Daily Outlook

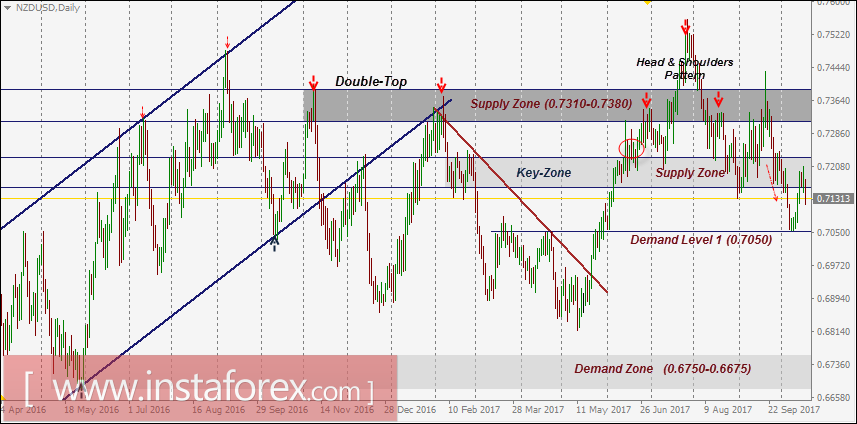

A recent bullish breakout above the downtrend line took place on May 22. Since then, the market has been bullish as depicted on the chart.

The price zone of 0.7150-0.7230 (Key-Zone) stood as a temporary resistance zone until a bullish breakout was expressed above 0.7230.

This resulted in a quick bullish advance towards the next supply zone around 0.7310-0.7380 which was temporarily breached to the upside.

Recent bearish pullback was executed towards the price zone of 0.7310-0.7380 (newly-established demand-zone) which failed to offer enough bullish support for the NZD/USD pair.

Re-consolidation below the price level of 0.7300 enhanced the bearish side of the market. This brought the NZD/USD pair again towards 0.7230-0.7150 (Key-Zone) which failed to pause the ongoing bearish momentum.

An atypical Head and Shoulders pattern was expressed on the depicted chart indicating high probability of bearish reversal.

Bearish persistence below the neckline 0.7150 confirms the reversal pattern. Next bearish targets are located around 0.7050, 0.6925 and eventually 0.6800.

As expected, the price level of 0.7050 offered significant bullish support which allowed bullish pullback towards 0.7190-0.7230 (Key-Zone) to be watched for further decisions.

Recent signs of bearish rejection are manifested around the depicted supply zone ( 0.7190-0.7230 ). That's why, another bearish wave should be expected towards 0.7050.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română