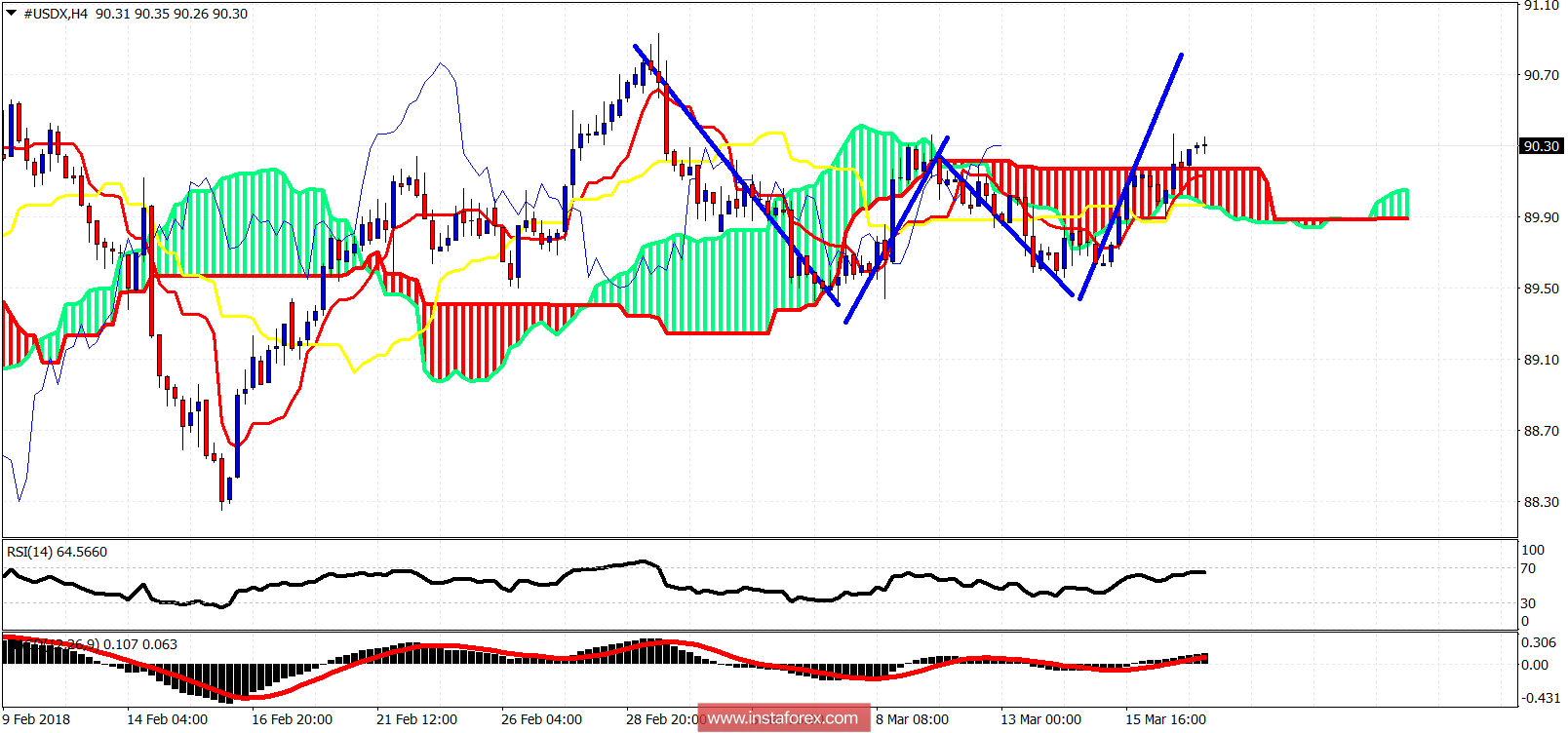

The Dollar index is in a bullish short-term trend. Price is breaking above the Ichimoku cloud in the 4-hour chart while price has formed a W-reversal pattern.

