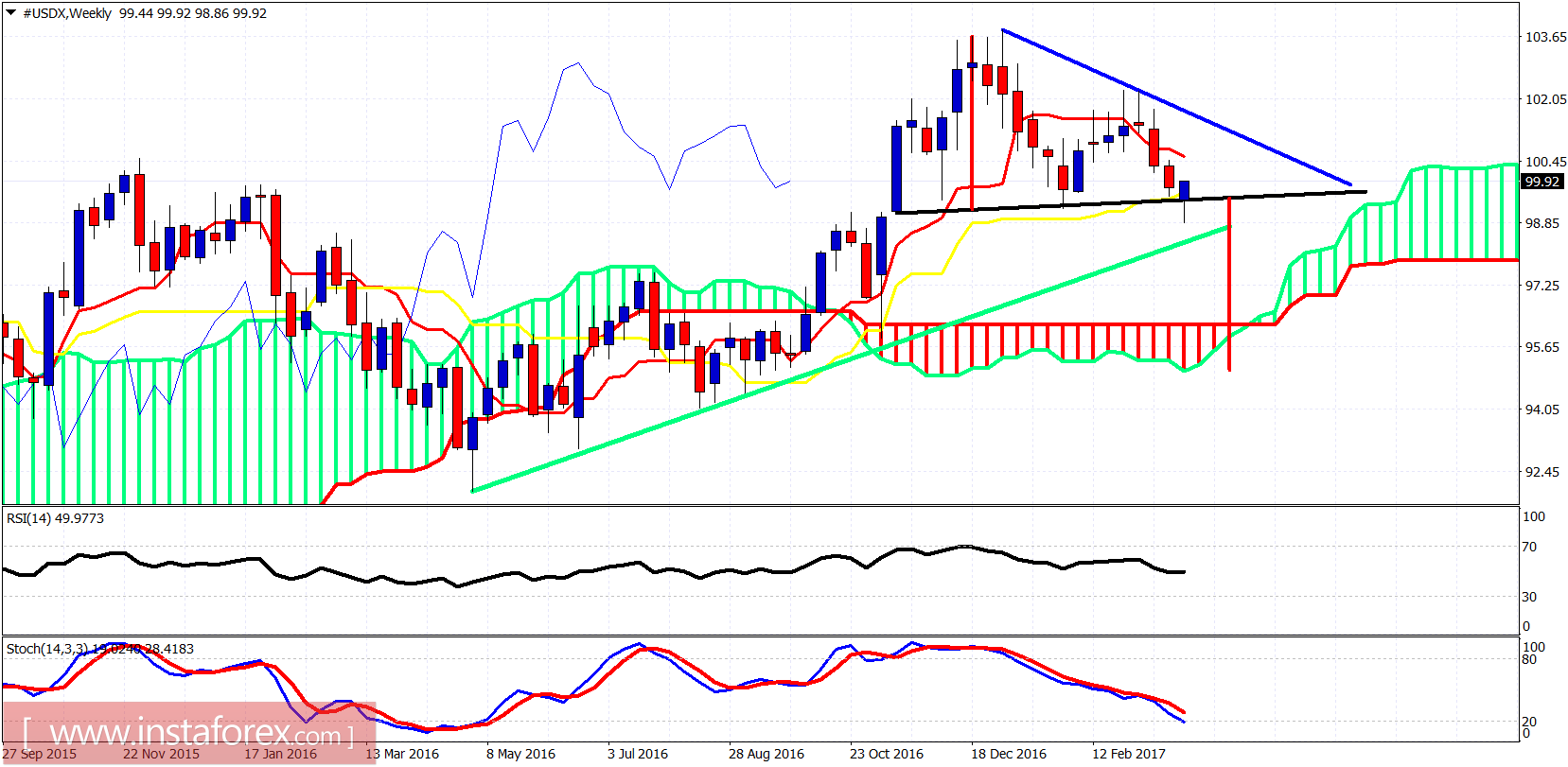

The Dollar index bounced as we were expecting since the divergence signals were increasing. The Dollar index has bounced off important support at 99-98.80 area and is trying to break above the first important resistance levels. I believe the most probable outcome will be a lower high and another bearish reversal.

