan-sen indicator at $1,245. My longer-term view remains bullish. This downward move is most probably the last chance for long positions in Gold before the big breakout.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română