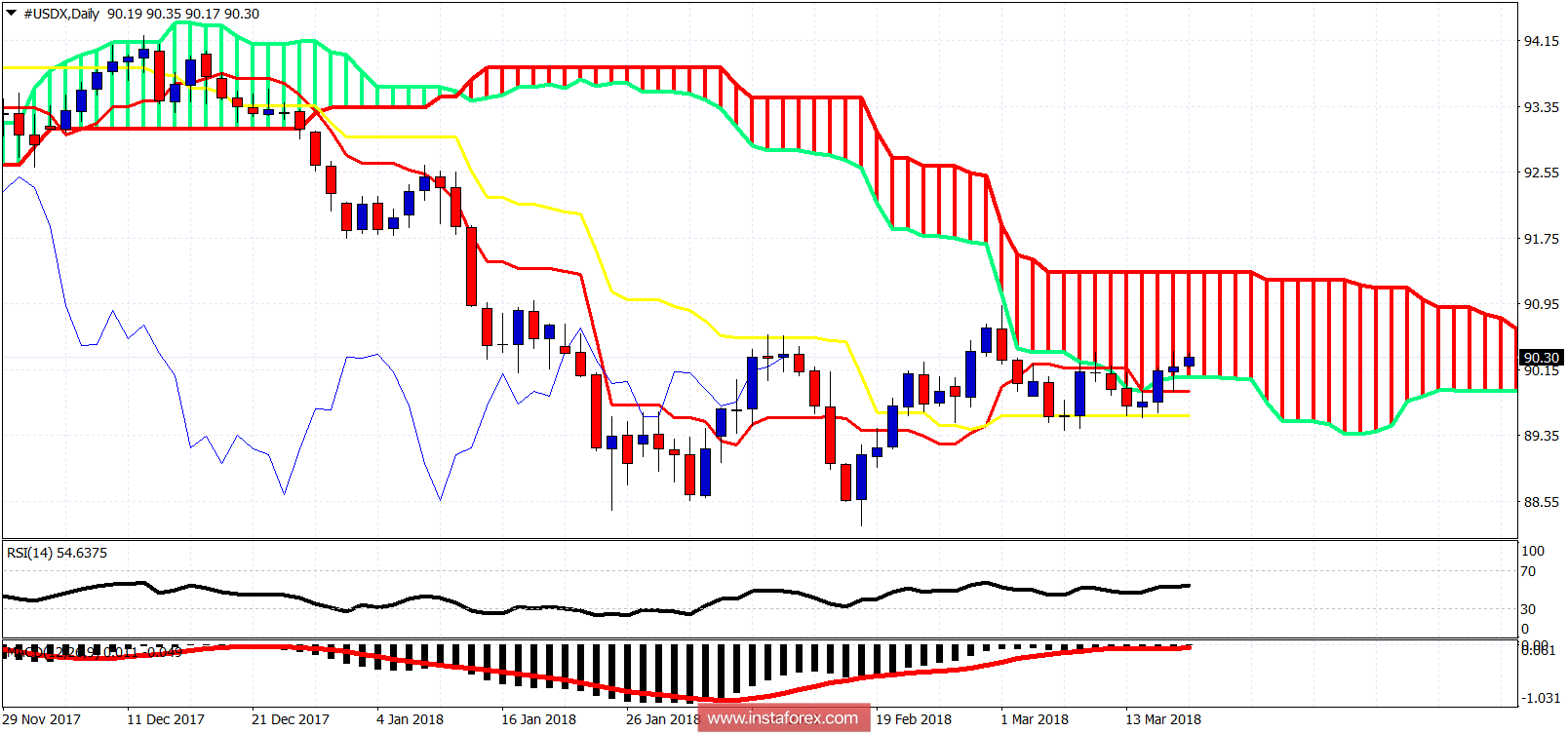

On a daily basis, the Dollar index has broken inside the Daily Kumo. Trend has changed to neutral. Resistance is at the upper cloud boundary at 91.35. For a bigger bounce bulls need to break above the cloud. On the other hand, Dollar bears will need to see price close for at least one day below the cloud (below 90). For now bulls seem to be gaining control of the trend.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română