Blue line -trend line resistance

Green line -long-term trend line support

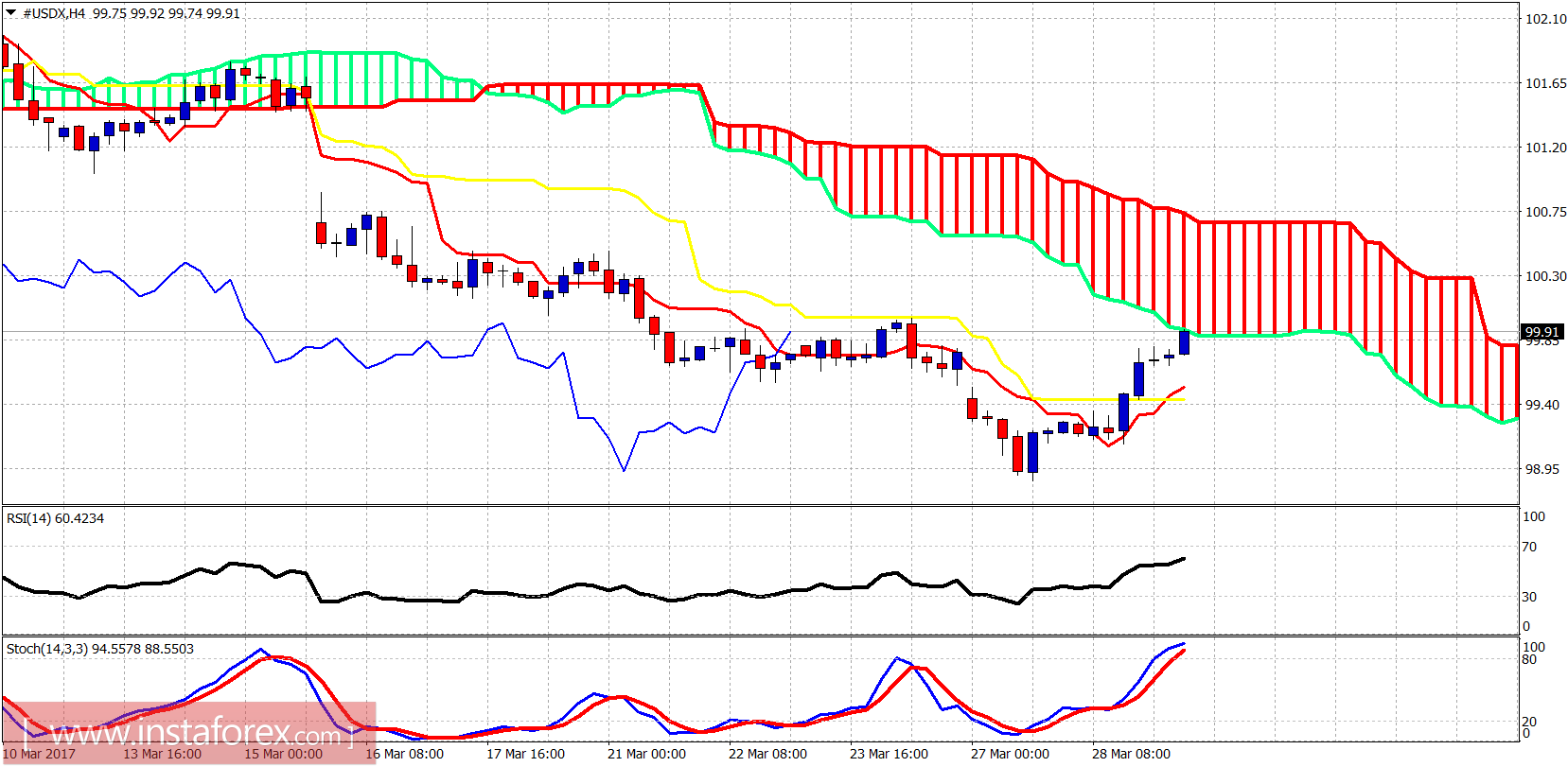

The Dollar index owed us a bounce from oversold levels and delivered it yesterday despite the weakness it showed on Monday. As I said in a previous post, weekly candles are not shaped on Monday and that is why we need to be patient with the weekly close. I expect the Dollar index to make a lower high relative to the 102.30 and then reverse lower towards 98 or even 97.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română